Fractional farmland ownership allows investors to buy shares of agricultural land, reducing entry costs and diversifying risk compared to direct farmland ownership, where investors purchase entire plots and bear full responsibility for management and expenses. This model offers access to professional farm management and potential passive income, while direct ownership provides complete control and potentially higher long-term returns. Explore the key differences and benefits to determine the best investment approach for your agricultural portfolio.

Why it is important

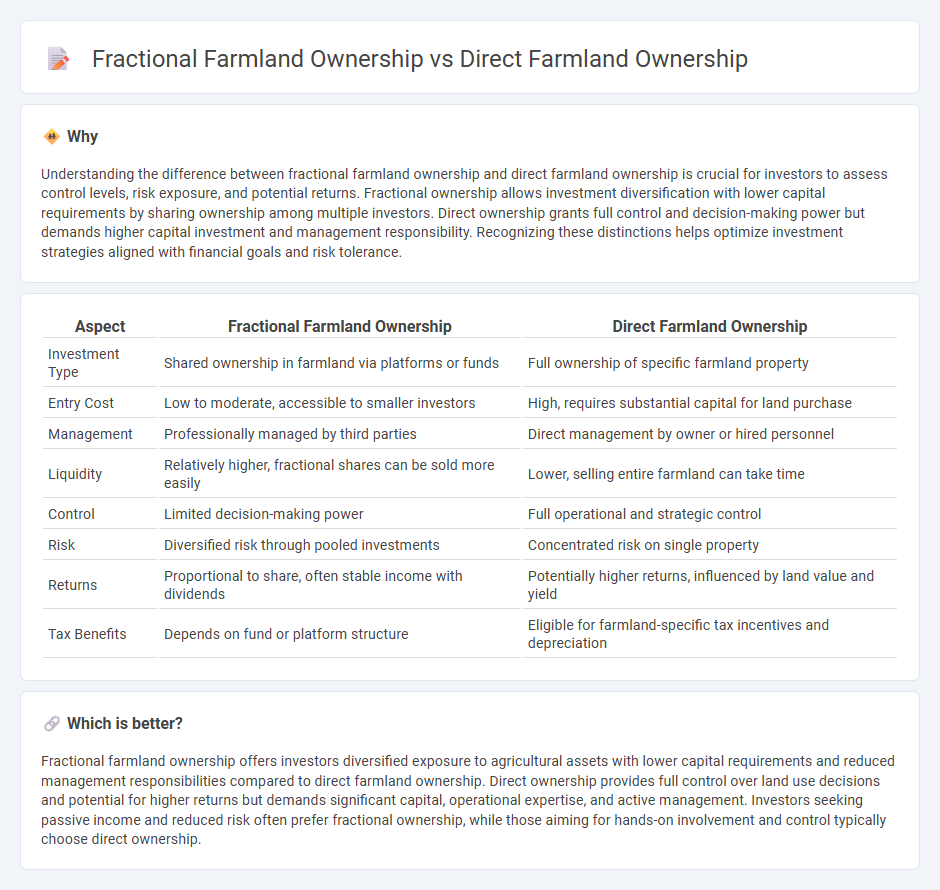

Understanding the difference between fractional farmland ownership and direct farmland ownership is crucial for investors to assess control levels, risk exposure, and potential returns. Fractional ownership allows investment diversification with lower capital requirements by sharing ownership among multiple investors. Direct ownership grants full control and decision-making power but demands higher capital investment and management responsibility. Recognizing these distinctions helps optimize investment strategies aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Fractional Farmland Ownership | Direct Farmland Ownership |

|---|---|---|

| Investment Type | Shared ownership in farmland via platforms or funds | Full ownership of specific farmland property |

| Entry Cost | Low to moderate, accessible to smaller investors | High, requires substantial capital for land purchase |

| Management | Professionally managed by third parties | Direct management by owner or hired personnel |

| Liquidity | Relatively higher, fractional shares can be sold more easily | Lower, selling entire farmland can take time |

| Control | Limited decision-making power | Full operational and strategic control |

| Risk | Diversified risk through pooled investments | Concentrated risk on single property |

| Returns | Proportional to share, often stable income with dividends | Potentially higher returns, influenced by land value and yield |

| Tax Benefits | Depends on fund or platform structure | Eligible for farmland-specific tax incentives and depreciation |

Which is better?

Fractional farmland ownership offers investors diversified exposure to agricultural assets with lower capital requirements and reduced management responsibilities compared to direct farmland ownership. Direct ownership provides full control over land use decisions and potential for higher returns but demands significant capital, operational expertise, and active management. Investors seeking passive income and reduced risk often prefer fractional ownership, while those aiming for hands-on involvement and control typically choose direct ownership.

Connection

Fractional farmland ownership allows multiple investors to buy shares in agricultural land, providing access to farmland investment without the high capital requirement of direct ownership. Direct farmland ownership involves purchasing entire plots, offering full control over land management and operations. Both models enable participation in the agriculture sector, but fractional ownership diversifies risk across investors while direct ownership offers concentrated management benefits.

Key Terms

Title Deed

Direct farmland ownership provides full control and exclusive rights secured by a title deed recorded in land registries, ensuring clear legal ownership and transferability. Fractional farmland ownership involves shared equity among multiple investors, often managed through a legal framework such as a tenancy or partnership agreement but may lack individual title deeds for each participant. Explore more to understand how title deeds impact ownership rights and investment security in farmland.

Liquidity

Direct farmland ownership offers tangible assets and full control but often suffers from low liquidity due to lengthy transaction times and limited buyer pools. Fractional farmland ownership improves liquidity by enabling investors to buy and sell smaller shares more easily within a pooled structure, facilitating quicker access to capital. Explore the benefits and challenges of each model to determine which liquidity strategy aligns best with your investment goals.

Fractional Shares

Fractional farmland ownership offers investors the ability to diversify agricultural assets with lower capital outlay compared to direct farmland ownership, which requires significant upfront investment and management responsibilities. Fractional shares provide flexibility, liquidity, and access to professionally managed farms, enhancing risk management and potentially increasing returns. Explore the benefits and mechanics of fractional farmland ownership to understand how it can fit into your investment portfolio.

Source and External Links

Investing in farmland | Nuveen - Direct farmland ownership involves the investor operating the farm directly, providing machinery, personnel, and crop inputs; this approach has the highest return potential but also the highest risk compared to other strategies like cash leasing or custom farming.

Farm Ownership Loans - Direct Farm Ownership Loans by the USDA's Farm Service Agency provide financing up to $600,000 directly to farmers for the purchase and development of farm property, with repayment terms up to 40 years and competitive interest rates.

How to Buy Farm Land As a Beginning Farmer - FBN - FSA Direct Farm Ownership Joint Financing Loans can cover up to 50% of farmland purchase costs to help beginning farmers buy or expand farms, requiring the farmer to substantially participate in operations and meet eligibility criteria.

dowidth.com

dowidth.com