Fractional ownership allows investors to buy partial shares of high-value assets, reducing entry barriers and increasing portfolio diversification. Managed portfolios are professionally guided investment accounts designed to optimize returns based on individual risk tolerance and financial goals. Explore the differences and benefits of each investment strategy to determine which suits your financial objectives best.

Why it is important

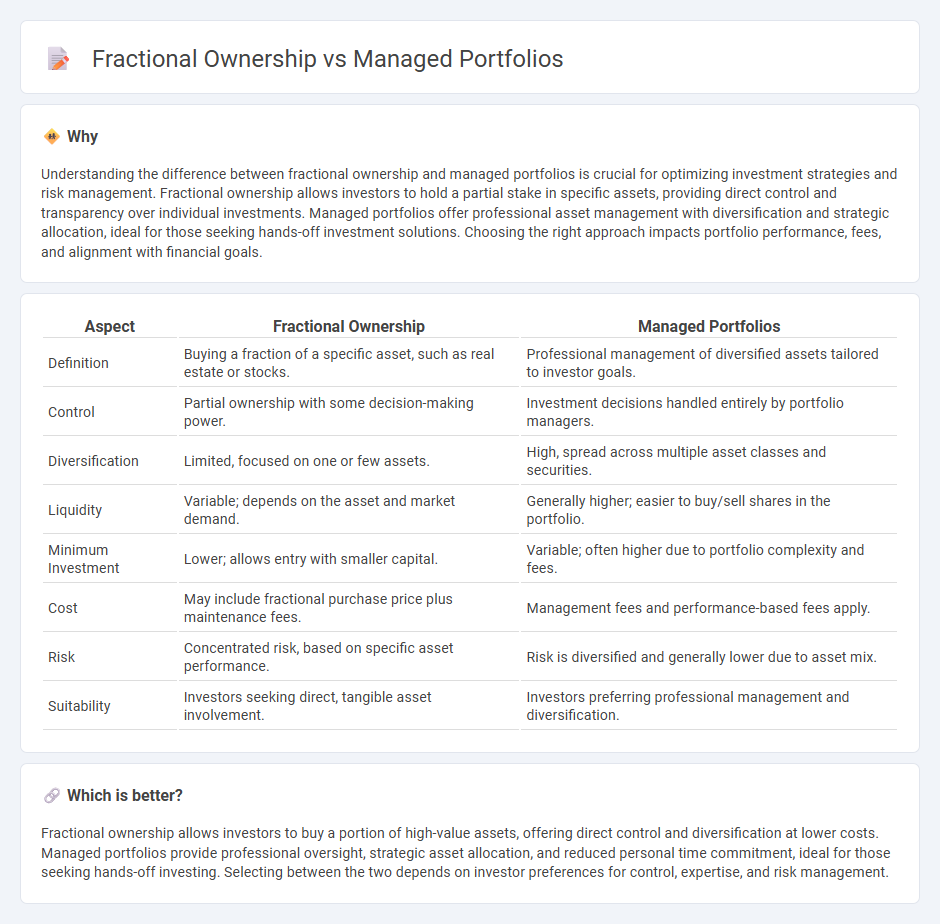

Understanding the difference between fractional ownership and managed portfolios is crucial for optimizing investment strategies and risk management. Fractional ownership allows investors to hold a partial stake in specific assets, providing direct control and transparency over individual investments. Managed portfolios offer professional asset management with diversification and strategic allocation, ideal for those seeking hands-off investment solutions. Choosing the right approach impacts portfolio performance, fees, and alignment with financial goals.

Comparison Table

| Aspect | Fractional Ownership | Managed Portfolios |

|---|---|---|

| Definition | Buying a fraction of a specific asset, such as real estate or stocks. | Professional management of diversified assets tailored to investor goals. |

| Control | Partial ownership with some decision-making power. | Investment decisions handled entirely by portfolio managers. |

| Diversification | Limited, focused on one or few assets. | High, spread across multiple asset classes and securities. |

| Liquidity | Variable; depends on the asset and market demand. | Generally higher; easier to buy/sell shares in the portfolio. |

| Minimum Investment | Lower; allows entry with smaller capital. | Variable; often higher due to portfolio complexity and fees. |

| Cost | May include fractional purchase price plus maintenance fees. | Management fees and performance-based fees apply. |

| Risk | Concentrated risk, based on specific asset performance. | Risk is diversified and generally lower due to asset mix. |

| Suitability | Investors seeking direct, tangible asset involvement. | Investors preferring professional management and diversification. |

Which is better?

Fractional ownership allows investors to buy a portion of high-value assets, offering direct control and diversification at lower costs. Managed portfolios provide professional oversight, strategic asset allocation, and reduced personal time commitment, ideal for those seeking hands-off investing. Selecting between the two depends on investor preferences for control, expertise, and risk management.

Connection

Fractional ownership allows investors to purchase a portion of high-value assets, making diversified investment accessible with lower capital requirements. Managed portfolios leverage fractional ownership by pooling these smaller investments into professionally supervised asset collections to optimize returns and reduce risk. Combining fractional ownership with managed portfolios enhances investment strategies by increasing diversification and providing expert oversight.

Key Terms

Asset Allocation

Managed portfolios offer professional asset allocation tailored to individual risk tolerance and financial goals, often incorporating diversification across various asset classes to optimize returns. Fractional ownership provides investors with the ability to purchase parts of high-value assets, enabling diversified holdings without the need for full asset acquisition. Explore the nuances of asset allocation in both strategies to determine the best fit for your investment objectives.

Minimum Investment

Managed portfolios often require minimum investments ranging from $5,000 to $25,000, appealing to investors who prefer professional asset management and diversification. Fractional ownership allows investors to purchase portions of high-value assets like real estate or luxury items with significantly lower minimums, sometimes as small as $100. Explore more to determine which investment strategy aligns best with your financial goals and starting capital.

Ownership Structure

Managed portfolios offer centralized ownership structure where clients invest in a professionally managed pool of assets, maintaining indirect ownership of securities. Fractional ownership provides investors with direct, proportional ownership of specific assets or properties, allowing for individual asset control and liquidity. Explore more to understand which ownership structure aligns best with your investment goals.

Source and External Links

Schwab Managed Portfolios - Schwab offers professionally managed, diversified portfolios of mutual funds or ETFs with competitive fees, including models tailored to various risk tolerances, actively managed by a professional team that adjusts and rebalances portfolios based on market cycles.

Managed Portfolios - Investing - Axos Bank - Axos provides actively managed portfolios that combine expert oversight and technology, tailoring investments with ETFs, mutual funds, and stocks to an investor's lifecycle stage, with continuous portfolio adjustment by professional managers.

Managed Portfolios | Investment Portfolios - Wilshire - Wilshire offers a broad range of institutional-quality managed portfolios, including diversified asset allocation, ETFs, liquid alternatives, and fixed income solutions designed for advisors seeking cost-effective, outcome-driven investment options.

dowidth.com

dowidth.com