Fractional real estate investing allows individuals to purchase shares of a property, providing direct ownership and proportional returns, while real estate limited partnerships (RELPs) offer pooled investment opportunities managed by general partners with limited liability for investors. Both options diversify portfolios and minimize risk compared to traditional real estate investments, but they differ in liquidity, control, and management involvement. Explore the nuances between these investment vehicles to determine the best fit for your financial goals.

Why it is important

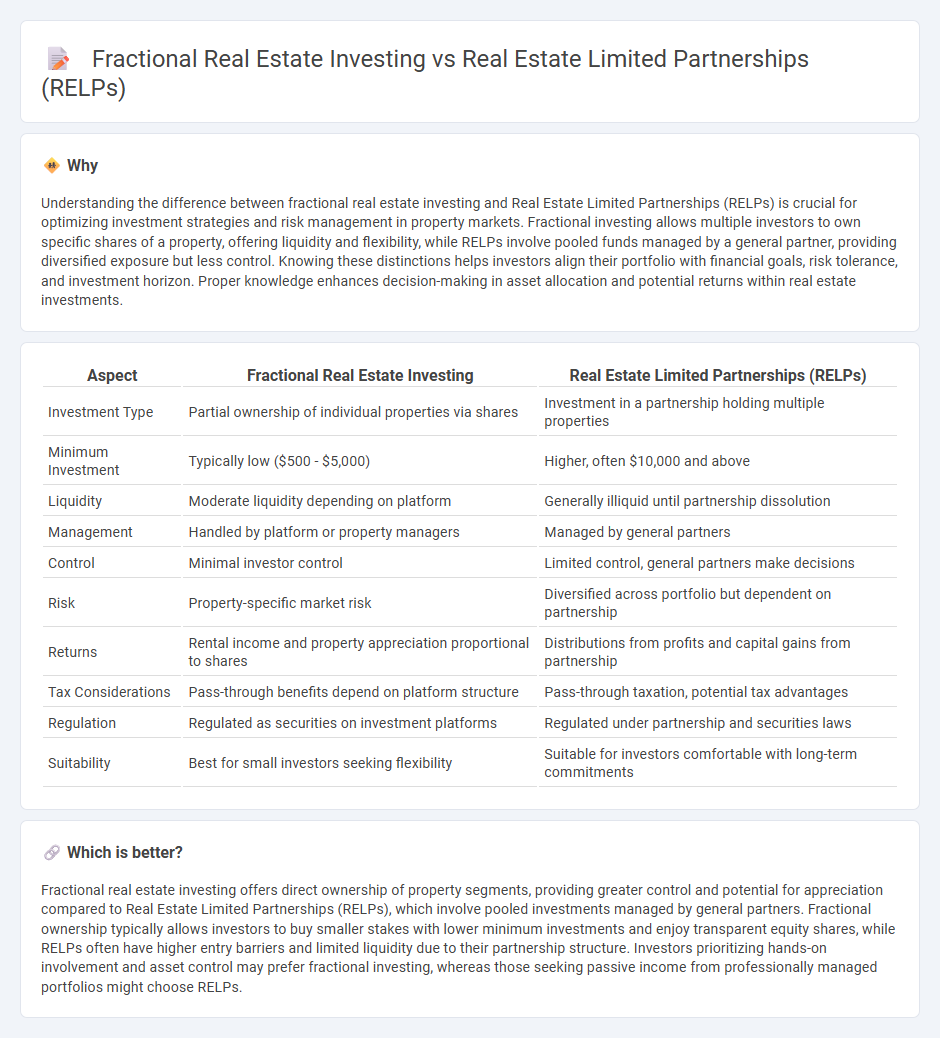

Understanding the difference between fractional real estate investing and Real Estate Limited Partnerships (RELPs) is crucial for optimizing investment strategies and risk management in property markets. Fractional investing allows multiple investors to own specific shares of a property, offering liquidity and flexibility, while RELPs involve pooled funds managed by a general partner, providing diversified exposure but less control. Knowing these distinctions helps investors align their portfolio with financial goals, risk tolerance, and investment horizon. Proper knowledge enhances decision-making in asset allocation and potential returns within real estate investments.

Comparison Table

| Aspect | Fractional Real Estate Investing | Real Estate Limited Partnerships (RELPs) |

|---|---|---|

| Investment Type | Partial ownership of individual properties via shares | Investment in a partnership holding multiple properties |

| Minimum Investment | Typically low ($500 - $5,000) | Higher, often $10,000 and above |

| Liquidity | Moderate liquidity depending on platform | Generally illiquid until partnership dissolution |

| Management | Handled by platform or property managers | Managed by general partners |

| Control | Minimal investor control | Limited control, general partners make decisions |

| Risk | Property-specific market risk | Diversified across portfolio but dependent on partnership |

| Returns | Rental income and property appreciation proportional to shares | Distributions from profits and capital gains from partnership |

| Tax Considerations | Pass-through benefits depend on platform structure | Pass-through taxation, potential tax advantages |

| Regulation | Regulated as securities on investment platforms | Regulated under partnership and securities laws |

| Suitability | Best for small investors seeking flexibility | Suitable for investors comfortable with long-term commitments |

Which is better?

Fractional real estate investing offers direct ownership of property segments, providing greater control and potential for appreciation compared to Real Estate Limited Partnerships (RELPs), which involve pooled investments managed by general partners. Fractional ownership typically allows investors to buy smaller stakes with lower minimum investments and enjoy transparent equity shares, while RELPs often have higher entry barriers and limited liquidity due to their partnership structure. Investors prioritizing hands-on involvement and asset control may prefer fractional investing, whereas those seeking passive income from professionally managed portfolios might choose RELPs.

Connection

Fractional real estate investing and Real Estate Limited Partnerships (RELPs) both enable investors to pool capital for property ownership, allowing participation in high-value real estate with reduced individual investment. Fractional investing divides ownership into smaller shares, while RELPs structure investors as limited partners sharing profits and risks managed by a general partner. Both models provide access to diversified real estate portfolios, enhancing liquidity and lowering barriers to entry in the property market.

Key Terms

Ownership Structure

Real estate limited partnerships (RELPs) feature a hierarchical ownership structure where limited partners invest capital but hold no management control, while the general partner manages property operations and decision-making. Fractional real estate investing divides property ownership into equal shares, granting investors direct ownership and potential voting rights proportional to their investment. Discover more about how ownership structures influence your real estate investment strategy.

Liquidity

Real estate limited partnerships (RELPs) typically offer low liquidity since investors must wait for the partnership to sell properties or dissolve to access their capital. Fractional real estate investing provides higher liquidity, allowing investors to buy and sell shares on secondary markets or platforms more easily and quickly. Explore the differences in liquidity and investment flexibility to determine which real estate option suits your financial goals.

Minimum Investment

Real estate limited partnerships (RELPs) typically require minimum investments ranging from $25,000 to $100,000, making them accessible primarily to accredited investors. Fractional real estate investing lowers the entry barrier significantly, often allowing investors to start with as little as $500 to $5,000. Explore detailed comparisons to determine which investment aligns best with your financial goals and risk tolerance.

Source and External Links

What Is a Real Estate Limited Partnership (RELP)? - SmartAsset - A RELP is a partnership where general partners manage the real estate project and assume unlimited liability, while limited partners provide capital, have no management role, and face liability only up to their investment.

Real Estate Limited Partnerships in Commercial Real Estate - RELPs are commonly used in commercial real estate, with a general partner handling operations and limited liability for limited partners, but investments are typically illiquid and often restricted to accredited investors.

How real estate partnerships work: The pros and cons - RELPs separate management (general partner) from investment (limited partners), offering liability protection for passive investors, unlike general partnerships where all partners share control and unlimited liability.

dowidth.com

dowidth.com