Tax lien certificates offer investors a secured asset backed by property tax debts with potential for high returns through interest or property acquisition. Mutual funds provide diversified portfolios managed by professionals, spreading risk across stocks, bonds, or other securities for balanced growth. Explore the benefits and risks of each to determine which investment aligns with your financial goals.

Why it is important

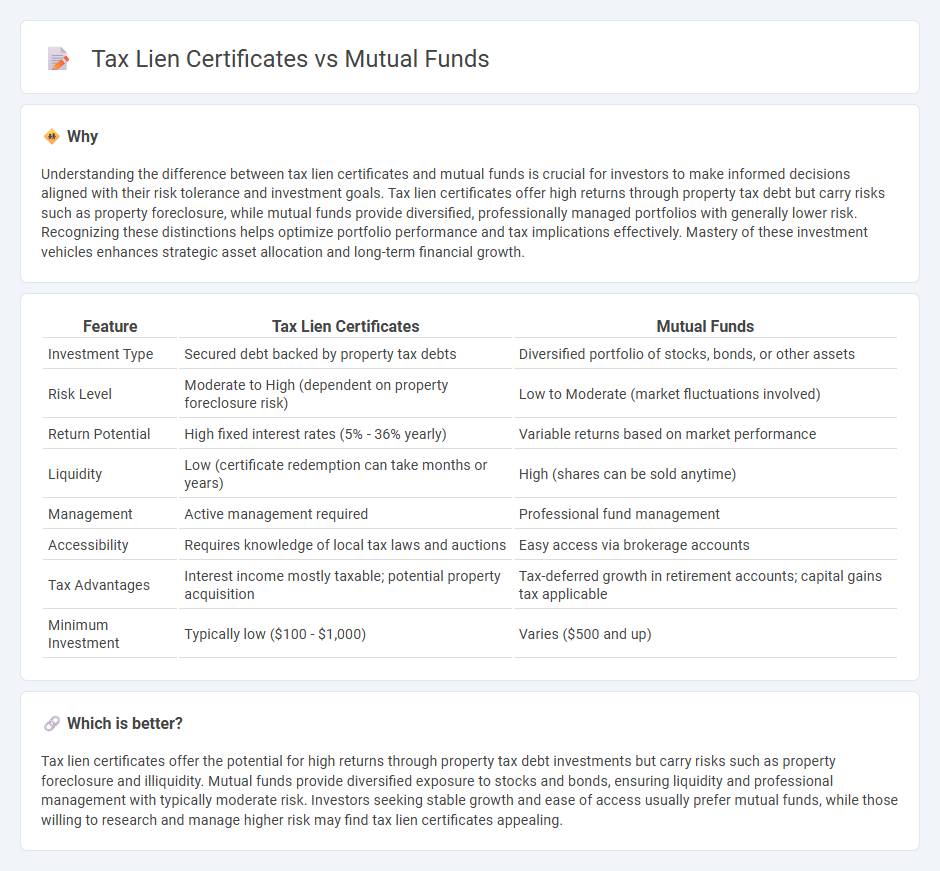

Understanding the difference between tax lien certificates and mutual funds is crucial for investors to make informed decisions aligned with their risk tolerance and investment goals. Tax lien certificates offer high returns through property tax debt but carry risks such as property foreclosure, while mutual funds provide diversified, professionally managed portfolios with generally lower risk. Recognizing these distinctions helps optimize portfolio performance and tax implications effectively. Mastery of these investment vehicles enhances strategic asset allocation and long-term financial growth.

Comparison Table

| Feature | Tax Lien Certificates | Mutual Funds |

|---|---|---|

| Investment Type | Secured debt backed by property tax debts | Diversified portfolio of stocks, bonds, or other assets |

| Risk Level | Moderate to High (dependent on property foreclosure risk) | Low to Moderate (market fluctuations involved) |

| Return Potential | High fixed interest rates (5% - 36% yearly) | Variable returns based on market performance |

| Liquidity | Low (certificate redemption can take months or years) | High (shares can be sold anytime) |

| Management | Active management required | Professional fund management |

| Accessibility | Requires knowledge of local tax laws and auctions | Easy access via brokerage accounts |

| Tax Advantages | Interest income mostly taxable; potential property acquisition | Tax-deferred growth in retirement accounts; capital gains tax applicable |

| Minimum Investment | Typically low ($100 - $1,000) | Varies ($500 and up) |

Which is better?

Tax lien certificates offer the potential for high returns through property tax debt investments but carry risks such as property foreclosure and illiquidity. Mutual funds provide diversified exposure to stocks and bonds, ensuring liquidity and professional management with typically moderate risk. Investors seeking stable growth and ease of access usually prefer mutual funds, while those willing to research and manage higher risk may find tax lien certificates appealing.

Connection

Tax lien certificates and mutual funds intersect through their role in diversified investment portfolios focused on income generation and risk management. Investors may use mutual funds that specialize in real estate or municipal securities, which can include tax lien certificates as underlying assets, providing exposure to secured debts with potential high yields. This connection leverages the stability of government-backed liens alongside the liquidity and professional management offered by mutual funds.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various asset classes, reducing individual risk. Tax lien certificates concentrate investment in specific municipal properties, providing higher returns but greater exposure to locality-specific risks. Explore more to understand which strategy aligns best with your portfolio goals.

Yield

Mutual funds typically offer average annual yields ranging from 4% to 10%, depending on their investment strategy and market conditions. Tax lien certificates can yield returns between 8% and 36%, influenced by local interest rates and auction success, but come with higher risk and liquidity challenges. Explore detailed comparisons to understand which investment aligns best with your yield goals and risk tolerance.

Liquidity

Mutual funds offer high liquidity as investors can buy or sell shares daily on the stock market, providing easy access to their money. In contrast, tax lien certificates often have lower liquidity since investors must wait for property owners to repay the lien or for foreclosure proceedings to complete. Explore the detailed comparisons to understand which investment aligns better with your liquidity needs.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment vehicles that pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities, managed by professional investment advisers.

Mutual fund - Wikipedia - Mutual funds are investment funds that gather money from multiple investors to purchase securities, offering diversification, professional management, and liquidity, but come with various fees and expenses.

What are mutual funds? - Fidelity Investments - Mutual funds allow investors to collectively invest in a portfolio of assets, with share prices (NAV) calculated daily based on the total value of the fund's holdings divided by outstanding shares.

dowidth.com

dowidth.com