Sports team ownership shares offer dynamic opportunities with potential for high returns through franchise value appreciation and revenue from merchandising, ticket sales, and broadcasting rights. Wine investment provides portfolio diversification with the added benefit of tangible assets that typically appreciate over time due to rarity and vintage quality. Explore the unique advantages and risks of both investment types to make an informed decision.

Why it is important

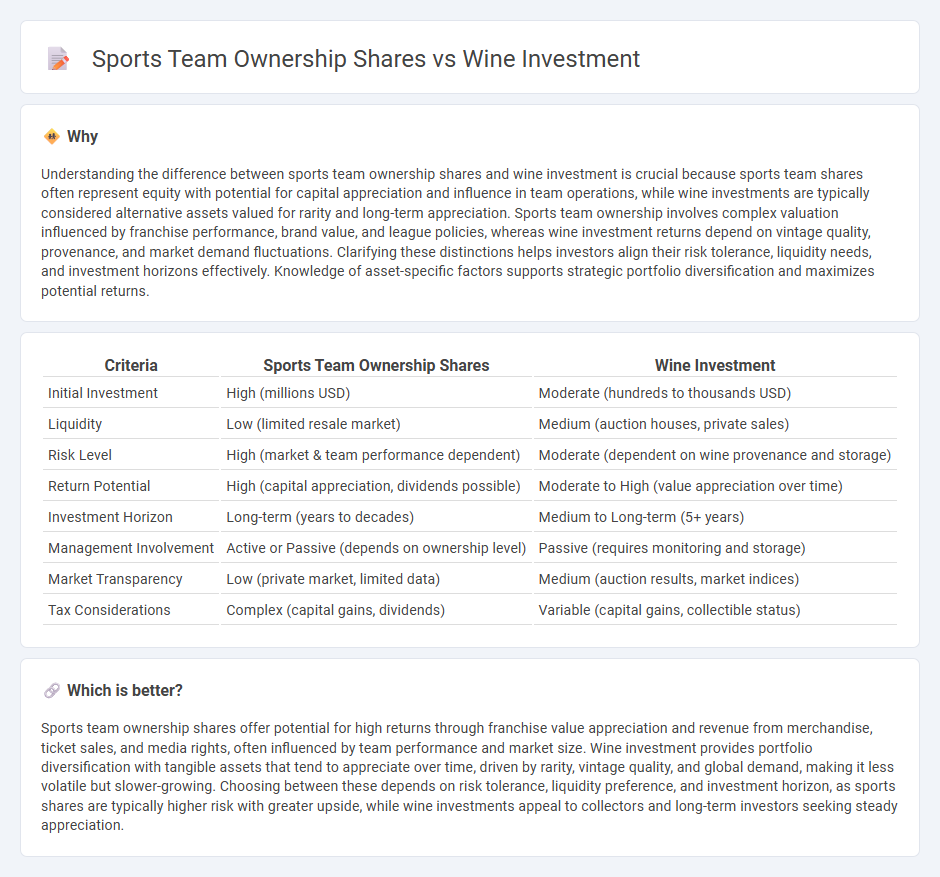

Understanding the difference between sports team ownership shares and wine investment is crucial because sports team shares often represent equity with potential for capital appreciation and influence in team operations, while wine investments are typically considered alternative assets valued for rarity and long-term appreciation. Sports team ownership involves complex valuation influenced by franchise performance, brand value, and league policies, whereas wine investment returns depend on vintage quality, provenance, and market demand fluctuations. Clarifying these distinctions helps investors align their risk tolerance, liquidity needs, and investment horizons effectively. Knowledge of asset-specific factors supports strategic portfolio diversification and maximizes potential returns.

Comparison Table

| Criteria | Sports Team Ownership Shares | Wine Investment |

|---|---|---|

| Initial Investment | High (millions USD) | Moderate (hundreds to thousands USD) |

| Liquidity | Low (limited resale market) | Medium (auction houses, private sales) |

| Risk Level | High (market & team performance dependent) | Moderate (dependent on wine provenance and storage) |

| Return Potential | High (capital appreciation, dividends possible) | Moderate to High (value appreciation over time) |

| Investment Horizon | Long-term (years to decades) | Medium to Long-term (5+ years) |

| Management Involvement | Active or Passive (depends on ownership level) | Passive (requires monitoring and storage) |

| Market Transparency | Low (private market, limited data) | Medium (auction results, market indices) |

| Tax Considerations | Complex (capital gains, dividends) | Variable (capital gains, collectible status) |

Which is better?

Sports team ownership shares offer potential for high returns through franchise value appreciation and revenue from merchandise, ticket sales, and media rights, often influenced by team performance and market size. Wine investment provides portfolio diversification with tangible assets that tend to appreciate over time, driven by rarity, vintage quality, and global demand, making it less volatile but slower-growing. Choosing between these depends on risk tolerance, liquidity preference, and investment horizon, as sports shares are typically higher risk with greater upside, while wine investments appeal to collectors and long-term investors seeking steady appreciation.

Connection

Investment in sports team ownership shares and wine shares the characteristic of diversification into alternative assets that offer potential long-term appreciation and unique market dynamics. Both asset classes attract investors seeking non-correlated returns, with sports team shares benefiting from franchise valuation growth and media rights, while wine investment capitalizes on scarcity, vintage quality, and global demand trends. Institutional investors increasingly allocate capital to these sectors to enhance portfolio resilience and capitalize on niche market inefficiencies.

Key Terms

Wine investment:

Investing in wine offers tangible asset diversification through fine wine collections, known for historical appreciation in value and relatively low correlation with stock markets, unlike sports team ownership shares, which can be highly volatile and dependent on team performance and management decisions. Wine investments provide potential tax benefits and liquidity options via specialized auction platforms and wine funds, while sports team shares often require substantial capital commitment and entail regulatory complexities. Explore the nuances of wine investment to understand how this alternative asset class can enhance your portfolio.

Provenance

Provenance plays a critical role in both wine investment and sports team ownership shares, impacting authenticity, value, and market confidence. Verified history and documented lineage of fine wines enhance their desirability and potential returns, while transparent ownership records and brand legacy influence the valuation of sports team shares. Explore the nuances of provenance to understand how it shapes investment strategies in these dynamic markets.

Storage conditions

Optimal storage conditions for wine investment require consistent temperature control between 55-59degF (13-15degC), humidity levels around 70%, and protection from light and vibration to maintain value and quality over time. Sports team ownership shares do not necessitate physical storage but depend on regulatory documentation and secure digital asset management. Explore more on how storage impacts the long-term returns in these unique investment types.

Source and External Links

Getting Started with Wine Investments | Wine Folly - Investment wines are typically age-worthy and in demand, with the most sought-after being fine Bordeaux and Grand Cru Burgundy; successful wine investing involves buying by the case, ensuring provenance, and considering storage and insurance for valuable wines.

Evaluating the Investment Performance of Fine Wine: Returns and ... - Fine wine investment has delivered consistent average annual returns of 10% since 1988, with better stability over longer investment horizons and opportunities to buy after market downturns, while the market is increasingly diversified beyond Bordeaux to regions like Burgundy, Champagne, Italy, and Napa.

The ten things you need to know about wine investment - Tim Atkin - Wine should be considered a medium- to long-term, less liquid investment that should form only a small part of a diversified portfolio, with critical factors including provenance, bonded storage to avoid taxes, and awareness of commissions and fees related to buying and selling.

dowidth.com

dowidth.com