Fractional ownership in real estate allows investors to purchase a share of a specific property, offering direct control over asset management and potential rental income. Real Estate Investment Trusts (REITs) provide a more liquid investment option by pooling funds to invest in diversified portfolios of properties, delivering dividends without the complexities of property management. Explore the benefits and risks of each investment strategy to determine the best fit for your financial goals.

Why it is important

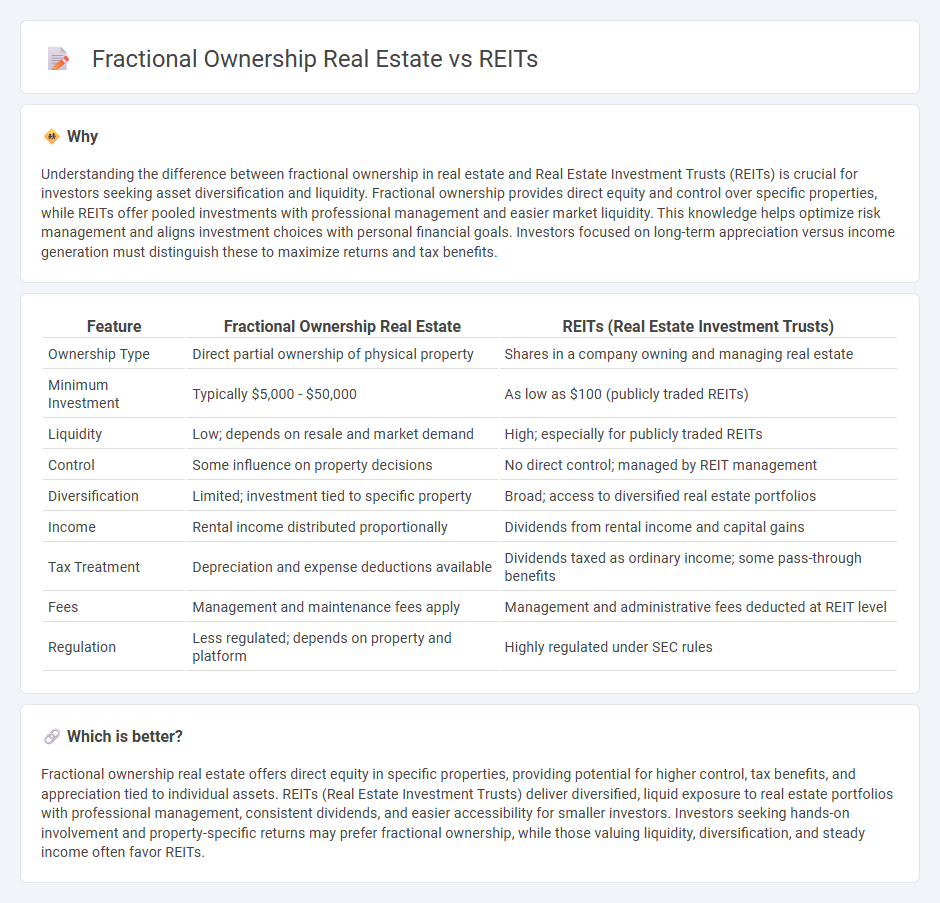

Understanding the difference between fractional ownership in real estate and Real Estate Investment Trusts (REITs) is crucial for investors seeking asset diversification and liquidity. Fractional ownership provides direct equity and control over specific properties, while REITs offer pooled investments with professional management and easier market liquidity. This knowledge helps optimize risk management and aligns investment choices with personal financial goals. Investors focused on long-term appreciation versus income generation must distinguish these to maximize returns and tax benefits.

Comparison Table

| Feature | Fractional Ownership Real Estate | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Ownership Type | Direct partial ownership of physical property | Shares in a company owning and managing real estate |

| Minimum Investment | Typically $5,000 - $50,000 | As low as $100 (publicly traded REITs) |

| Liquidity | Low; depends on resale and market demand | High; especially for publicly traded REITs |

| Control | Some influence on property decisions | No direct control; managed by REIT management |

| Diversification | Limited; investment tied to specific property | Broad; access to diversified real estate portfolios |

| Income | Rental income distributed proportionally | Dividends from rental income and capital gains |

| Tax Treatment | Depreciation and expense deductions available | Dividends taxed as ordinary income; some pass-through benefits |

| Fees | Management and maintenance fees apply | Management and administrative fees deducted at REIT level |

| Regulation | Less regulated; depends on property and platform | Highly regulated under SEC rules |

Which is better?

Fractional ownership real estate offers direct equity in specific properties, providing potential for higher control, tax benefits, and appreciation tied to individual assets. REITs (Real Estate Investment Trusts) deliver diversified, liquid exposure to real estate portfolios with professional management, consistent dividends, and easier accessibility for smaller investors. Investors seeking hands-on involvement and property-specific returns may prefer fractional ownership, while those valuing liquidity, diversification, and steady income often favor REITs.

Connection

Fractional ownership in real estate allows investors to purchase a portion of a property, while Real Estate Investment Trusts (REITs) pool funds from multiple investors to buy and manage a diversified portfolio of income-generating real estate assets. Both methods provide access to real estate markets with lower capital requirements and increased liquidity compared to whole-property investment. This connection enables individual investors to gain exposure to real estate's cash flow and asset appreciation without directly owning or managing properties.

Key Terms

Equity Ownership

REITs offer investors liquidity and diversification by pooling funds to own large-scale real estate assets, providing shares that represent equity but without direct property control. Fractional ownership grants investors a tangible equity stake in a specific property, enabling shared decision-making and potential influence over management and operations. Explore in-depth comparisons of equity benefits and control in REITs versus fractional real estate ownership.

Liquidity

REITs offer high liquidity through publicly traded shares, enabling investors to buy and sell easily on stock exchanges, whereas fractional ownership entails direct investment in property with limited liquidity due to ownership transfer complexities. REITs provide daily market access and immediate pricing, while fractional ownership may require longer holding periods and legal procedures to exit. Explore deeper insights into liquidity differences between REITs and fractional ownership for informed investment decisions.

Dividend Yield

REITs typically offer higher and more consistent dividend yields compared to fractional ownership real estate, averaging between 4% to 7% annually due to their mandated income distribution structure. Fractional ownership yields can vary widely, often influenced by property type, location, and management efficiency, with returns more reliant on property appreciation and rental income. Explore the detailed financial benefits and risks associated with each investment approach to make an informed decision.

Source and External Links

Real estate investment trust - A REIT is a company that owns and typically operates income-producing real estate, such as office buildings, apartments, shopping centers, and hotels, and is structured to avoid corporate income tax by distributing most of its income as dividends.

Real Estate Investment Trusts (REITs) - REITs allow individual investors to earn income from commercial real estate ownership without directly buying property, by purchasing shares in companies that own and manage real estate assets like office buildings, shopping malls, and hotels.

Real Estate Investment Trusts (REITs) - Investors can buy and sell REIT shares on stock exchanges, benefiting from potential capital appreciation and regular dividends, while the REIT itself avoids double taxation by distributing at least 90% of its taxable income to shareholders.

dowidth.com

dowidth.com