Fractional ownership real estate allows investors to purchase a share of a specific property, gaining direct equity and potential rental income, while real estate development funds pool capital to invest in multiple projects, offering diversification and professional management. Ownership in fractional properties is tangible and limited to individual assets, whereas development funds provide exposure to broader market trends through a managed portfolio. Discover how each option aligns with your investment goals and risk tolerance.

Why it is important

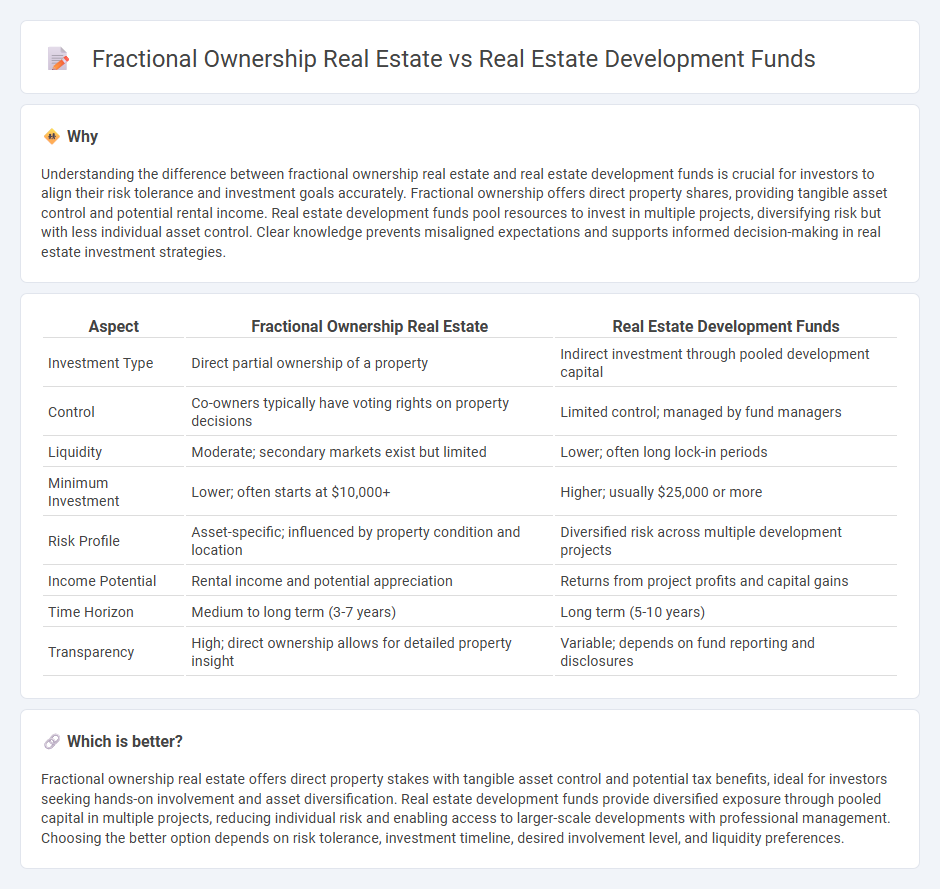

Understanding the difference between fractional ownership real estate and real estate development funds is crucial for investors to align their risk tolerance and investment goals accurately. Fractional ownership offers direct property shares, providing tangible asset control and potential rental income. Real estate development funds pool resources to invest in multiple projects, diversifying risk but with less individual asset control. Clear knowledge prevents misaligned expectations and supports informed decision-making in real estate investment strategies.

Comparison Table

| Aspect | Fractional Ownership Real Estate | Real Estate Development Funds |

|---|---|---|

| Investment Type | Direct partial ownership of a property | Indirect investment through pooled development capital |

| Control | Co-owners typically have voting rights on property decisions | Limited control; managed by fund managers |

| Liquidity | Moderate; secondary markets exist but limited | Lower; often long lock-in periods |

| Minimum Investment | Lower; often starts at $10,000+ | Higher; usually $25,000 or more |

| Risk Profile | Asset-specific; influenced by property condition and location | Diversified risk across multiple development projects |

| Income Potential | Rental income and potential appreciation | Returns from project profits and capital gains |

| Time Horizon | Medium to long term (3-7 years) | Long term (5-10 years) |

| Transparency | High; direct ownership allows for detailed property insight | Variable; depends on fund reporting and disclosures |

Which is better?

Fractional ownership real estate offers direct property stakes with tangible asset control and potential tax benefits, ideal for investors seeking hands-on involvement and asset diversification. Real estate development funds provide diversified exposure through pooled capital in multiple projects, reducing individual risk and enabling access to larger-scale developments with professional management. Choosing the better option depends on risk tolerance, investment timeline, desired involvement level, and liquidity preferences.

Connection

Fractional ownership in real estate allows multiple investors to purchase shares of a property, sharing both risks and returns, which aligns closely with the pooled capital structure of real estate development funds. Real estate development funds aggregate investor capital to finance property projects, and fractional ownership offers a mechanism for investors in these funds to hold specific, divisible interests in the developments. This connection enhances liquidity and accessibility in real estate investment, democratizing entry and enabling diversified portfolios across physical assets and fund management structures.

Key Terms

Real Estate Development Funds:

Real estate development funds pool capital from multiple investors to finance property development projects, offering exposure to large-scale commercial and residential developments with professional management and risk diversification. These funds provide investors with a share of profits generated from property sales or leases without the operational responsibilities of direct ownership. Discover more about how real estate development funds can diversify your investment portfolio and drive growth.

Equity Participation

Real estate development funds offer investors the opportunity to pool capital into large-scale projects, enabling significant equity participation with professional management and diversified risk across multiple developments. Fractional ownership real estate, by contrast, allows individuals to acquire partial equity in specific properties, providing direct ownership and income potential with more hands-on involvement. Explore the advantages and nuances of equity participation in both investment models to make informed real estate decisions.

Development Yield

Real estate development funds typically offer higher development yields by pooling capital to invest in large-scale projects with substantial value-add potential. Fractional ownership real estate provides investors direct stake in properties with steady income streams, but often with lower yield compared to development projects. Explore the detailed comparison of development yield and risk profiles to make informed investment decisions.

Source and External Links

How to Set Up a Private Equity Real Estate Fund - Outlines how private equity real estate funds are structured, including value-add and opportunity funds that focus on property improvements, redevelopment, and distressed assets, targeting net equity IRRs of 11-15%+ for investors.

Invest in Continental's Real Estate Development Funds - Offers accredited investors access to professionally managed, geographically diversified portfolios of new, suburban multifamily apartment communities developed and managed by an experienced national firm.

Private Real Estate Investment Funds - Provides private credit, debt, and housing funds focused on impact investing in affordable housing, aiming for high current income, capital appreciation, and tax-advantaged returns for accredited investors.

dowidth.com

dowidth.com