Private credit funds specialize in providing direct loans and debt financing to middle-market companies, offering flexible capital solutions with potentially higher yields compared to traditional fixed income. Infrastructure funds focus on long-term investments in physical assets like transportation, utilities, and energy, aiming for steady cash flows and inflation protection. Explore the distinct risk-return profiles and strategic benefits of private credit versus infrastructure funds to optimize your investment portfolio.

Why it is important

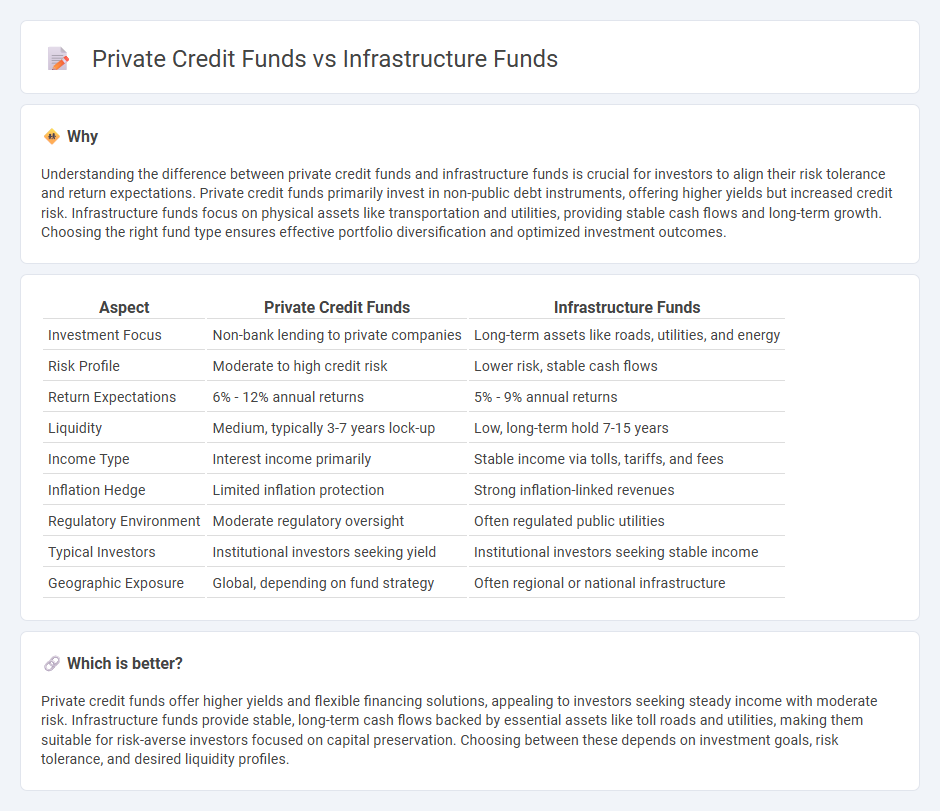

Understanding the difference between private credit funds and infrastructure funds is crucial for investors to align their risk tolerance and return expectations. Private credit funds primarily invest in non-public debt instruments, offering higher yields but increased credit risk. Infrastructure funds focus on physical assets like transportation and utilities, providing stable cash flows and long-term growth. Choosing the right fund type ensures effective portfolio diversification and optimized investment outcomes.

Comparison Table

| Aspect | Private Credit Funds | Infrastructure Funds |

|---|---|---|

| Investment Focus | Non-bank lending to private companies | Long-term assets like roads, utilities, and energy |

| Risk Profile | Moderate to high credit risk | Lower risk, stable cash flows |

| Return Expectations | 6% - 12% annual returns | 5% - 9% annual returns |

| Liquidity | Medium, typically 3-7 years lock-up | Low, long-term hold 7-15 years |

| Income Type | Interest income primarily | Stable income via tolls, tariffs, and fees |

| Inflation Hedge | Limited inflation protection | Strong inflation-linked revenues |

| Regulatory Environment | Moderate regulatory oversight | Often regulated public utilities |

| Typical Investors | Institutional investors seeking yield | Institutional investors seeking stable income |

| Geographic Exposure | Global, depending on fund strategy | Often regional or national infrastructure |

Which is better?

Private credit funds offer higher yields and flexible financing solutions, appealing to investors seeking steady income with moderate risk. Infrastructure funds provide stable, long-term cash flows backed by essential assets like toll roads and utilities, making them suitable for risk-averse investors focused on capital preservation. Choosing between these depends on investment goals, risk tolerance, and desired liquidity profiles.

Connection

Private credit funds and infrastructure funds are interconnected through their shared focus on long-term, stable cash flow investments with relatively low correlation to public markets. Private credit funds often provide debt financing for infrastructure projects, enabling these funds to support capital-intensive assets like energy, transportation, and utilities. This symbiotic relationship enhances risk diversification and access to alternative financing within the infrastructure sector.

Key Terms

Asset Type

Infrastructure funds primarily invest in physical assets such as transportation, energy, and utilities, offering long-term, stable cash flows from tangible projects. Private credit funds focus on providing debt financing to mid-market companies, emphasizing a broad range of loan structures including senior secured loans and mezzanine debt. Explore the key differences in asset types and investment strategies to understand which fund aligns with your portfolio goals.

Risk Profile

Infrastructure funds typically carry moderate risk due to long-term, stable cash flows from essential public assets like roads and utilities, often supported by inflation-linked revenues and government contracts. Private credit funds, by contrast, present higher risk profiles through direct lending to middle-market companies, with variable default rates influenced by borrower credit quality and economic cycles. Explore detailed risk assessments and comparative strategies to better understand these investment vehicles.

Liquidity

Infrastructure funds generally exhibit lower liquidity due to their investment in long-term assets such as bridges, airports, and energy facilities, which require substantial holding periods to realize returns. In contrast, private credit funds typically offer higher liquidity profiles by engaging in shorter-term lending arrangements across corporate loans and direct lending strategies, allowing for more frequent capital repayments and redemptions. Explore detailed insights on liquidity characteristics to determine which fund type aligns best with your investment strategy.

Source and External Links

Infrastructure fund - An infrastructure fund is a privately offered or publicly listed fund that invests directly or indirectly in infrastructure and related industries, including sectors like energy, transportation, and communications.

Cohen & Steers Infrastructure Fund - This fund focuses on achieving total return with an emphasis on income through investments in securities issued by infrastructure companies.

PGIM Jennison Global Infrastructure Fund - This fund seeks total return by investing worldwide in companies that own, operate, build, and service infrastructure assets.

dowidth.com

dowidth.com