Royalty rights investing involves purchasing the rights to a percentage of a company's revenue or product sales, providing passive income without operational responsibilities. Direct business ownership requires significant involvement in managing and growing the company, with potential for higher returns but increased risk and time commitment. Explore the advantages and challenges of each investment strategy to determine the best fit for your financial goals.

Why it is important

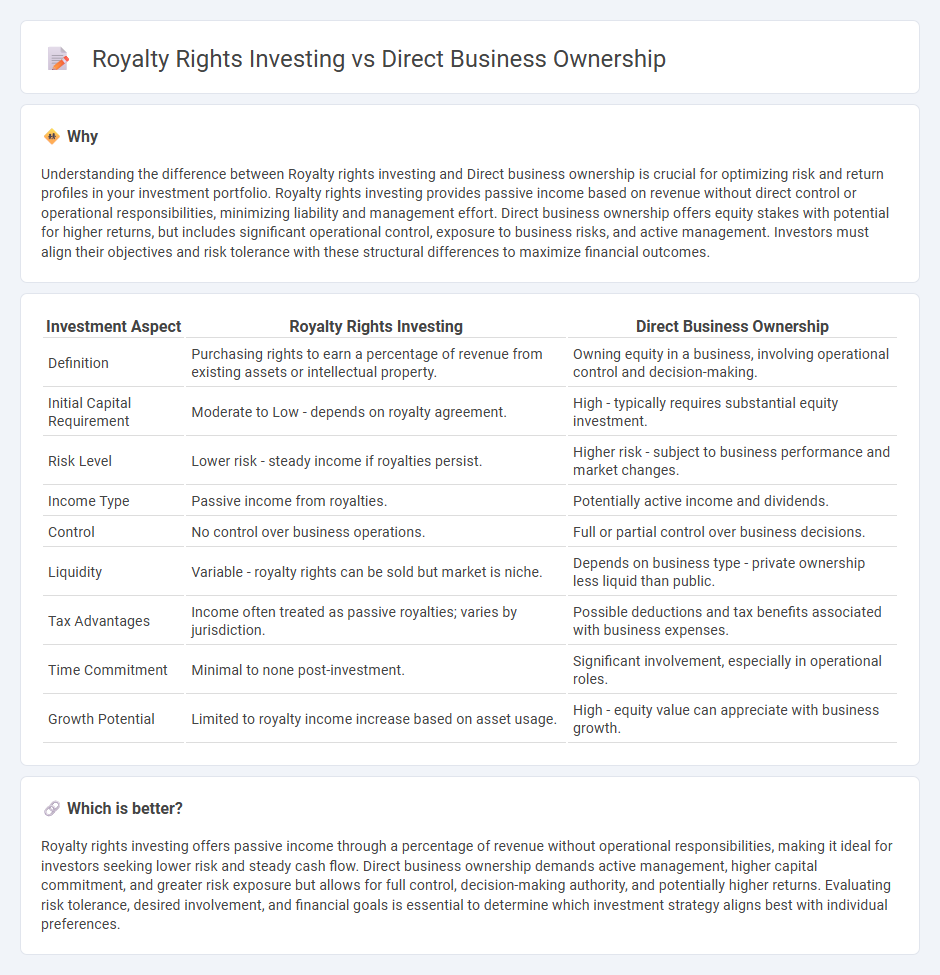

Understanding the difference between Royalty rights investing and Direct business ownership is crucial for optimizing risk and return profiles in your investment portfolio. Royalty rights investing provides passive income based on revenue without direct control or operational responsibilities, minimizing liability and management effort. Direct business ownership offers equity stakes with potential for higher returns, but includes significant operational control, exposure to business risks, and active management. Investors must align their objectives and risk tolerance with these structural differences to maximize financial outcomes.

Comparison Table

| Investment Aspect | Royalty Rights Investing | Direct Business Ownership |

|---|---|---|

| Definition | Purchasing rights to earn a percentage of revenue from existing assets or intellectual property. | Owning equity in a business, involving operational control and decision-making. |

| Initial Capital Requirement | Moderate to Low - depends on royalty agreement. | High - typically requires substantial equity investment. |

| Risk Level | Lower risk - steady income if royalties persist. | Higher risk - subject to business performance and market changes. |

| Income Type | Passive income from royalties. | Potentially active income and dividends. |

| Control | No control over business operations. | Full or partial control over business decisions. |

| Liquidity | Variable - royalty rights can be sold but market is niche. | Depends on business type - private ownership less liquid than public. |

| Tax Advantages | Income often treated as passive royalties; varies by jurisdiction. | Possible deductions and tax benefits associated with business expenses. |

| Time Commitment | Minimal to none post-investment. | Significant involvement, especially in operational roles. |

| Growth Potential | Limited to royalty income increase based on asset usage. | High - equity value can appreciate with business growth. |

Which is better?

Royalty rights investing offers passive income through a percentage of revenue without operational responsibilities, making it ideal for investors seeking lower risk and steady cash flow. Direct business ownership demands active management, higher capital commitment, and greater risk exposure but allows for full control, decision-making authority, and potentially higher returns. Evaluating risk tolerance, desired involvement, and financial goals is essential to determine which investment strategy aligns best with individual preferences.

Connection

Royalty rights investing and direct business ownership are connected through their shared focus on generating income from business assets or operations. Royalty rights provide investors with a percentage of revenue or profits without requiring active management, while direct business ownership involves controlling equity and decision-making authority. Both investment approaches enable diversification and the potential for passive income streams linked to the success of underlying business activities.

Key Terms

Equity Stake

Direct business ownership involves holding an equity stake, granting decision-making power and potential dividends from company profits. Royalty rights investing provides income based on revenue generated by specific assets without ownership control or equity appreciation. Explore the advantages and nuances of each approach to optimize your investment strategy.

Intellectual Property

Direct business ownership offers complete control and higher profit potential from Intellectual Property (IP) assets, while royalty rights investing provides passive income through licensing without operational responsibilities. Evaluating risk tolerance, capital availability, and long-term goals is essential in choosing between active management of IP or generating steady revenue via royalties. Explore in-depth comparisons to determine the optimal strategy for maximizing returns from intellectual property.

Passive Income

Direct business ownership involves hands-on management and operational control, often requiring significant time and capital investment for sustained passive income. Royalty rights investing generates income through licensing agreements or revenue-sharing without the complexities of running a business, providing a more hands-off passive income stream. Explore the advantages and challenges of each strategy to determine which passive income approach aligns best with your financial goals.

Source and External Links

How to Differentiate Between Direct or Indirect Ownership - This webpage explains the concept of direct and indirect ownership, where direct ownership refers to individuals or entities holding shares directly in a legal entity.

Indirect vs Direct Employee Ownership - This article discusses the differences between direct and indirect employee ownership, highlighting how direct ownership gives employees a stronger sense of engagement with the company.

Employee Ownership for Small Businesses - This guide provides information on how employees can become direct owners by acquiring shares directly, allowing them to exercise ownership rights in small businesses.

dowidth.com

dowidth.com