Spice trading offers high liquidity and rapid market fluctuations, attracting investors seeking short-term gains through commodity market expertise. Real estate investing provides long-term asset appreciation and steady rental income, appealing to those focused on building equity and financial stability over time. Explore the distinctive advantages and risks of spice trading versus real estate investing to determine the best fit for your portfolio goals.

Why it is important

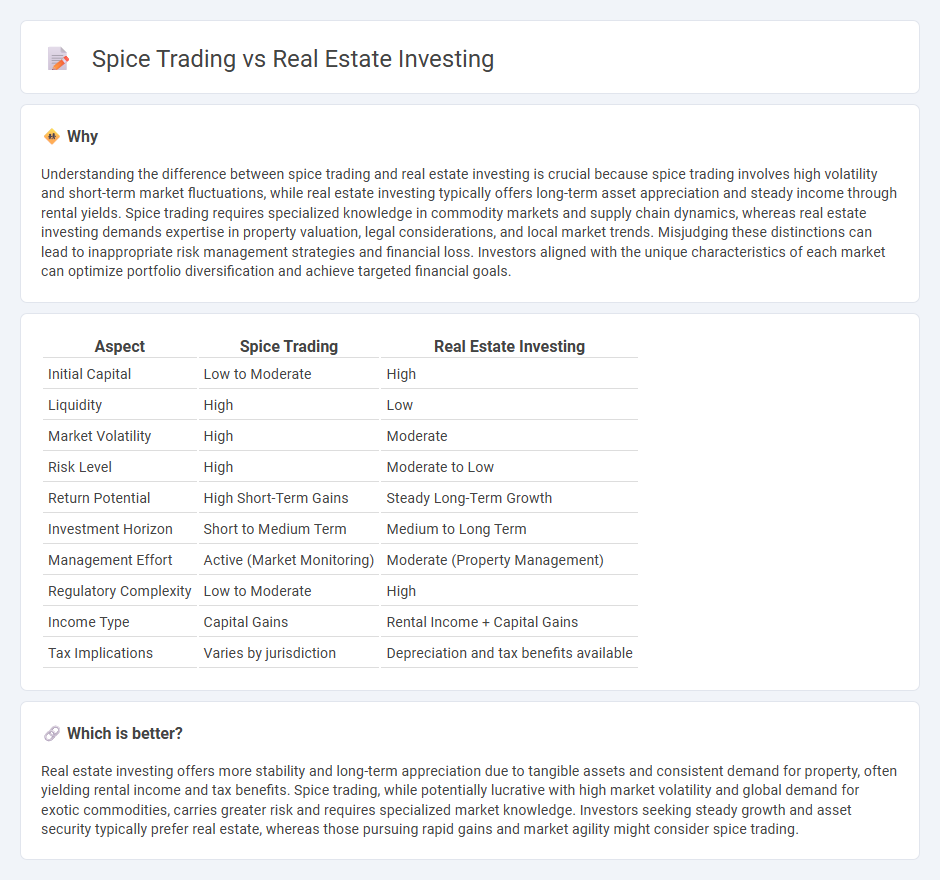

Understanding the difference between spice trading and real estate investing is crucial because spice trading involves high volatility and short-term market fluctuations, while real estate investing typically offers long-term asset appreciation and steady income through rental yields. Spice trading requires specialized knowledge in commodity markets and supply chain dynamics, whereas real estate investing demands expertise in property valuation, legal considerations, and local market trends. Misjudging these distinctions can lead to inappropriate risk management strategies and financial loss. Investors aligned with the unique characteristics of each market can optimize portfolio diversification and achieve targeted financial goals.

Comparison Table

| Aspect | Spice Trading | Real Estate Investing |

|---|---|---|

| Initial Capital | Low to Moderate | High |

| Liquidity | High | Low |

| Market Volatility | High | Moderate |

| Risk Level | High | Moderate to Low |

| Return Potential | High Short-Term Gains | Steady Long-Term Growth |

| Investment Horizon | Short to Medium Term | Medium to Long Term |

| Management Effort | Active (Market Monitoring) | Moderate (Property Management) |

| Regulatory Complexity | Low to Moderate | High |

| Income Type | Capital Gains | Rental Income + Capital Gains |

| Tax Implications | Varies by jurisdiction | Depreciation and tax benefits available |

Which is better?

Real estate investing offers more stability and long-term appreciation due to tangible assets and consistent demand for property, often yielding rental income and tax benefits. Spice trading, while potentially lucrative with high market volatility and global demand for exotic commodities, carries greater risk and requires specialized market knowledge. Investors seeking steady growth and asset security typically prefer real estate, whereas those pursuing rapid gains and market agility might consider spice trading.

Connection

Spice trading and real estate investing share a foundational principle of leveraging market demand to generate significant returns over time. Both markets require strategic investment decisions based on location analysis, historical trends, and risk assessment to maximize profitability. Investors benefit from understanding supply chain dynamics in spice trading and urban development patterns in real estate to optimize portfolio diversification and wealth growth.

Key Terms

**Real Estate Investing:**

Real estate investing offers stable cash flow through rental income and long-term appreciation potential, making it a preferred choice for wealth building. With assets like residential properties, commercial buildings, and REITs, investors benefit from tax advantages and portfolio diversification. Discover more about maximizing returns in real estate investing strategies.

Appreciation

Real estate investing offers long-term appreciation through property value growth driven by location demand, market trends, and urban development. Spice trading benefits from appreciation via rarity, quality, and shifts in global supply chains that influence spice prices. Explore further to understand which investment aligns with your financial goals and risk tolerance.

Cash Flow

Real estate investing generates consistent cash flow through rental income and property appreciation, offering long-term financial stability and potential tax benefits. Spice trading involves high liquidity and quick turnover but comes with significant market volatility and supply chain risks that can disrupt cash flow. Explore detailed strategies for maximizing cash flow in both markets to make informed investment decisions.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - NerdWallet - This source outlines five accessible ways to invest in real estate, including buying REITs, rental properties, flipping houses, and online platforms, catering to various levels of involvement from passive to active investment styles.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Provides an overview of the real estate market, defining key property types like residential, commercial, and land, while emphasizing the necessary skills and knowledge for success in real estate investment.

Real estate investment made easy - Start today - Yieldstreet - Highlights a contemporary platform that facilitates private real estate investing with a relatively low entry point, emphasizing historical real estate returns outpacing inflation and offering direct access to various property types.

dowidth.com

dowidth.com