Sneakers flipping involves buying limited-edition sneakers at retail prices and reselling them at a higher value, often leveraging market trends and scarcity to generate quick profits. Angel investing requires providing capital to startups in exchange for equity, focusing on long-term growth potential and higher risk tolerance. Explore the benefits and risks associated with each investment strategy to determine which aligns best with your financial goals.

Why it is important

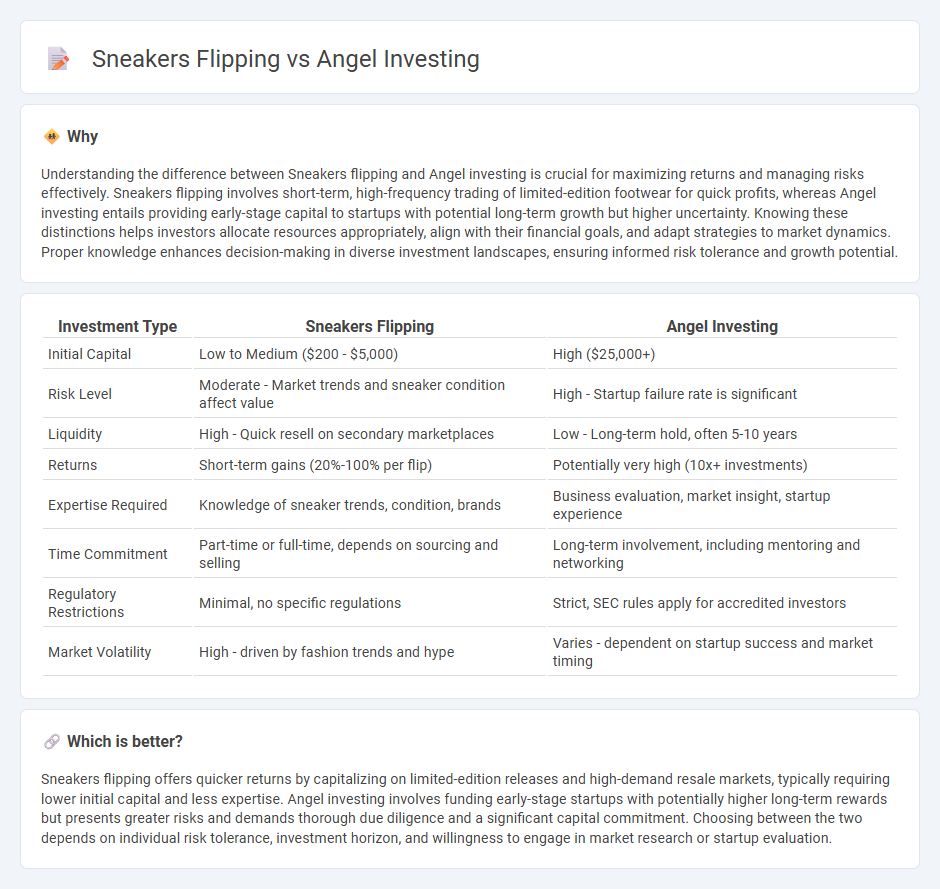

Understanding the difference between Sneakers flipping and Angel investing is crucial for maximizing returns and managing risks effectively. Sneakers flipping involves short-term, high-frequency trading of limited-edition footwear for quick profits, whereas Angel investing entails providing early-stage capital to startups with potential long-term growth but higher uncertainty. Knowing these distinctions helps investors allocate resources appropriately, align with their financial goals, and adapt strategies to market dynamics. Proper knowledge enhances decision-making in diverse investment landscapes, ensuring informed risk tolerance and growth potential.

Comparison Table

| Investment Type | Sneakers Flipping | Angel Investing |

|---|---|---|

| Initial Capital | Low to Medium ($200 - $5,000) | High ($25,000+) |

| Risk Level | Moderate - Market trends and sneaker condition affect value | High - Startup failure rate is significant |

| Liquidity | High - Quick resell on secondary marketplaces | Low - Long-term hold, often 5-10 years |

| Returns | Short-term gains (20%-100% per flip) | Potentially very high (10x+ investments) |

| Expertise Required | Knowledge of sneaker trends, condition, brands | Business evaluation, market insight, startup experience |

| Time Commitment | Part-time or full-time, depends on sourcing and selling | Long-term involvement, including mentoring and networking |

| Regulatory Restrictions | Minimal, no specific regulations | Strict, SEC rules apply for accredited investors |

| Market Volatility | High - driven by fashion trends and hype | Varies - dependent on startup success and market timing |

Which is better?

Sneakers flipping offers quicker returns by capitalizing on limited-edition releases and high-demand resale markets, typically requiring lower initial capital and less expertise. Angel investing involves funding early-stage startups with potentially higher long-term rewards but presents greater risks and demands thorough due diligence and a significant capital commitment. Choosing between the two depends on individual risk tolerance, investment horizon, and willingness to engage in market research or startup evaluation.

Connection

Sneaker flipping and angel investing both involve identifying undervalued assets with high growth potential, leveraging market trends and consumer demand to maximize returns. Both practices require keen market analysis, timing, and risk assessment to capitalize on emerging value before broader recognition. The entrepreneurial mindset inherent in sneaker flipping parallels angel investing's focus on early-stage opportunities driving significant financial growth.

Key Terms

Angel Investing:

Angel investing involves providing capital to early-stage startups in exchange for equity, offering the potential for high returns through company growth and successful exits. This form of investing requires due diligence, a strong understanding of market trends, and a tolerance for risk, as many startups may fail or take years to become profitable. Discover the benefits and strategies of angel investing to build a diversified portfolio and support innovation.

Equity

Angel investing involves providing capital to startups in exchange for equity shares, allowing investors to benefit from the company's potential growth and profits. Sneakers flipping, by contrast, typically focuses on short-term resale profits without ownership stakes or equity in the brand. Explore the differences in risk, return, and long-term value creation between these two investment strategies.

Due Diligence

Angel investing demands rigorous due diligence involving comprehensive analysis of startup financials, market potential, and founding team expertise to mitigate high risks. Sneakers flipping requires evaluating sneaker authenticity, market demand, and price fluctuations to ensure profitable resale. Explore detailed strategies to master due diligence in both fields for optimal investment outcomes.

Source and External Links

Understanding Angel Financing and Investing - This article explains how angel investors provide crucial early-stage funding for startups in exchange for equity or convertible debt, helping them bridge the gap between initial funding and institutional investment rounds.

Demystifying Angel Investing - This resource provides an introduction to angel investing, highlighting its potential for returns, community impact, and tax incentives, while also connecting investors with resources and best practices.

Angel Investors - This webpage describes angel investors as wealthy individuals who provide capital to startups in exchange for equity, often offering mentorship and strategic guidance to help businesses succeed.

dowidth.com

dowidth.com