Sports card fractionalization leverages high market demand and liquidity in collectible cards, enabling investors to own shares in rare, high-value items without the need for full purchase. Fine jewelry fractional ownership offers access to luxurious assets with enduring value, often benefiting from expert appraisal and secure storage solutions. Explore further to understand which fractional investment suits your portfolio goals best.

Why it is important

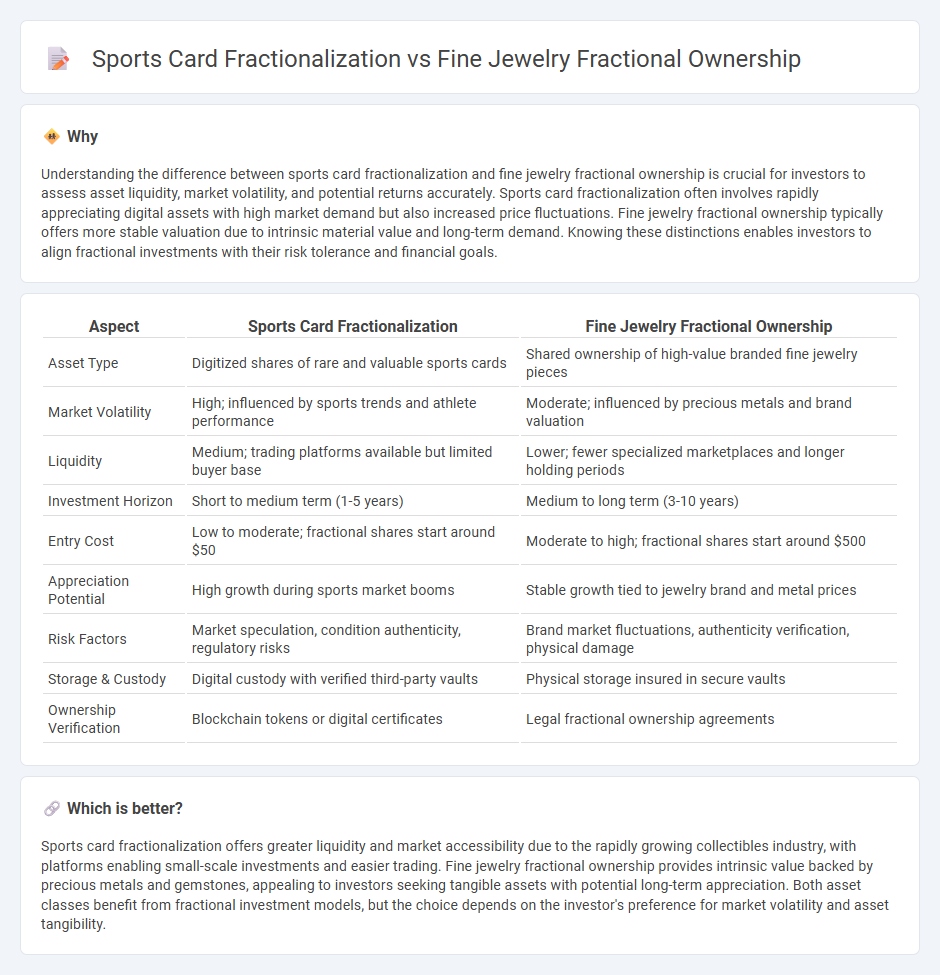

Understanding the difference between sports card fractionalization and fine jewelry fractional ownership is crucial for investors to assess asset liquidity, market volatility, and potential returns accurately. Sports card fractionalization often involves rapidly appreciating digital assets with high market demand but also increased price fluctuations. Fine jewelry fractional ownership typically offers more stable valuation due to intrinsic material value and long-term demand. Knowing these distinctions enables investors to align fractional investments with their risk tolerance and financial goals.

Comparison Table

| Aspect | Sports Card Fractionalization | Fine Jewelry Fractional Ownership |

|---|---|---|

| Asset Type | Digitized shares of rare and valuable sports cards | Shared ownership of high-value branded fine jewelry pieces |

| Market Volatility | High; influenced by sports trends and athlete performance | Moderate; influenced by precious metals and brand valuation |

| Liquidity | Medium; trading platforms available but limited buyer base | Lower; fewer specialized marketplaces and longer holding periods |

| Investment Horizon | Short to medium term (1-5 years) | Medium to long term (3-10 years) |

| Entry Cost | Low to moderate; fractional shares start around $50 | Moderate to high; fractional shares start around $500 |

| Appreciation Potential | High growth during sports market booms | Stable growth tied to jewelry brand and metal prices |

| Risk Factors | Market speculation, condition authenticity, regulatory risks | Brand market fluctuations, authenticity verification, physical damage |

| Storage & Custody | Digital custody with verified third-party vaults | Physical storage insured in secure vaults |

| Ownership Verification | Blockchain tokens or digital certificates | Legal fractional ownership agreements |

Which is better?

Sports card fractionalization offers greater liquidity and market accessibility due to the rapidly growing collectibles industry, with platforms enabling small-scale investments and easier trading. Fine jewelry fractional ownership provides intrinsic value backed by precious metals and gemstones, appealing to investors seeking tangible assets with potential long-term appreciation. Both asset classes benefit from fractional investment models, but the choice depends on the investor's preference for market volatility and asset tangibility.

Connection

Sports card fractionalization and fine jewelry fractional ownership both leverage blockchain technology to democratize access to high-value assets, enabling investors to buy and trade partial shares securely. This tokenization enhances liquidity in traditionally illiquid markets, allowing fractional investors to diversify portfolios with rare sports cards and certified fine jewelry pieces. The shared emphasis on transparency, provenance verification, and market accessibility links these emerging asset classes in the evolving investment landscape.

Key Terms

Asset Authentication

Fine jewelry fractional ownership relies heavily on advanced gemological certification and blockchain-enabled provenance tracking to ensure authenticity and prevent fraud. Sports card fractionalization depends on professional grading services like PSA or Beckett combined with secure digital ledgers to validate card condition and ownership. Explore how cutting-edge authentication technologies secure your investment in these emerging fractional asset markets.

Market Liquidity

Fine jewelry fractional ownership enhances market liquidity by enabling investors to buy and sell shares of rare gems and designer pieces, often facilitated through blockchain platforms ensuring transparency and security. In contrast, sports card fractionalization increases liquidity in a historically illiquid market by allowing collectors to trade shares in high-value cards, with marketplaces providing real-time pricing and access to a broader investor base. Explore further to understand how these models are transforming asset liquidity and investment strategies.

Valuation Methodology

Fine jewelry fractional ownership valuation relies on expert appraisals considering gemstone quality, craftsmanship, and market demand, ensuring precise asset-based pricing. Sports card fractionalization employs market-driven valuation, using recent sale prices, rarity, and condition grades from platforms like PSA and Beckett to determine share value. Explore detailed methodologies to understand unique valuation nuances across these asset classes.

Source and External Links

Fractional Ownership - This article discusses how fractional ownership in high-end jewelry allows investors to benefit from potential appreciation and diversification without the high initial costs.

8 Ways Technology Is Changing Fine Jewelry Investment - The article highlights how technology like blockchain is enabling fractional ownership models in fine jewelry, making it more accessible and liquid.

Luxury Jewelry: Smart Investment for Style Financial Growth - While this article focuses on responsible and sustainable luxury jewelry investments, it touches on the broader concept of fine jewelry as a long-term investment opportunity.

dowidth.com

dowidth.com