Litigation finance involves funding legal cases in exchange for a portion of the settlement or award, offering investors access to a non-correlated asset class with potential high returns. Real estate investment focuses on acquiring, managing, and selling property to generate income or capital appreciation, providing tangible assets and steady cash flow. Explore detailed insights to determine which investment aligns best with your financial goals.

Why it is important

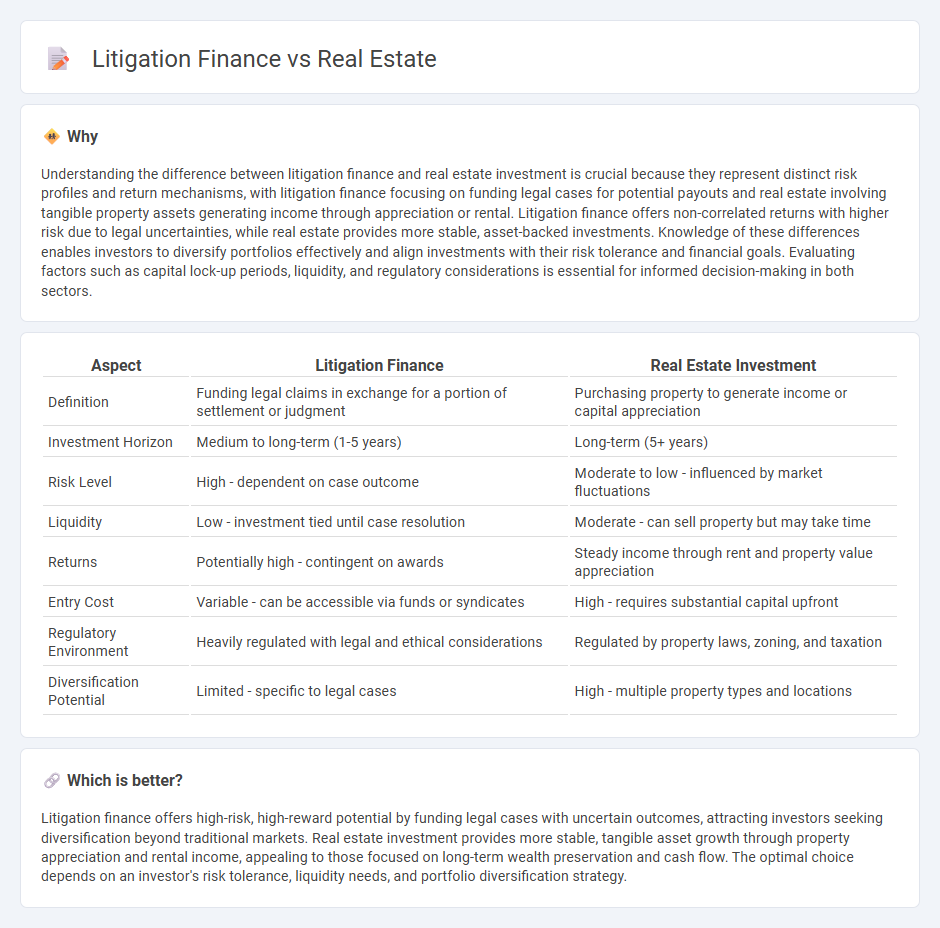

Understanding the difference between litigation finance and real estate investment is crucial because they represent distinct risk profiles and return mechanisms, with litigation finance focusing on funding legal cases for potential payouts and real estate involving tangible property assets generating income through appreciation or rental. Litigation finance offers non-correlated returns with higher risk due to legal uncertainties, while real estate provides more stable, asset-backed investments. Knowledge of these differences enables investors to diversify portfolios effectively and align investments with their risk tolerance and financial goals. Evaluating factors such as capital lock-up periods, liquidity, and regulatory considerations is essential for informed decision-making in both sectors.

Comparison Table

| Aspect | Litigation Finance | Real Estate Investment |

|---|---|---|

| Definition | Funding legal claims in exchange for a portion of settlement or judgment | Purchasing property to generate income or capital appreciation |

| Investment Horizon | Medium to long-term (1-5 years) | Long-term (5+ years) |

| Risk Level | High - dependent on case outcome | Moderate to low - influenced by market fluctuations |

| Liquidity | Low - investment tied until case resolution | Moderate - can sell property but may take time |

| Returns | Potentially high - contingent on awards | Steady income through rent and property value appreciation |

| Entry Cost | Variable - can be accessible via funds or syndicates | High - requires substantial capital upfront |

| Regulatory Environment | Heavily regulated with legal and ethical considerations | Regulated by property laws, zoning, and taxation |

| Diversification Potential | Limited - specific to legal cases | High - multiple property types and locations |

Which is better?

Litigation finance offers high-risk, high-reward potential by funding legal cases with uncertain outcomes, attracting investors seeking diversification beyond traditional markets. Real estate investment provides more stable, tangible asset growth through property appreciation and rental income, appealing to those focused on long-term wealth preservation and cash flow. The optimal choice depends on an investor's risk tolerance, liquidity needs, and portfolio diversification strategy.

Connection

Litigation finance and real estate intersect through the financing of property-related legal disputes, where investors provide capital to fund lawsuits involving real estate transactions, development projects, or property rights. This financial support allows plaintiffs to pursue claims without immediate financial strain, potentially leading to settlements or judgments that impact property values or ownership. The growing integration of litigation finance within real estate litigation enhances access to justice while creating new investment opportunities linked to property market outcomes.

Key Terms

Asset Appreciation (Real Estate)

Real estate investment offers significant asset appreciation potential through property value increases driven by market demand, location, and development improvements. Litigation finance, on the other hand, generates returns linked to legal case outcomes, often yielding unpredictable and non-appreciating assets. Explore the dynamics of asset appreciation in both fields to make informed investment decisions.

Case Outcome Risk (Litigation Finance)

Case outcome risk in litigation finance represents the unpredictability of legal decisions directly affecting investment returns, contrasting with real estate where market fluctuations primarily drive risk. Litigation finance investors must assess legal precedents, judge behavior, and case merits to mitigate potential losses, while real estate investors analyze property values, location trends, and economic indicators. Explore more about managing case outcome risk in litigation finance to enhance investment strategies.

Liquidity

Real estate investments typically offer lower liquidity due to lengthy transaction processes and market volatility, whereas litigation finance provides quicker access to capital by advancing funds based on potential legal case outcomes. The liquidity in litigation finance hinges on case resolution timelines, often resulting in faster returns compared to real estate's months-long property sales. Explore how these liquidity dynamics influence portfolio strategies to make informed investment decisions.

Source and External Links

Baltimore, MD Real Estate For Sale I Real Estate in Baltimore City - Baltimore offers a diverse real estate market with options including luxury condos, penthouse suites, colonial estates, row-houses, and townhouses, often with amenities like pools, fitness centers, and concierge services.

Baltimore MD Real Estate & Homes For Sale - Zillow - Zillow lists over 2,500 homes for sale in Baltimore featuring various price points and home sizes, providing detailed listings with photos and sales history.

Baltimore, MD Homes for Sale & Real Estate - Redfin - Redfin updates listings every few minutes and offers a range of options including multi-family properties and single-family homes with modern finishes near key locations like universities and downtown.

dowidth.com

dowidth.com