Crowdlending platforms enable investors to directly fund loans to businesses or individuals, often offering higher interest rates compared to traditional investments. Index funds provide diversified exposure to a broad market segment, minimizing risk through passive management and lower fees. Explore how each option aligns with your financial goals and risk tolerance to make informed investment decisions.

Why it is important

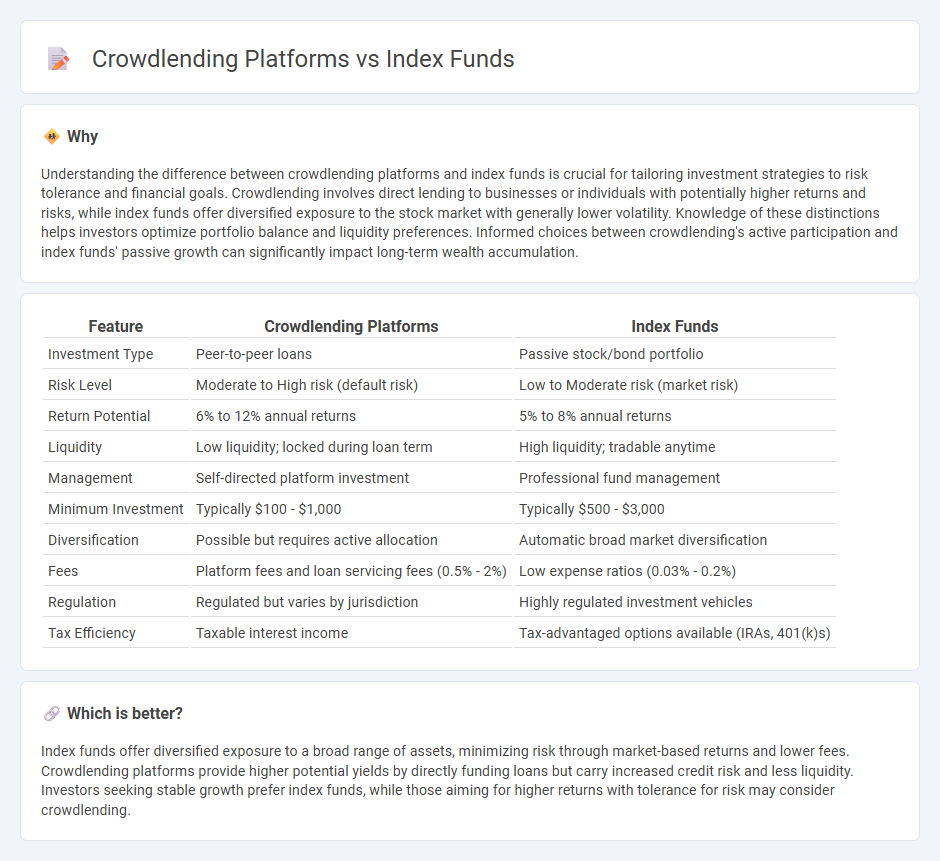

Understanding the difference between crowdlending platforms and index funds is crucial for tailoring investment strategies to risk tolerance and financial goals. Crowdlending involves direct lending to businesses or individuals with potentially higher returns and risks, while index funds offer diversified exposure to the stock market with generally lower volatility. Knowledge of these distinctions helps investors optimize portfolio balance and liquidity preferences. Informed choices between crowdlending's active participation and index funds' passive growth can significantly impact long-term wealth accumulation.

Comparison Table

| Feature | Crowdlending Platforms | Index Funds |

|---|---|---|

| Investment Type | Peer-to-peer loans | Passive stock/bond portfolio |

| Risk Level | Moderate to High risk (default risk) | Low to Moderate risk (market risk) |

| Return Potential | 6% to 12% annual returns | 5% to 8% annual returns |

| Liquidity | Low liquidity; locked during loan term | High liquidity; tradable anytime |

| Management | Self-directed platform investment | Professional fund management |

| Minimum Investment | Typically $100 - $1,000 | Typically $500 - $3,000 |

| Diversification | Possible but requires active allocation | Automatic broad market diversification |

| Fees | Platform fees and loan servicing fees (0.5% - 2%) | Low expense ratios (0.03% - 0.2%) |

| Regulation | Regulated but varies by jurisdiction | Highly regulated investment vehicles |

| Tax Efficiency | Taxable interest income | Tax-advantaged options available (IRAs, 401(k)s) |

Which is better?

Index funds offer diversified exposure to a broad range of assets, minimizing risk through market-based returns and lower fees. Crowdlending platforms provide higher potential yields by directly funding loans but carry increased credit risk and less liquidity. Investors seeking stable growth prefer index funds, while those aiming for higher returns with tolerance for risk may consider crowdlending.

Connection

Crowdlending platforms and index funds are connected through their shared goal of providing diversified investment opportunities with accessible entry points for individual investors. Crowdlending allows investors to fund multiple loans across various borrowers, minimizing risk, similarly to how index funds distribute investment across a wide range of assets to achieve balanced exposure. Both instruments support portfolio diversification strategies that enhance risk-adjusted returns in personal finance and investment management.

Key Terms

Diversification

Index funds provide broad market exposure by investing in a wide range of securities, reducing risk through diversification across sectors and companies. Crowdlending platforms focus on distributing investments among multiple loans to mitigate default risk, though they may have less liquidity and higher risk compared to traditional securities. Explore the strengths and trade-offs of these options to determine which diversification strategy suits your financial goals.

Liquidity

Index funds offer high liquidity, allowing investors to buy or sell shares quickly on the stock market with minimal transaction costs. Crowdlending platforms typically have lower liquidity since loans are often locked in until maturity, limiting early withdrawal options. Explore more about the liquidity differences between index funds and crowdlending platforms to optimize your investment strategy.

Risk

Index funds offer diversified exposure to a broad market, reducing individual asset risk through passive management and typically lower volatility compared to crowdlending platforms. Crowdlending platforms involve direct lending to businesses or individuals, presenting higher risk due to potential borrower default, but possibly delivering higher interest returns. Explore detailed risk comparisons and investment strategies to make an informed decision.

Source and External Links

Index Funds | Investor.gov - This page provides an overview of index funds, including how they track market indexes and how they are structured.

What is an index fund? - Vanguard - This article explains the concept of index funds and their role in tracking specific benchmarks like the S&P 500.

The Best Index Funds | Morningstar - This resource lists top-rated index funds and explains their popularity in comparison to actively managed funds.

dowidth.com

dowidth.com