Art flipping involves purchasing artwork to quickly resell for a profit, capitalizing on trends in the art market and artist reputation, while sneaker flipping focuses on buying limited-edition sneakers that often appreciate rapidly due to exclusivity and high demand. Both investment strategies require deep market knowledge, timing, and an understanding of consumer behavior to maximize returns. Discover more about the unique opportunities and risks in art flipping and sneaker flipping investments.

Why it is important

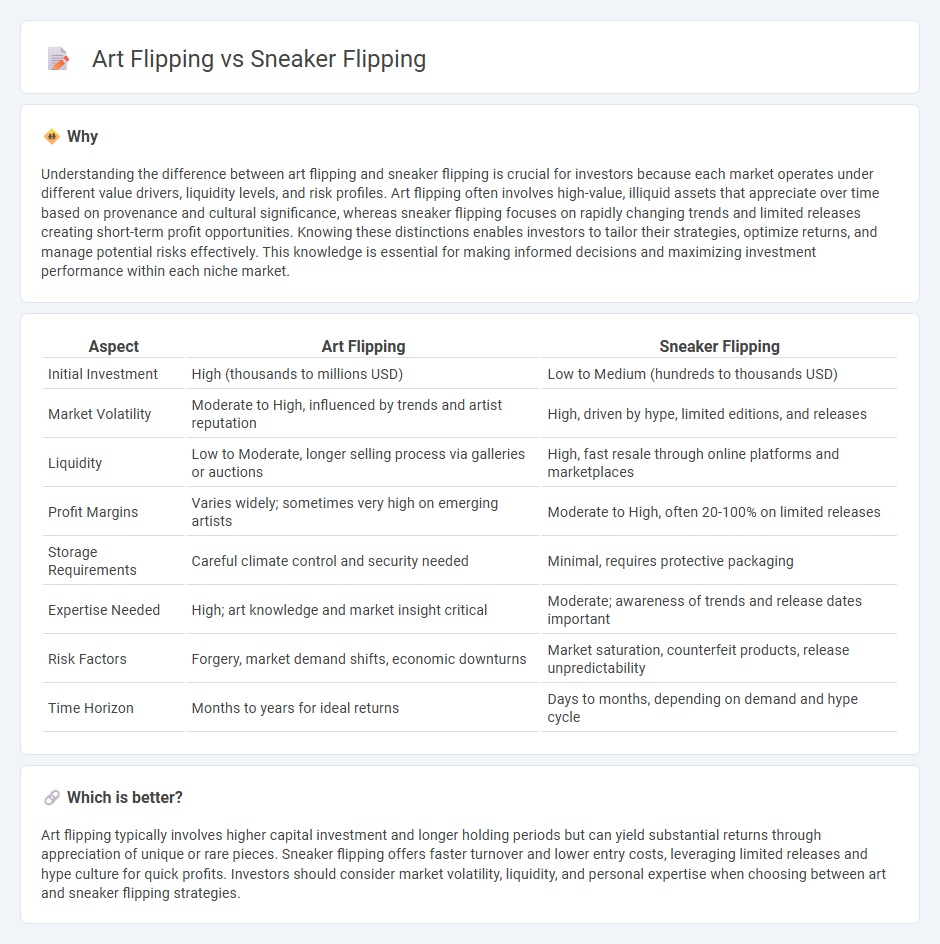

Understanding the difference between art flipping and sneaker flipping is crucial for investors because each market operates under different value drivers, liquidity levels, and risk profiles. Art flipping often involves high-value, illiquid assets that appreciate over time based on provenance and cultural significance, whereas sneaker flipping focuses on rapidly changing trends and limited releases creating short-term profit opportunities. Knowing these distinctions enables investors to tailor their strategies, optimize returns, and manage potential risks effectively. This knowledge is essential for making informed decisions and maximizing investment performance within each niche market.

Comparison Table

| Aspect | Art Flipping | Sneaker Flipping |

|---|---|---|

| Initial Investment | High (thousands to millions USD) | Low to Medium (hundreds to thousands USD) |

| Market Volatility | Moderate to High, influenced by trends and artist reputation | High, driven by hype, limited editions, and releases |

| Liquidity | Low to Moderate, longer selling process via galleries or auctions | High, fast resale through online platforms and marketplaces |

| Profit Margins | Varies widely; sometimes very high on emerging artists | Moderate to High, often 20-100% on limited releases |

| Storage Requirements | Careful climate control and security needed | Minimal, requires protective packaging |

| Expertise Needed | High; art knowledge and market insight critical | Moderate; awareness of trends and release dates important |

| Risk Factors | Forgery, market demand shifts, economic downturns | Market saturation, counterfeit products, release unpredictability |

| Time Horizon | Months to years for ideal returns | Days to months, depending on demand and hype cycle |

Which is better?

Art flipping typically involves higher capital investment and longer holding periods but can yield substantial returns through appreciation of unique or rare pieces. Sneaker flipping offers faster turnover and lower entry costs, leveraging limited releases and hype culture for quick profits. Investors should consider market volatility, liquidity, and personal expertise when choosing between art and sneaker flipping strategies.

Connection

Art flipping and sneaker flipping both capitalize on the rapid appreciation of limited-edition assets within niche markets driven by exclusivity and cultural trends. Investors leverage market demand fluctuations and scarcity to resell artworks or collectible sneakers at substantial profits. This speculative strategy hinges on keen market insight and timing to maximize returns.

Key Terms

**Sneaker Flipping:**

Sneaker flipping involves buying limited-edition or hyped sneakers at retail price and reselling them at a higher value due to demand and scarcity, often capitalizing on brand collaborations like Nike x Off-White or Adidas Yeezy releases. This market thrives on quick turnover, authenticity verification, and trending sneaker culture, with platforms like StockX and GOAT facilitating secure transactions. Explore expert strategies and market insights to maximize profits in sneaker flipping.

Hype Releases

Sneaker flipping capitalizes on limited-edition hype releases, where exclusive drops from brands like Nike and Adidas create skyrocketing resale values driven by strong demand and cultural trends. Art flipping involves procuring works from emerging artists or trending art shows and reselling when market interest spikes, often influenced by social media buzz and collector fervor. Explore deeper strategies and market insights to maximize profits in these dynamic flipping arenas.

Deadstock Condition

Sneaker flipping hinges on the importance of deadstock condition, where unworn and pristine shoes command premium resale prices due to rarity and demand from collectors. In art flipping, deadstock condition translates to an untouched, original state that preserves value and authenticity, critical for investor confidence and high market valuation. Explore how maintaining deadstock condition influences profitability in both sneaker and art markets.

Source and External Links

How to Flip Sneakers - Benzinga - Sneaker flipping involves buying limited-edition or popular sneakers at retail prices and reselling them for profit, requiring market research, sourcing, authentication, and pricing based on demand and rarity.

Reselling Shoes: How I Make $10,000 a Month Flipping Sneakers - Sneaker flipping can be a profitable side hustle or business, with experienced resellers making thousands per month by buying at retail and selling at a markup driven by limited supply and high demand.

How To Resell Sneakers in 2024 3 METHODS - YouTube - Popular sneaker flipping methods include using refund policies to minimize risk, reselling accessible "brick flips" with lower profit margins, and targeting high-demand limited releases for larger returns.

dowidth.com

dowidth.com