Investing in music royalties offers a unique revenue stream backed by intellectual property rights and consistent royalty payments, contrasting with precious metals like gold and silver that provide tangible assets valued for their intrinsic scarcity and inflation hedging properties. Music royalties generate passive income from song plays, licensing, and mechanical royalties, while precious metals serve as a physical store of value and portfolio diversification tool amid economic uncertainty. Explore the advantages and risks of each asset class to determine the optimal investment strategy.

Why it is important

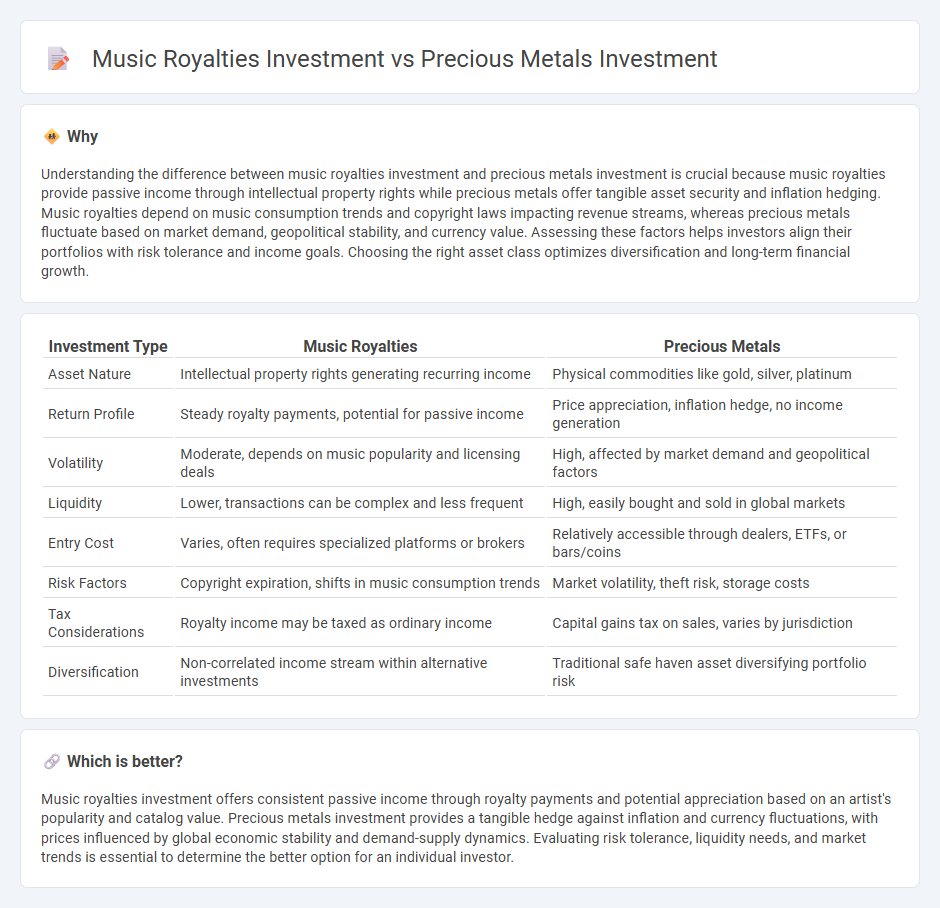

Understanding the difference between music royalties investment and precious metals investment is crucial because music royalties provide passive income through intellectual property rights while precious metals offer tangible asset security and inflation hedging. Music royalties depend on music consumption trends and copyright laws impacting revenue streams, whereas precious metals fluctuate based on market demand, geopolitical stability, and currency value. Assessing these factors helps investors align their portfolios with risk tolerance and income goals. Choosing the right asset class optimizes diversification and long-term financial growth.

Comparison Table

| Investment Type | Music Royalties | Precious Metals |

|---|---|---|

| Asset Nature | Intellectual property rights generating recurring income | Physical commodities like gold, silver, platinum |

| Return Profile | Steady royalty payments, potential for passive income | Price appreciation, inflation hedge, no income generation |

| Volatility | Moderate, depends on music popularity and licensing deals | High, affected by market demand and geopolitical factors |

| Liquidity | Lower, transactions can be complex and less frequent | High, easily bought and sold in global markets |

| Entry Cost | Varies, often requires specialized platforms or brokers | Relatively accessible through dealers, ETFs, or bars/coins |

| Risk Factors | Copyright expiration, shifts in music consumption trends | Market volatility, theft risk, storage costs |

| Tax Considerations | Royalty income may be taxed as ordinary income | Capital gains tax on sales, varies by jurisdiction |

| Diversification | Non-correlated income stream within alternative investments | Traditional safe haven asset diversifying portfolio risk |

Which is better?

Music royalties investment offers consistent passive income through royalty payments and potential appreciation based on an artist's popularity and catalog value. Precious metals investment provides a tangible hedge against inflation and currency fluctuations, with prices influenced by global economic stability and demand-supply dynamics. Evaluating risk tolerance, liquidity needs, and market trends is essential to determine the better option for an individual investor.

Connection

Music royalties investment and precious metals investment both serve as alternative asset classes that diversify traditional portfolios and hedge against market volatility. Music royalties provide steady cash flow through intellectual property rights, while precious metals like gold and silver act as tangible stores of value during economic uncertainty. Together, they balance income generation with wealth preservation, appealing to investors seeking risk-adjusted returns beyond stocks and bonds.

Key Terms

**Precious metals investment:**

Precious metals investment involves acquiring tangible assets such as gold, silver, platinum, and palladium, known for their historical value retention and inflation hedge properties. These metals are traded in various forms including bullion, coins, and ETFs, providing liquidity and portfolio diversification. Explore the advantages, risks, and market trends of precious metals investment to make informed financial decisions.

Bullion

Bullion investment, including gold and silver bars or coins, offers tangible asset security and liquidity, often serving as a hedge against inflation and market volatility. In contrast, music royalties provide passive income streams tied to intellectual property performance, but they carry higher risk due to market unpredictability and rights management complexities. Explore the benefits and risks of bullion versus music royalties to make informed investment decisions.

Spot price

Spot prices of precious metals like gold and silver fluctuate based on real-time supply and demand, providing transparent valuation for investors. Music royalties investment offers income streams less tied to market volatility, often influenced by streaming trends and royalty collection schedules rather than spot market dynamics. Discover the intricate differences between these assets to make an informed investment decision.

Source and External Links

Investing in Precious Metals: A Guide for Beginners - Money - Precious metals investment can be done by buying physical bullion (coins, rounds, bars, ingots) or investing in mining company stocks and mutual funds, with each method carrying distinct risks and benefits related to market exposure and the metal's characteristics.

Seven things to consider when investing in precious metals - TD Bank - Investing in precious metals like gold, silver, and platinum primarily serves to diversify portfolios against stock and bond market fluctuations, with options including physical purchases, futures contracts, and storage or insurance considerations impacting returns.

Investor Advisory: Precious Metals and Coin Investments - Investors can gain exposure to precious metals through mutual funds and exchange-traded products (ETPs) that invest in metals, mining companies, or related futures, offering potentially lower risk but with fees and tax implications that affect returns.

dowidth.com

dowidth.com