Tangible asset tokenization leverages blockchain technology to convert physical assets into digital tokens, enabling fractional ownership, increased liquidity, and 24/7 trading access. Real Estate Investment Trusts (REITs) offer investors exposure to real estate portfolios with regular dividends and professional management but often lack the liquidity and direct ownership benefits found in tokenized assets. Explore how these innovative investment vehicles can diversify your portfolio and optimize returns.

Why it is important

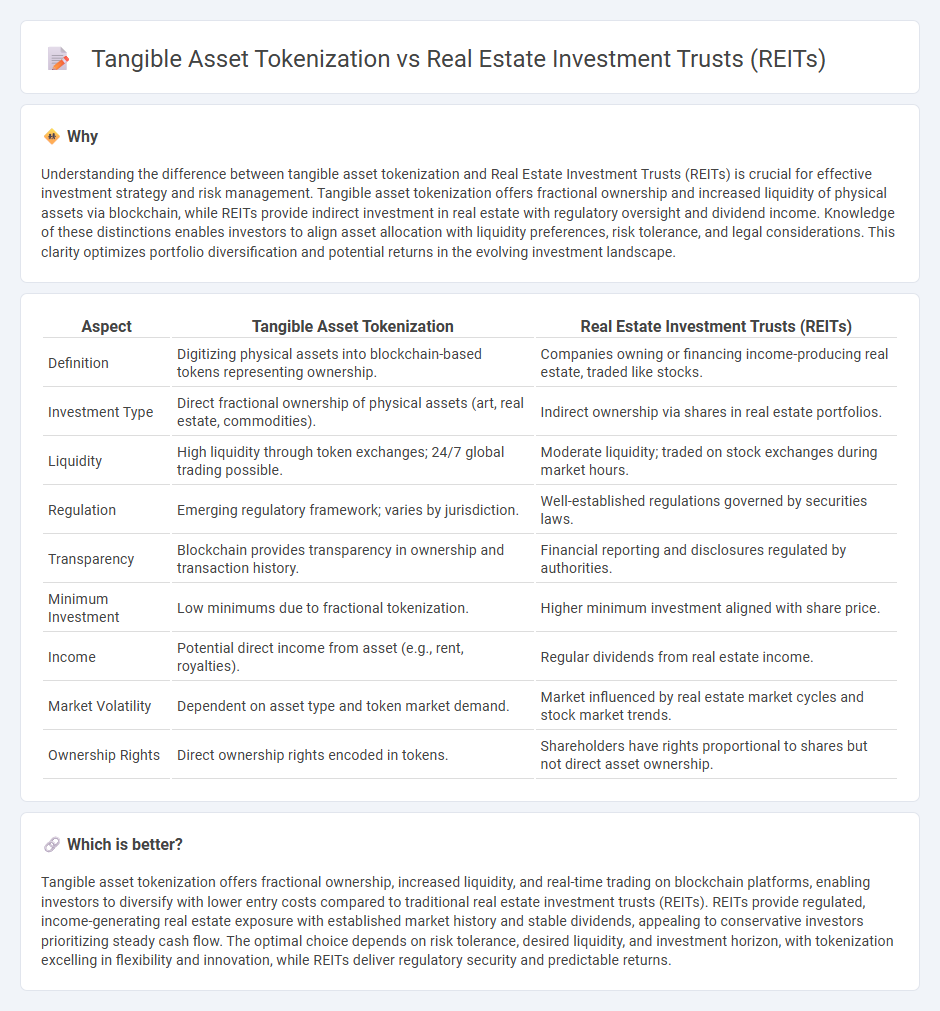

Understanding the difference between tangible asset tokenization and Real Estate Investment Trusts (REITs) is crucial for effective investment strategy and risk management. Tangible asset tokenization offers fractional ownership and increased liquidity of physical assets via blockchain, while REITs provide indirect investment in real estate with regulatory oversight and dividend income. Knowledge of these distinctions enables investors to align asset allocation with liquidity preferences, risk tolerance, and legal considerations. This clarity optimizes portfolio diversification and potential returns in the evolving investment landscape.

Comparison Table

| Aspect | Tangible Asset Tokenization | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Digitizing physical assets into blockchain-based tokens representing ownership. | Companies owning or financing income-producing real estate, traded like stocks. |

| Investment Type | Direct fractional ownership of physical assets (art, real estate, commodities). | Indirect ownership via shares in real estate portfolios. |

| Liquidity | High liquidity through token exchanges; 24/7 global trading possible. | Moderate liquidity; traded on stock exchanges during market hours. |

| Regulation | Emerging regulatory framework; varies by jurisdiction. | Well-established regulations governed by securities laws. |

| Transparency | Blockchain provides transparency in ownership and transaction history. | Financial reporting and disclosures regulated by authorities. |

| Minimum Investment | Low minimums due to fractional tokenization. | Higher minimum investment aligned with share price. |

| Income | Potential direct income from asset (e.g., rent, royalties). | Regular dividends from real estate income. |

| Market Volatility | Dependent on asset type and token market demand. | Market influenced by real estate market cycles and stock market trends. |

| Ownership Rights | Direct ownership rights encoded in tokens. | Shareholders have rights proportional to shares but not direct asset ownership. |

Which is better?

Tangible asset tokenization offers fractional ownership, increased liquidity, and real-time trading on blockchain platforms, enabling investors to diversify with lower entry costs compared to traditional real estate investment trusts (REITs). REITs provide regulated, income-generating real estate exposure with established market history and stable dividends, appealing to conservative investors prioritizing steady cash flow. The optimal choice depends on risk tolerance, desired liquidity, and investment horizon, with tokenization excelling in flexibility and innovation, while REITs deliver regulatory security and predictable returns.

Connection

Tangible asset tokenization transforms physical real estate properties into digital tokens, enabling fractional ownership and increased liquidity. Real Estate Investment Trusts (REITs) similarly pool investor capital to invest in income-generating properties, offering liquidity through tradable shares. Both mechanisms democratize real estate investment by lowering entry barriers and enhancing market accessibility.

Key Terms

Liquidity

Real estate investment trusts (REITs) offer investors liquidity through publicly traded shares that can be bought or sold on stock exchanges, enabling quicker access to funds compared to direct property investments. Tangible asset tokenization leverages blockchain technology to fractionalize ownership in real estate, providing enhanced liquidity with 24/7 trading opportunities on digital platforms and reduced transaction costs. Explore the evolving landscape of real estate liquidity by learning more about these innovative investment options.

Ownership Structure

Real estate investment trusts (REITs) offer investors fractional ownership in income-generating real estate through shares traded on public exchanges, providing liquidity and regulatory oversight. Tangible asset tokenization involves converting ownership rights of physical assets into digital tokens on a blockchain, enabling direct, decentralized, and often peer-to-peer transactions with enhanced transparency and reduced intermediaries. Explore the nuances of ownership structures in REITs and tokenization to understand their impact on control, liquidity, and investor rights.

Regulatory Framework

Real estate investment trusts (REITs) operate under well-established regulatory frameworks such as SEC regulations in the U.S., ensuring investor protection and standardized disclosures. Tangible asset tokenization leverages blockchain technology but faces evolving legal landscapes, with regulatory bodies worldwide developing guidelines to address digital security and asset ownership. Explore how regulatory policies shape the future of property investment through these innovative financial structures.

Source and External Links

Real estate investment trust - Wikipedia - REITs are companies that own and typically operate income-producing real estate, offering investors a way to access diversified real estate portfolios while benefiting from special tax considerations.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs provide investors with regular income streams, diversification, and potential long-term capital appreciation, all through a structure modeled after mutual funds that is liquid and accessible.

Real Estate Investment Trusts (REITs) - Investor.gov - REITs allow individuals to invest in large-scale, income-producing real estate like offices, malls, and hotels, without the need to buy or manage properties directly.

dowidth.com

dowidth.com