Virtual land real estate offers a unique investment opportunity through blockchain technology, allowing ownership of digital property in metaverse platforms with potential high returns and liquidity. Mutual funds provide diversified exposure to traditional markets by pooling investor capital into stocks and bonds managed by professionals, balancing risks and returns. Explore the advantages and risks of these distinct investment options to determine which aligns best with your financial goals.

Why it is important

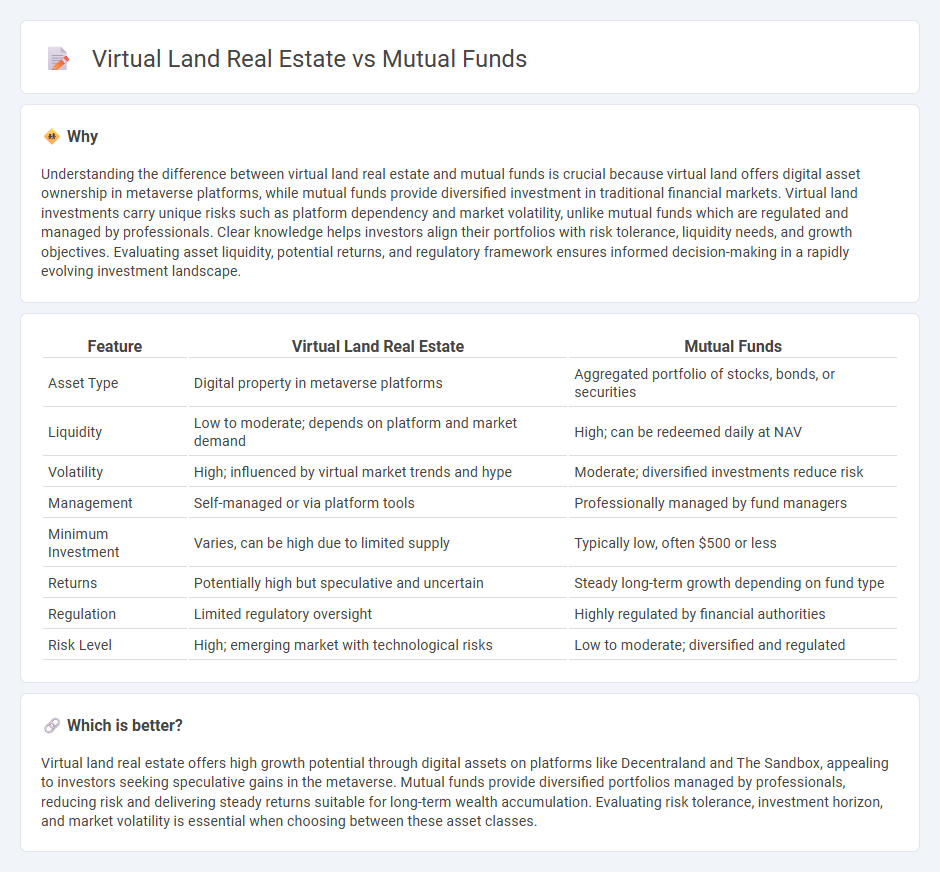

Understanding the difference between virtual land real estate and mutual funds is crucial because virtual land offers digital asset ownership in metaverse platforms, while mutual funds provide diversified investment in traditional financial markets. Virtual land investments carry unique risks such as platform dependency and market volatility, unlike mutual funds which are regulated and managed by professionals. Clear knowledge helps investors align their portfolios with risk tolerance, liquidity needs, and growth objectives. Evaluating asset liquidity, potential returns, and regulatory framework ensures informed decision-making in a rapidly evolving investment landscape.

Comparison Table

| Feature | Virtual Land Real Estate | Mutual Funds |

|---|---|---|

| Asset Type | Digital property in metaverse platforms | Aggregated portfolio of stocks, bonds, or securities |

| Liquidity | Low to moderate; depends on platform and market demand | High; can be redeemed daily at NAV |

| Volatility | High; influenced by virtual market trends and hype | Moderate; diversified investments reduce risk |

| Management | Self-managed or via platform tools | Professionally managed by fund managers |

| Minimum Investment | Varies, can be high due to limited supply | Typically low, often $500 or less |

| Returns | Potentially high but speculative and uncertain | Steady long-term growth depending on fund type |

| Regulation | Limited regulatory oversight | Highly regulated by financial authorities |

| Risk Level | High; emerging market with technological risks | Low to moderate; diversified and regulated |

Which is better?

Virtual land real estate offers high growth potential through digital assets on platforms like Decentraland and The Sandbox, appealing to investors seeking speculative gains in the metaverse. Mutual funds provide diversified portfolios managed by professionals, reducing risk and delivering steady returns suitable for long-term wealth accumulation. Evaluating risk tolerance, investment horizon, and market volatility is essential when choosing between these asset classes.

Connection

Virtual land real estate and mutual funds intersect through diversified investment strategies that blend digital asset portfolios with traditional financial instruments. Investors leverage mutual funds to gain exposure to virtual land markets within metaverse platforms, benefiting from professional management and risk mitigation. This convergence expands opportunities for portfolio growth by integrating emerging digital assets with established investment vehicles.

Key Terms

Diversification

Mutual funds offer extensive diversification by pooling investments across various sectors, asset classes, and geographic regions, reducing risk through portfolio variety. Virtual land real estate, while providing unique digital asset exposure, often lacks the broad diversification inherent to mutual funds due to its niche market focus and higher volatility. Explore detailed comparisons on diversification benefits to optimize your investment strategy effectively.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy or sell shares quickly during market hours, while virtual land real estate tends to have lower liquidity due to its niche market and limited buyers. The ability to access funds promptly makes mutual funds appealing for those needing flexibility or short-term investments, whereas virtual land requires strategic planning for long-term growth. Explore deeper insights on liquidity and investment potential in these asset classes to enhance your portfolio strategy.

Asset valuation

Mutual funds offer transparent asset valuation based on market prices of underlying securities, regularly updated and regulated by financial authorities, ensuring liquidity and price accuracy. Virtual land real estate valuation depends on factors like platform popularity, scarcity, and demand within metaverse ecosystems, often subject to volatility and speculative pricing without standardized appraisal methods. Explore detailed insights to understand how asset valuation impacts investment risks and opportunities in these distinct asset classes.

Source and External Links

Mutual Funds - A mutual fund is an SEC-registered open-end investment company that pools money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities, professionally managed and easily tradable at net asset value.

Mutual fund - Mutual funds pool money from many investors to purchase securities, offering diversification, liquidity, and professional management, and are structured mainly as open-end funds with various investment focuses like money market, equity, or bond funds.

Understanding mutual funds - Mutual funds allow investors to combine resources to invest in stocks, bonds, and other assets, featuring professional management, diversification, low costs due to large-scale transactions, and easy access through banks and brokerages.

dowidth.com

dowidth.com