Digital real estate offers investors a unique opportunity to own virtual properties within online platforms, providing high liquidity and accessibility compared to traditional assets. Real Estate Investment Trusts (REITs) deliver exposure to diversified property portfolios with steady income streams through dividends, backed by tangible physical assets. Explore the distinctive benefits and risks of digital real estate and REITs to make informed investment decisions.

Why it is important

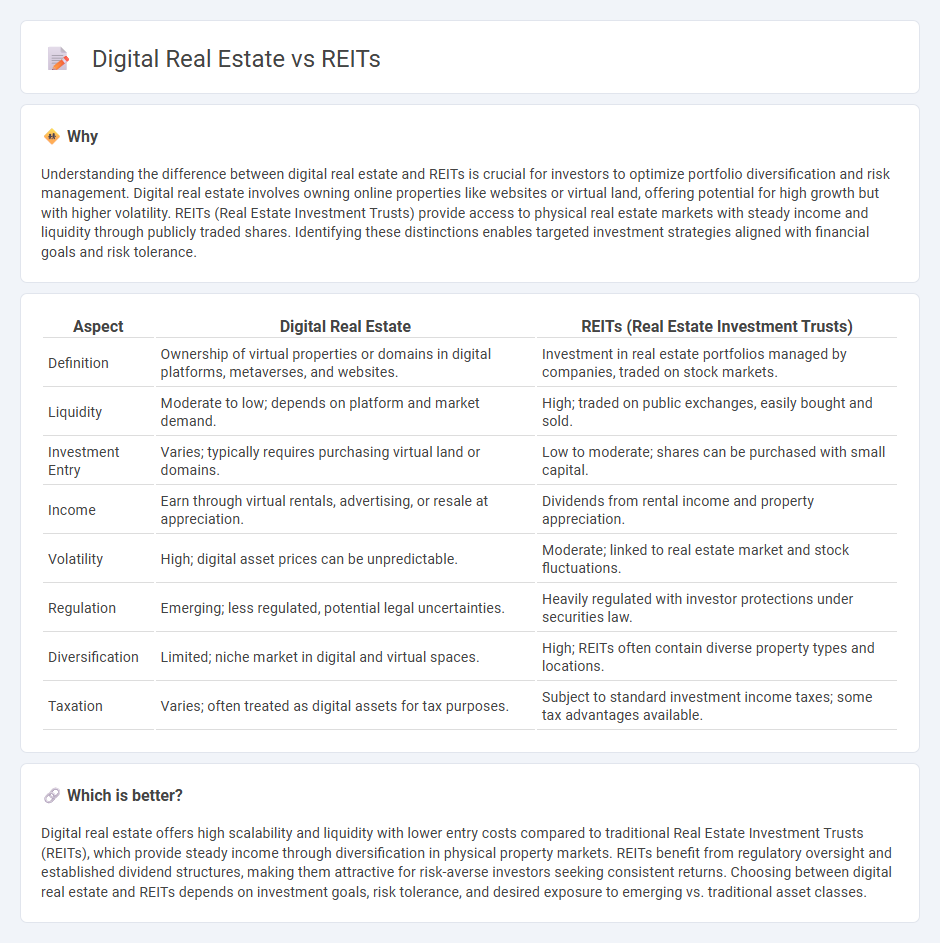

Understanding the difference between digital real estate and REITs is crucial for investors to optimize portfolio diversification and risk management. Digital real estate involves owning online properties like websites or virtual land, offering potential for high growth but with higher volatility. REITs (Real Estate Investment Trusts) provide access to physical real estate markets with steady income and liquidity through publicly traded shares. Identifying these distinctions enables targeted investment strategies aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Digital Real Estate | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Definition | Ownership of virtual properties or domains in digital platforms, metaverses, and websites. | Investment in real estate portfolios managed by companies, traded on stock markets. |

| Liquidity | Moderate to low; depends on platform and market demand. | High; traded on public exchanges, easily bought and sold. |

| Investment Entry | Varies; typically requires purchasing virtual land or domains. | Low to moderate; shares can be purchased with small capital. |

| Income | Earn through virtual rentals, advertising, or resale at appreciation. | Dividends from rental income and property appreciation. |

| Volatility | High; digital asset prices can be unpredictable. | Moderate; linked to real estate market and stock fluctuations. |

| Regulation | Emerging; less regulated, potential legal uncertainties. | Heavily regulated with investor protections under securities law. |

| Diversification | Limited; niche market in digital and virtual spaces. | High; REITs often contain diverse property types and locations. |

| Taxation | Varies; often treated as digital assets for tax purposes. | Subject to standard investment income taxes; some tax advantages available. |

Which is better?

Digital real estate offers high scalability and liquidity with lower entry costs compared to traditional Real Estate Investment Trusts (REITs), which provide steady income through diversification in physical property markets. REITs benefit from regulatory oversight and established dividend structures, making them attractive for risk-averse investors seeking consistent returns. Choosing between digital real estate and REITs depends on investment goals, risk tolerance, and desired exposure to emerging vs. traditional asset classes.

Connection

Digital real estate and REITs are connected through their shared focus on real estate assets, offering investors diverse opportunities to generate income. Digital real estate involves virtual properties in online environments, while REITs invest in physical real estate portfolios, providing liquidity and dividend yields. Both investment types leverage technology to expand access to real estate markets and diversify portfolios.

Key Terms

Asset Type

REITs primarily invest in tangible property assets such as office buildings, retail centers, and residential complexes, offering traditional real estate exposure with steady income streams through rent. Digital real estate encompasses virtual properties within metaverse platforms, NFTs, and domain names, representing emerging, intangible asset classes driven by blockchain technology and digital demand. Explore the evolving landscape of REITs and digital real estate to unlock cutting-edge investment opportunities.

Liquidity

Real Estate Investment Trusts (REITs) offer high liquidity by allowing investors to buy and sell shares on major stock exchanges, providing quick access to capital. Digital real estate, including virtual land and NFTs, often faces lower liquidity due to limited buyer pools and platform-specific marketplaces. Explore the evolving liquidity dynamics between traditional REITs and digital real estate assets for informed investment strategies.

Revenue Model

REITs generate revenue primarily through rental income from physical properties and dividends distributed to investors based on property profits. Digital real estate, including virtual land and metaverse assets, monetizes through leasing virtual spaces, advertising, and NFT sales within online platforms. Explore the distinct revenue models and growth potential of REITs versus digital real estate to understand investment opportunities.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns and operates income-producing real estate such as offices, apartments, hospitals, and shopping centers, offering a way to invest in real estate with tax advantages and different types including equity and mortgage REITs.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individual investors to earn income from large-scale commercial real estate like malls and apartments without buying the properties themselves; they can be publicly traded or non-traded.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate, offering investors regular income, diversification, and potential appreciation, with most trading publicly on stock exchanges.

dowidth.com

dowidth.com