Investment strategies focusing on wine cask aging offer potential value growth through the natural maturation process and rarity of fine vintages, while luxury watches combine craftsmanship, brand prestige, and limited editions to attract collectors and investors alike. Both asset classes benefit from market demand fluctuations and scarcity, yet they differ significantly in liquidity and valuation methods. Explore the nuances between these unique investments to determine the most fitting strategy for your portfolio.

Why it is important

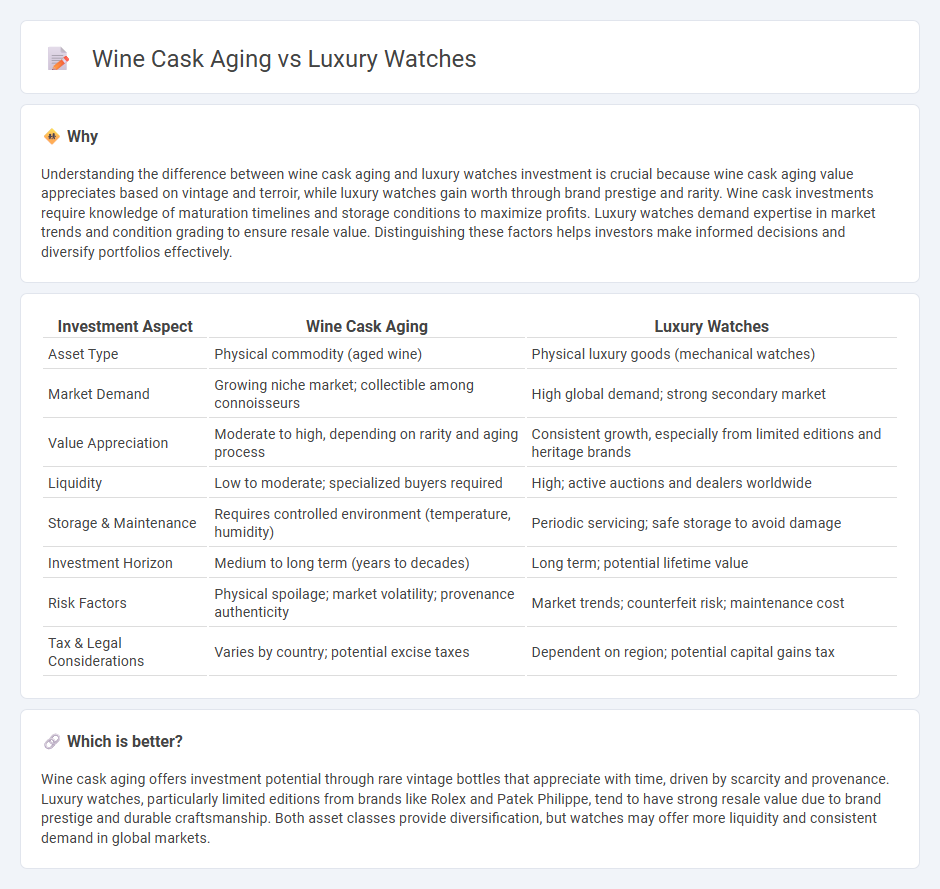

Understanding the difference between wine cask aging and luxury watches investment is crucial because wine cask aging value appreciates based on vintage and terroir, while luxury watches gain worth through brand prestige and rarity. Wine cask investments require knowledge of maturation timelines and storage conditions to maximize profits. Luxury watches demand expertise in market trends and condition grading to ensure resale value. Distinguishing these factors helps investors make informed decisions and diversify portfolios effectively.

Comparison Table

| Investment Aspect | Wine Cask Aging | Luxury Watches |

|---|---|---|

| Asset Type | Physical commodity (aged wine) | Physical luxury goods (mechanical watches) |

| Market Demand | Growing niche market; collectible among connoisseurs | High global demand; strong secondary market |

| Value Appreciation | Moderate to high, depending on rarity and aging process | Consistent growth, especially from limited editions and heritage brands |

| Liquidity | Low to moderate; specialized buyers required | High; active auctions and dealers worldwide |

| Storage & Maintenance | Requires controlled environment (temperature, humidity) | Periodic servicing; safe storage to avoid damage |

| Investment Horizon | Medium to long term (years to decades) | Long term; potential lifetime value |

| Risk Factors | Physical spoilage; market volatility; provenance authenticity | Market trends; counterfeit risk; maintenance cost |

| Tax & Legal Considerations | Varies by country; potential excise taxes | Dependent on region; potential capital gains tax |

Which is better?

Wine cask aging offers investment potential through rare vintage bottles that appreciate with time, driven by scarcity and provenance. Luxury watches, particularly limited editions from brands like Rolex and Patek Philippe, tend to have strong resale value due to brand prestige and durable craftsmanship. Both asset classes provide diversification, but watches may offer more liquidity and consistent demand in global markets.

Connection

Wine cask aging and luxury watches are connected through the shared emphasis on craftsmanship, time, and value appreciation. Both processes rely on meticulous aging--wine in oak barrels to develop complex flavors and watches through precise mechanical movements to enhance durability and worth. Collectors often seek matured wines and limited-edition luxury timepieces as appreciating assets that combine artistry with long-term investment potential.

Key Terms

Provenance

Luxury watches and wine cask aging both emphasize the critical role of provenance in value and authenticity. The detailed history of a luxury watch, including its manufacture, previous ownership, and limited editions, parallels the wine cask's origin, barrel material, and aging environment that influence flavor complexity. Explore deeper insights into how provenance drives desirability and market value in these artisanal crafts.

Liquidity

Luxury watches represent highly liquid assets due to their strong resale markets, brand prestige, and consistent demand among collectors. In contrast, wine cask aging ties up capital in long-term storage, with liquidity dependent on market trends and the physical aging process. Discover more about the comparative liquidity dynamics of these unique investment categories.

Appreciation

Luxury watches appreciate in value over time due to brand heritage, limited editions, and intricate craftsmanship, often becoming coveted collector's items. Wine cask aging enhances flavor complexity and market value as the wine matures, influenced by the type of wood and aging duration. Explore deeper insights into the appreciation dynamics of these refined investments.

Source and External Links

New Luxury Watches | Authorized Retailer - The 1916 Company offers new luxury watches from premier brands like Rolex, Cartier, Omega, and Tudor with full manufacturer warranties and personalized service both online and in showrooms.

Luxury Time NYC: Best Luxury Watches | Rolex, ... - Luxury Time NYC provides a wide catalog of authenticated luxury watches including Rolex, Audemars Piguet, and Patek Philippe, with a 2-year global warranty, concierge services, and 24/7 customer support.

Bob's Watches: Buy and Sell Pre Owned Luxury Watches - Bob's Watches specializes in pre-owned luxury watches from top brands like Rolex and Omega, offering a large inventory with a focus on vintage and contemporary models for men and women.

dowidth.com

dowidth.com