Music royalties investment offers a unique opportunity to earn passive income through rights to popular songs and catalogs, leveraging the growing demand for streaming and licensing revenues. Wine investment involves acquiring fine wines that appreciate in value based on rarity, vintage, and provenance, with market trends influenced by collectors and connoisseurs. Explore the distinct benefits and risks of music royalties versus wine investment to diversify your portfolio effectively.

Why it is important

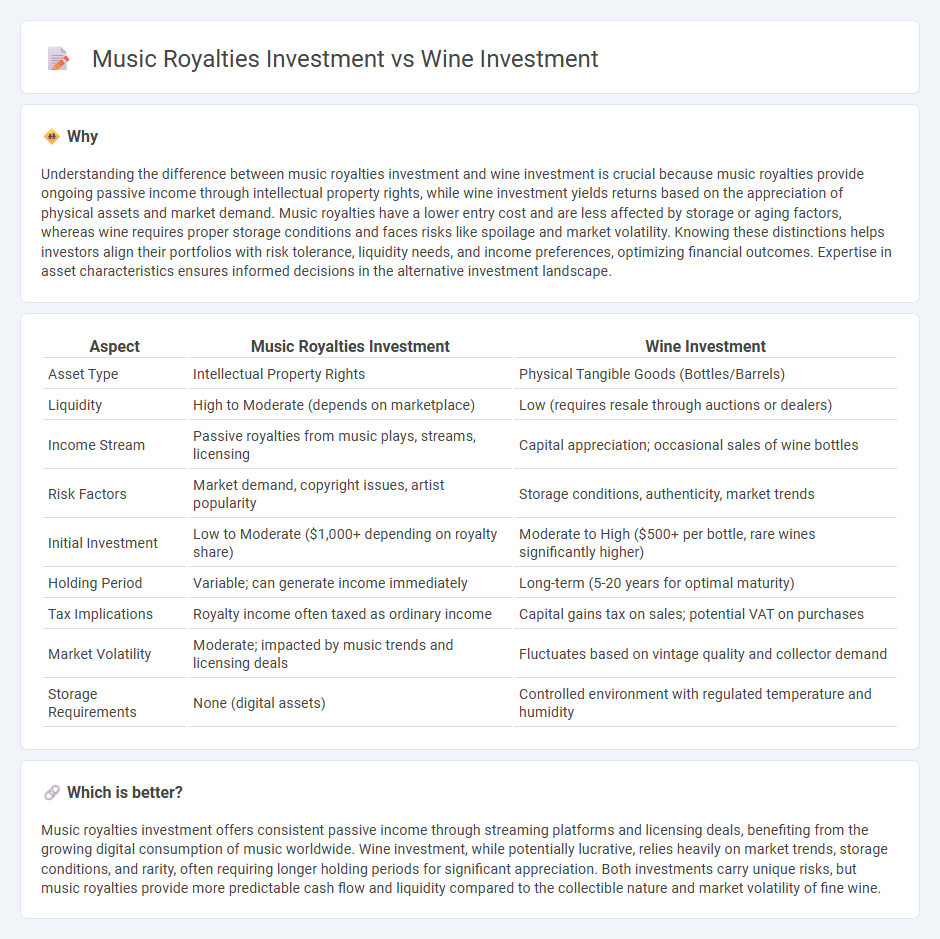

Understanding the difference between music royalties investment and wine investment is crucial because music royalties provide ongoing passive income through intellectual property rights, while wine investment yields returns based on the appreciation of physical assets and market demand. Music royalties have a lower entry cost and are less affected by storage or aging factors, whereas wine requires proper storage conditions and faces risks like spoilage and market volatility. Knowing these distinctions helps investors align their portfolios with risk tolerance, liquidity needs, and income preferences, optimizing financial outcomes. Expertise in asset characteristics ensures informed decisions in the alternative investment landscape.

Comparison Table

| Aspect | Music Royalties Investment | Wine Investment |

|---|---|---|

| Asset Type | Intellectual Property Rights | Physical Tangible Goods (Bottles/Barrels) |

| Liquidity | High to Moderate (depends on marketplace) | Low (requires resale through auctions or dealers) |

| Income Stream | Passive royalties from music plays, streams, licensing | Capital appreciation; occasional sales of wine bottles |

| Risk Factors | Market demand, copyright issues, artist popularity | Storage conditions, authenticity, market trends |

| Initial Investment | Low to Moderate ($1,000+ depending on royalty share) | Moderate to High ($500+ per bottle, rare wines significantly higher) |

| Holding Period | Variable; can generate income immediately | Long-term (5-20 years for optimal maturity) |

| Tax Implications | Royalty income often taxed as ordinary income | Capital gains tax on sales; potential VAT on purchases |

| Market Volatility | Moderate; impacted by music trends and licensing deals | Fluctuates based on vintage quality and collector demand |

| Storage Requirements | None (digital assets) | Controlled environment with regulated temperature and humidity |

Which is better?

Music royalties investment offers consistent passive income through streaming platforms and licensing deals, benefiting from the growing digital consumption of music worldwide. Wine investment, while potentially lucrative, relies heavily on market trends, storage conditions, and rarity, often requiring longer holding periods for significant appreciation. Both investments carry unique risks, but music royalties provide more predictable cash flow and liquidity compared to the collectible nature and market volatility of fine wine.

Connection

Music royalties investment and wine investment both offer alternative asset opportunities that generate passive income streams independent of traditional markets. Music royalties provide investors with ongoing earnings from intellectual property rights, while wine investment capitalizes on the appreciation of rare vintages over time. Both asset classes require specialized market knowledge, rely on scarcity and demand, and serve as portfolio diversification tools that hedge against inflation and economic downturns.

Key Terms

**Wine investment:**

Wine investment offers a tangible asset class with historically stable returns, driven by demand for rare and aged bottles from prestigious vineyards like Bordeaux and Burgundy. Fine wine appreciates alongside market trends in luxury goods and is less correlated with traditional financial markets, providing portfolio diversification. Explore more about the benefits and risks of wine investment to enhance your wealth strategy.

Provenance

Provenance plays a critical role in both wine and music royalties investments by ensuring authenticity and traceability, which directly impacts asset value and investor confidence. In wine investment, detailed records of vineyard origin, vintage, and storage conditions validate exclusivity and quality, while music royalties rely on accurate metadata and rights management to verify ownership and revenue streams. Explore how provenance influences returns and risks in these unique investment opportunities to make informed decisions.

Vintage

Investing in vintage wine centers on acquiring rare bottles whose value appreciates due to scarcity, provenance, and aging potential, often yielding substantial returns over time. Music royalties investment involves purchasing rights to income generated by songs, providing a steady cash flow based on play frequency and licensing deals, with vintage tracks potentially offering higher returns as their popularity endures. Discover how these asset classes compare in risk, liquidity, and market trends by exploring detailed analyses today.

Source and External Links

Getting Started with Wine Investments - Wine investment focuses on fine Bordeaux and Grand Cru Burgundy bottles, recommending buying by the case with provenance and considering wine insurance for home storage.

Investing in Fine Wines - Fine wine is a tangible, stable asset with a history of growth and low correlation to traditional markets, with tailored portfolio management and insured storage offered by firms like Cru Wine.

Investing In Fine Wine | Cult Wines United States - Cult Wines provides expert portfolio creation for wine investment, boasting strong historic returns and highlighting wine as a preferred low-risk portfolio diversifier for modern investors.

dowidth.com

dowidth.com