Sneakers flipping leverages limited-edition releases and brand collaborations to generate high returns in a volatile market driven by trends and hype. Wine investing focuses on acquiring prestigious vintages that appreciate steadily over time, benefiting from rarity and aging potential. Explore the unique advantages and risks of each investment to determine the best fit for your portfolio.

Why it is important

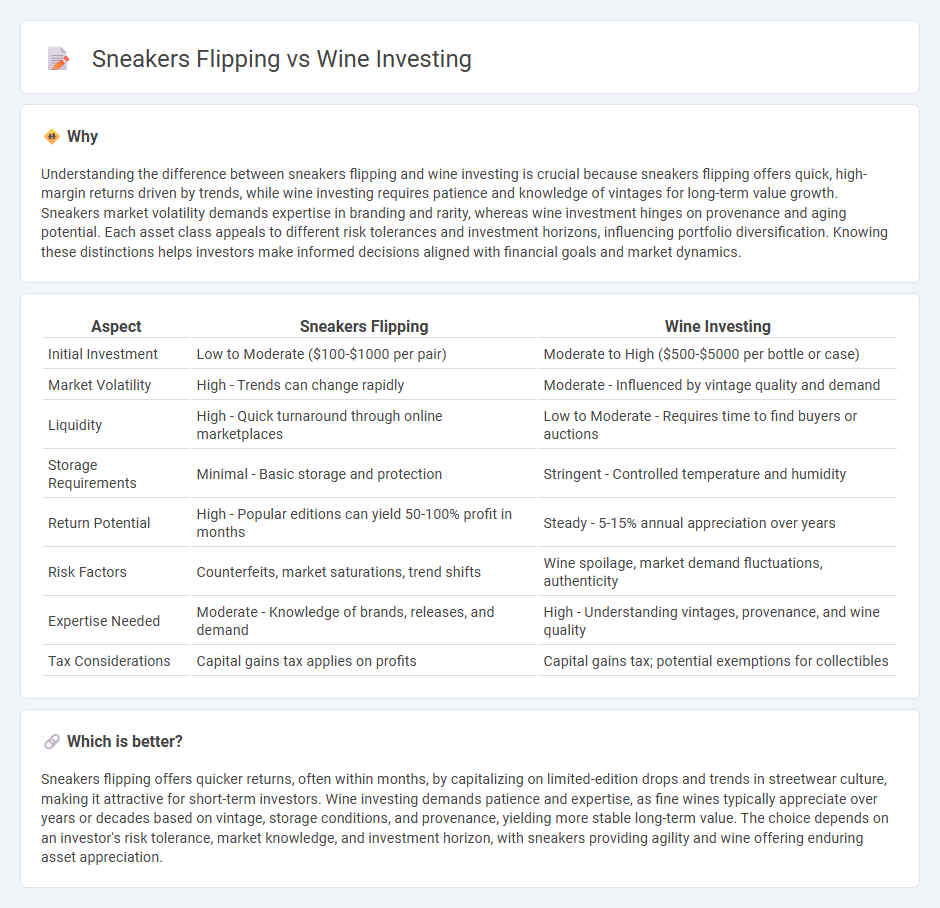

Understanding the difference between sneakers flipping and wine investing is crucial because sneakers flipping offers quick, high-margin returns driven by trends, while wine investing requires patience and knowledge of vintages for long-term value growth. Sneakers market volatility demands expertise in branding and rarity, whereas wine investment hinges on provenance and aging potential. Each asset class appeals to different risk tolerances and investment horizons, influencing portfolio diversification. Knowing these distinctions helps investors make informed decisions aligned with financial goals and market dynamics.

Comparison Table

| Aspect | Sneakers Flipping | Wine Investing |

|---|---|---|

| Initial Investment | Low to Moderate ($100-$1000 per pair) | Moderate to High ($500-$5000 per bottle or case) |

| Market Volatility | High - Trends can change rapidly | Moderate - Influenced by vintage quality and demand |

| Liquidity | High - Quick turnaround through online marketplaces | Low to Moderate - Requires time to find buyers or auctions |

| Storage Requirements | Minimal - Basic storage and protection | Stringent - Controlled temperature and humidity |

| Return Potential | High - Popular editions can yield 50-100% profit in months | Steady - 5-15% annual appreciation over years |

| Risk Factors | Counterfeits, market saturations, trend shifts | Wine spoilage, market demand fluctuations, authenticity |

| Expertise Needed | Moderate - Knowledge of brands, releases, and demand | High - Understanding vintages, provenance, and wine quality |

| Tax Considerations | Capital gains tax applies on profits | Capital gains tax; potential exemptions for collectibles |

Which is better?

Sneakers flipping offers quicker returns, often within months, by capitalizing on limited-edition drops and trends in streetwear culture, making it attractive for short-term investors. Wine investing demands patience and expertise, as fine wines typically appreciate over years or decades based on vintage, storage conditions, and provenance, yielding more stable long-term value. The choice depends on an investor's risk tolerance, market knowledge, and investment horizon, with sneakers providing agility and wine offering enduring asset appreciation.

Connection

Sneakers flipping and wine investing both capitalize on the principles of rarity, market demand, and cultural trends to generate significant returns. Limited-edition sneakers and fine wines appreciate in value due to scarcity, brand reputation, and consumer enthusiasm within niche markets. Investors in these assets rely on authenticity verification and market timing to maximize profits, reflecting a shared strategy of leveraging collectible goods for investment growth.

Key Terms

**Wine Investing:**

Wine investing offers a unique opportunity to capitalize on the appreciation of rare vintages and prestigious wineries, with the global wine market projected to grow steadily at a CAGR of 7.9% through 2028. Key factors influencing wine value include provenance, aging potential, and storage conditions, making professional storage and authentication essential for maximizing returns. Explore more about the strategies and risks involved in building a profitable wine investment portfolio.

Provenance

Provenance plays a crucial role in both wine investing and sneakers flipping, serving as a key determinant of value and authenticity in each market. In wine investing, detailed records of vineyard origins, vintage years, and storage conditions establish trust and enhance resale prices, while in sneakers flipping, documentation such as receipts, limited edition releases, and authentication certificates are essential to verify legitimacy and boost market demand. Explore more on how provenance impacts market dynamics and investment strategies in these thriving asset classes.

Vintage

Vintage wine investing offers a unique blend of historical value, limited supply, and aging potential that can yield significant returns over time, appealing to collectors and connoisseurs alike. Sneakers flipping thrives on limited-edition releases, cultural trends, and brand collaborations, creating fast turnover but often less predictable long-term value compared to vintage wine. Explore the nuances of vintage wine investment to understand its enduring appeal and market dynamics.

Source and External Links

Understanding Online Wine Investments And ... - Online wine investment platforms like Cru Wine offer personalized, fully managed portfolios with state-of-the-art digital access and storage security, delivering average annualized returns of about 11.8%, while emphasizing diversification across regions and varietals to manage investment risk.

Getting Started with Wine Investments - Investment wines are typically age-worthy and in demand, with fine Bordeaux and Grand Cru Burgundy as the most sought-after, and successful investing involves buying by the case, ensuring provenance, and considering flagship wines from other regions like Napa Valley and Champagne.

Evaluating the Investment Performance of Fine Wine - Fine wine investment historically delivers average annual returns of around 10%, with more consistent gains the longer the holding period (minimum five years), and market corrections present optimal entry points for acquiring investment-grade wines.

dowidth.com

dowidth.com