Spice trading, a centuries-old investment method, involves the buying and selling of rare spices with high market demand and limited supply, offering potential for substantial returns through commodity price fluctuations. Peer-to-peer lending connects borrowers directly with investors via online platforms, enabling investors to earn interest income by funding personal or business loans with diversified risk profiles. Explore more to understand which investment avenue aligns best with your financial goals and risk tolerance.

Why it is important

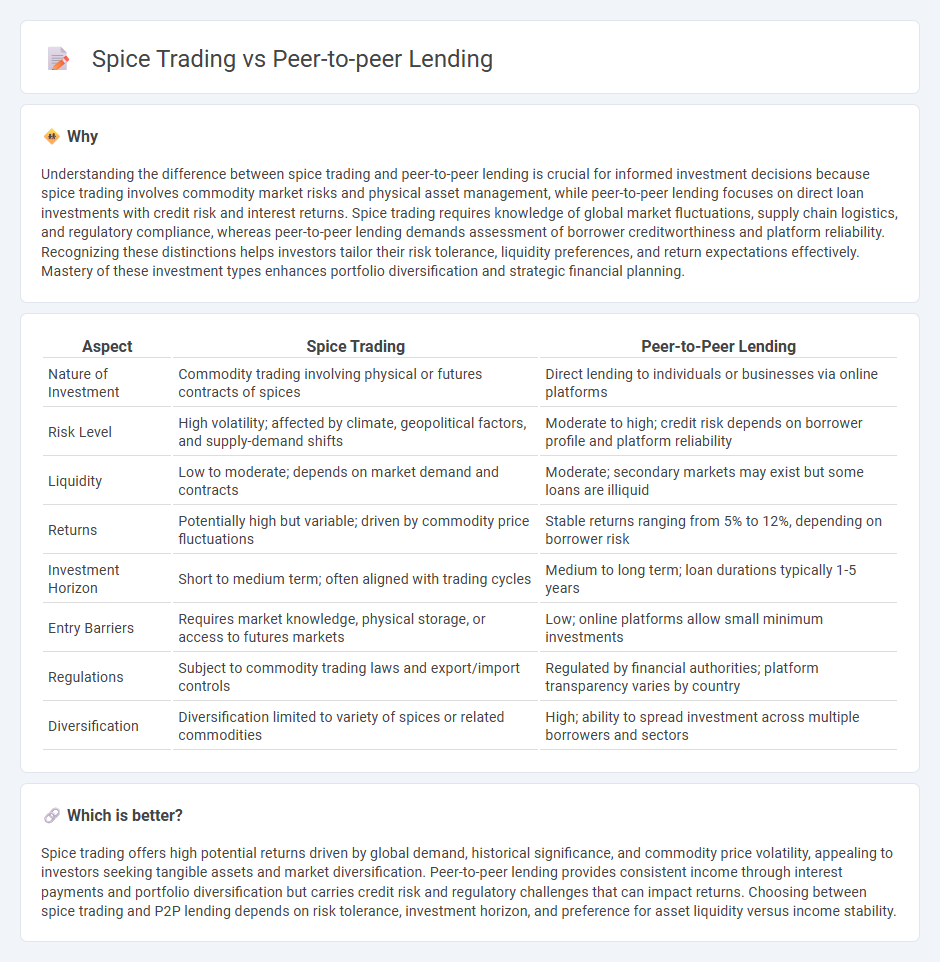

Understanding the difference between spice trading and peer-to-peer lending is crucial for informed investment decisions because spice trading involves commodity market risks and physical asset management, while peer-to-peer lending focuses on direct loan investments with credit risk and interest returns. Spice trading requires knowledge of global market fluctuations, supply chain logistics, and regulatory compliance, whereas peer-to-peer lending demands assessment of borrower creditworthiness and platform reliability. Recognizing these distinctions helps investors tailor their risk tolerance, liquidity preferences, and return expectations effectively. Mastery of these investment types enhances portfolio diversification and strategic financial planning.

Comparison Table

| Aspect | Spice Trading | Peer-to-Peer Lending |

|---|---|---|

| Nature of Investment | Commodity trading involving physical or futures contracts of spices | Direct lending to individuals or businesses via online platforms |

| Risk Level | High volatility; affected by climate, geopolitical factors, and supply-demand shifts | Moderate to high; credit risk depends on borrower profile and platform reliability |

| Liquidity | Low to moderate; depends on market demand and contracts | Moderate; secondary markets may exist but some loans are illiquid |

| Returns | Potentially high but variable; driven by commodity price fluctuations | Stable returns ranging from 5% to 12%, depending on borrower risk |

| Investment Horizon | Short to medium term; often aligned with trading cycles | Medium to long term; loan durations typically 1-5 years |

| Entry Barriers | Requires market knowledge, physical storage, or access to futures markets | Low; online platforms allow small minimum investments |

| Regulations | Subject to commodity trading laws and export/import controls | Regulated by financial authorities; platform transparency varies by country |

| Diversification | Diversification limited to variety of spices or related commodities | High; ability to spread investment across multiple borrowers and sectors |

Which is better?

Spice trading offers high potential returns driven by global demand, historical significance, and commodity price volatility, appealing to investors seeking tangible assets and market diversification. Peer-to-peer lending provides consistent income through interest payments and portfolio diversification but carries credit risk and regulatory challenges that can impact returns. Choosing between spice trading and P2P lending depends on risk tolerance, investment horizon, and preference for asset liquidity versus income stability.

Connection

Spice trading historically laid the foundation for global trade networks and risk-sharing practices that influenced modern financial systems like peer-to-peer lending. Both involve direct transactions between parties, reducing reliance on traditional intermediaries and fostering trust-based exchanges. The decentralization in spice trade financing parallels the peer-to-peer lending model, which leverages technology to connect borrowers and lenders efficiently.

Key Terms

**Peer-to-peer lending:**

Peer-to-peer lending connects individual borrowers with private investors through online platforms, bypassing traditional financial institutions and often resulting in lower interest rates and faster approval processes. This innovative financing method enhances financial inclusion by providing access to credit for underserved populations and offers attractive returns for lenders seeking diversification. Explore the advantages, risks, and key players in peer-to-peer lending to understand how it is reshaping modern finance.

Platform

Platform choice plays a critical role in peer-to-peer lending, where digital marketplaces like LendingClub and Prosper connect borrowers with individual investors through user-friendly interfaces and robust credit assessment tools. In contrast, spice trading platforms emphasize real-time commodity pricing, supply chain transparency, and secure transactions, often leveraging blockchain technology to ensure authenticity and traceability. Explore detailed comparisons of these platforms to understand how technology transforms asset exchange in diverse markets.

Interest Rate

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 36%, depending on borrower creditworthiness and loan terms, contrasting sharply with historical spice trading, where profits stemmed from price arbitrage rather than fixed interest rates. Interest rate volatility in peer-to-peer lending directly influences investor returns, whereas spice trading returns depend on market demand, supply constraints, and geopolitical factors. Explore detailed comparisons to understand how interest rates shape investment strategies in these distinct financial and commodity markets.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer lending enables borrowers to obtain loans directly from individual investors via online platforms without involving banks, offering potentially lower eligibility requirements and flexible repayment terms while presenting risks since loans lack traditional bank protections.

Peer-to-peer lending - Wikipedia - P2P lending is an online practice connecting lenders and borrowers via intermediaries who provide credit checks, loan servicing, and compliance, allowing unsecured or secured loans that can be traded as securities but are generally not insured by governments.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending is a marketplace where individuals can lend money to borrowers or businesses, typically earning higher interest than savings accounts but facing greater risk, with some platforms allowing lenders to select specific borrowers while others diversify automatically.

dowidth.com

dowidth.com