Music royalties platforms offer investors a unique opportunity to earn passive income by acquiring rights to songs and benefiting from streaming, licensing, and performance royalties. Art investment platforms enable users to diversify portfolios by purchasing shares in high-value artworks, gaining exposure to the growing art market without physical custody. Explore these innovative options to discover which creative asset class aligns best with your investment goals.

Why it is important

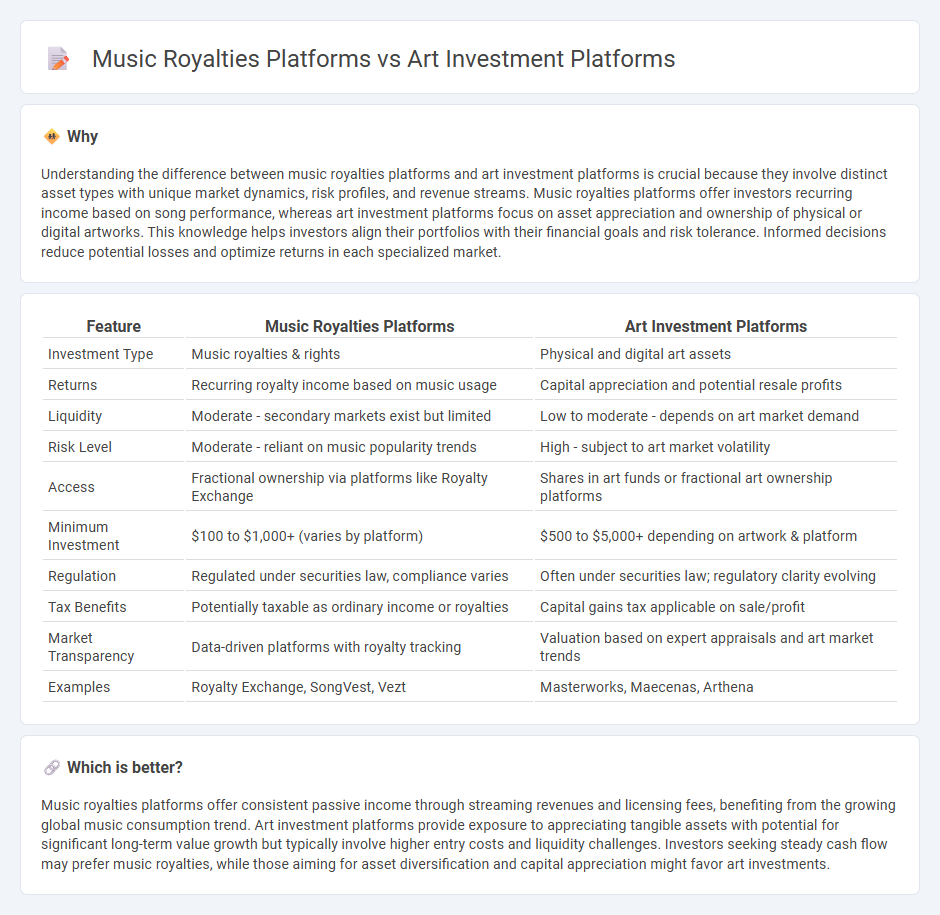

Understanding the difference between music royalties platforms and art investment platforms is crucial because they involve distinct asset types with unique market dynamics, risk profiles, and revenue streams. Music royalties platforms offer investors recurring income based on song performance, whereas art investment platforms focus on asset appreciation and ownership of physical or digital artworks. This knowledge helps investors align their portfolios with their financial goals and risk tolerance. Informed decisions reduce potential losses and optimize returns in each specialized market.

Comparison Table

| Feature | Music Royalties Platforms | Art Investment Platforms |

|---|---|---|

| Investment Type | Music royalties & rights | Physical and digital art assets |

| Returns | Recurring royalty income based on music usage | Capital appreciation and potential resale profits |

| Liquidity | Moderate - secondary markets exist but limited | Low to moderate - depends on art market demand |

| Risk Level | Moderate - reliant on music popularity trends | High - subject to art market volatility |

| Access | Fractional ownership via platforms like Royalty Exchange | Shares in art funds or fractional art ownership platforms |

| Minimum Investment | $100 to $1,000+ (varies by platform) | $500 to $5,000+ depending on artwork & platform |

| Regulation | Regulated under securities law, compliance varies | Often under securities law; regulatory clarity evolving |

| Tax Benefits | Potentially taxable as ordinary income or royalties | Capital gains tax applicable on sale/profit |

| Market Transparency | Data-driven platforms with royalty tracking | Valuation based on expert appraisals and art market trends |

| Examples | Royalty Exchange, SongVest, Vezt | Masterworks, Maecenas, Arthena |

Which is better?

Music royalties platforms offer consistent passive income through streaming revenues and licensing fees, benefiting from the growing global music consumption trend. Art investment platforms provide exposure to appreciating tangible assets with potential for significant long-term value growth but typically involve higher entry costs and liquidity challenges. Investors seeking steady cash flow may prefer music royalties, while those aiming for asset diversification and capital appreciation might favor art investments.

Connection

Music royalties platforms and art investment platforms intersect through the shared model of fractional ownership, allowing investors to acquire and trade rights or shares in creative assets. Both platforms leverage blockchain technology to ensure transparency, security, and efficient royalty distribution, attracting a diverse base of investors seeking alternative asset classes. This convergence enhances liquidity in traditionally illiquid markets, democratizing access and unlocking new revenue streams for artists and collectors alike.

Key Terms

Asset Valuation

Art investment platforms offer asset valuation based on provenance, artist reputation, auction results, and historical price trends, ensuring investors assess physical artwork's market worth accurately. Music royalties platforms value assets by analyzing streaming data, royalty income, rights ownership, and future earnings potential from copyrights. Discover how these platforms apply sophisticated valuation models to maximize returns in their respective markets.

Ownership Structure

Art investment platforms typically offer fractional ownership where investors purchase shares of high-value artworks held in a collective portfolio, ensuring shared equity and potential appreciation. Music royalties platforms grant direct ownership of income-generating rights from song catalogs, allowing investors to receive a portion of streaming, licensing, and performance revenues. Explore detailed comparisons to understand the nuances of ownership structures in both investment categories.

Liquidity Mechanism

Art investment platforms often provide liquidity through secondary markets where shares of art assets can be traded, although these markets may have lower transaction volumes and less frequent trading activity. Music royalties platforms leverage royalty streams that generate regular income, enabling investors to sell future royalties or shares on specialized exchanges with more predictable cash flows and potentially higher liquidity. Explore the nuances of liquidity mechanisms in both art and music investment platforms to optimize your portfolio strategy.

Source and External Links

Best Art Investments and Platforms in 2025 - Benzinga - Masterworks is a leading art investment platform offering fractional ownership in verified blue-chip artworks with an average return of 14% annually, featuring low fees and a secondary market for trading shares.

Top 6 Fractional Art Investment Platforms - Platforms like Masterworks, Mintus, Particle, and Timeless enable investors to purchase shares in high-value artworks, with Masterworks focusing on blue-chip art and offering long-term growth through a straightforward buying and secondary selling process.

Top Art Investment Platforms in 2025 - Slashdot - A variety of art investment platforms such as Artscapy, Splint Invest, Mastersworks.io, and others provide opportunities for full or fractional ownership and even blockchain-based art investment, increasing art market accessibility for diverse investors.

dowidth.com

dowidth.com