Forestry investment offers long-term capital growth through sustainable timber production and carbon sequestration, while agriculture investment provides quicker returns via crop yields and livestock products. Both sectors benefit from natural resource utilization but differ in risk profiles, market demand, and environmental impact. Discover detailed comparisons and strategic insights to optimize your portfolio in either forestry or agriculture investment.

Why it is important

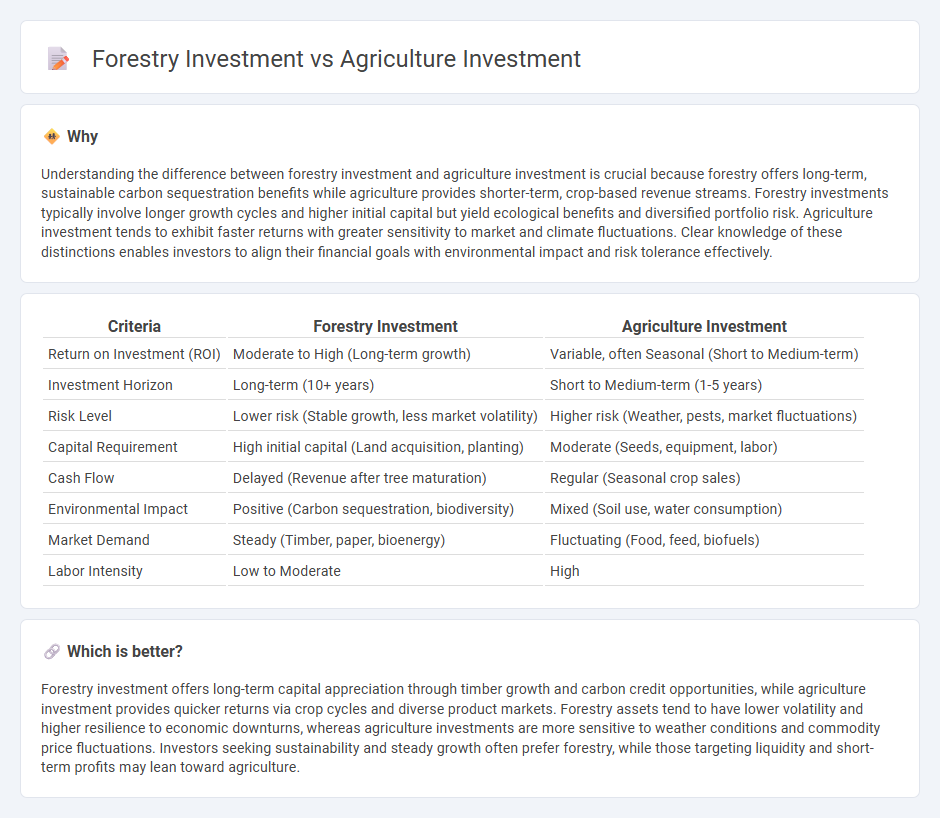

Understanding the difference between forestry investment and agriculture investment is crucial because forestry offers long-term, sustainable carbon sequestration benefits while agriculture provides shorter-term, crop-based revenue streams. Forestry investments typically involve longer growth cycles and higher initial capital but yield ecological benefits and diversified portfolio risk. Agriculture investment tends to exhibit faster returns with greater sensitivity to market and climate fluctuations. Clear knowledge of these distinctions enables investors to align their financial goals with environmental impact and risk tolerance effectively.

Comparison Table

| Criteria | Forestry Investment | Agriculture Investment |

|---|---|---|

| Return on Investment (ROI) | Moderate to High (Long-term growth) | Variable, often Seasonal (Short to Medium-term) |

| Investment Horizon | Long-term (10+ years) | Short to Medium-term (1-5 years) |

| Risk Level | Lower risk (Stable growth, less market volatility) | Higher risk (Weather, pests, market fluctuations) |

| Capital Requirement | High initial capital (Land acquisition, planting) | Moderate (Seeds, equipment, labor) |

| Cash Flow | Delayed (Revenue after tree maturation) | Regular (Seasonal crop sales) |

| Environmental Impact | Positive (Carbon sequestration, biodiversity) | Mixed (Soil use, water consumption) |

| Market Demand | Steady (Timber, paper, bioenergy) | Fluctuating (Food, feed, biofuels) |

| Labor Intensity | Low to Moderate | High |

Which is better?

Forestry investment offers long-term capital appreciation through timber growth and carbon credit opportunities, while agriculture investment provides quicker returns via crop cycles and diverse product markets. Forestry assets tend to have lower volatility and higher resilience to economic downturns, whereas agriculture investments are more sensitive to weather conditions and commodity price fluctuations. Investors seeking sustainability and steady growth often prefer forestry, while those targeting liquidity and short-term profits may lean toward agriculture.

Connection

Forestry investment and agriculture investment are interconnected through their shared reliance on land resources and natural ecosystems management. Both sectors contribute to sustainable rural development by enhancing soil health, promoting biodiversity, and supporting carbon sequestration efforts. Investment strategies often integrate agroforestry practices, combining tree cultivation with crop production to maximize economic returns and environmental benefits.

Key Terms

Crop Yield vs. Timber Yield

Agriculture investment typically prioritizes maximizing crop yield through advanced irrigation, soil management, and genetically improved seeds, resulting in rapid returns within a single growing season. Forestry investment, conversely, emphasizes long-term timber yield with sustainable practices like selective logging and reforestation, yielding high-value wood products over decades. Explore detailed comparisons of crop versus timber yield strategies for optimized land use and financial growth.

Harvest Cycle Duration

Agriculture investments typically yield returns within a single growing season, ranging from 3 to 9 months depending on the crop, enabling faster capital turnover compared to forestry investments. Forestry investments involve longer harvest cycles, often spanning 10 to 30 years, due to the natural growth period required for trees to mature for timber or biomass production. Explore the detailed dynamics of harvest cycle duration and its impact on investment returns to make informed decisions.

Climate Risk Specificity

Agriculture investment faces high climate risk specificity due to crop sensitivity to temperature fluctuations, drought, and pest outbreaks, impacting yield reliability and financial returns. Forestry investment provides greater climate risk resilience through long-term carbon sequestration, biodiversity support, and ecosystem service stability, although vulnerability to wildfires and storms remains. Explore detailed comparative analyses to optimize investment strategies aligned with climate risk specificity.

Source and External Links

Investing in farmland - Direct investment in global farmland offers diversification, inflation protection, and stable returns, driven by increasing food demand and scarce resources like water, making it a compelling opportunity.

More and Better Investments Are Needed in Agriculture ... - To end poverty and hunger by 2030, annual investments of USD 265 billion are needed, with USD 140 billion focused specifically on agriculture to support modernization and sustainable development.

Are Agricultural Investments Right for You? - Agriculture offers diverse investment options including farmland REITs, commodities, and AgTech, appealing to those seeking portfolio diversification, tangible assets, and socially responsible investing opportunities.

dowidth.com

dowidth.com