Art tokenization leverages blockchain technology to convert physical artworks into digital tokens, enabling fractional ownership and increased liquidity for investors. Real Estate Investment Trusts (REITs) allow individuals to invest in large-scale real estate portfolios without directly owning properties, offering diversification and steady income through dividends. Explore the key differences and benefits of art tokenization versus REITs to optimize your investment strategy.

Why it is important

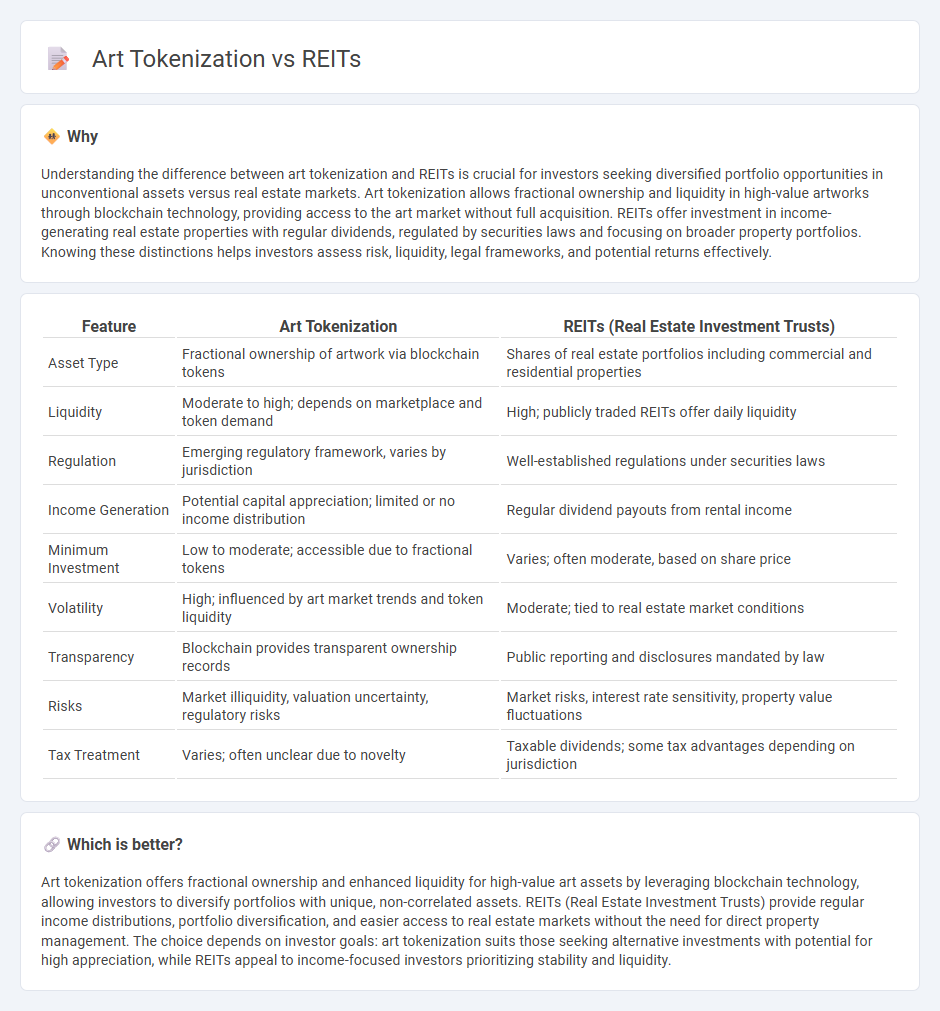

Understanding the difference between art tokenization and REITs is crucial for investors seeking diversified portfolio opportunities in unconventional assets versus real estate markets. Art tokenization allows fractional ownership and liquidity in high-value artworks through blockchain technology, providing access to the art market without full acquisition. REITs offer investment in income-generating real estate properties with regular dividends, regulated by securities laws and focusing on broader property portfolios. Knowing these distinctions helps investors assess risk, liquidity, legal frameworks, and potential returns effectively.

Comparison Table

| Feature | Art Tokenization | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Asset Type | Fractional ownership of artwork via blockchain tokens | Shares of real estate portfolios including commercial and residential properties |

| Liquidity | Moderate to high; depends on marketplace and token demand | High; publicly traded REITs offer daily liquidity |

| Regulation | Emerging regulatory framework, varies by jurisdiction | Well-established regulations under securities laws |

| Income Generation | Potential capital appreciation; limited or no income distribution | Regular dividend payouts from rental income |

| Minimum Investment | Low to moderate; accessible due to fractional tokens | Varies; often moderate, based on share price |

| Volatility | High; influenced by art market trends and token liquidity | Moderate; tied to real estate market conditions |

| Transparency | Blockchain provides transparent ownership records | Public reporting and disclosures mandated by law |

| Risks | Market illiquidity, valuation uncertainty, regulatory risks | Market risks, interest rate sensitivity, property value fluctuations |

| Tax Treatment | Varies; often unclear due to novelty | Taxable dividends; some tax advantages depending on jurisdiction |

Which is better?

Art tokenization offers fractional ownership and enhanced liquidity for high-value art assets by leveraging blockchain technology, allowing investors to diversify portfolios with unique, non-correlated assets. REITs (Real Estate Investment Trusts) provide regular income distributions, portfolio diversification, and easier access to real estate markets without the need for direct property management. The choice depends on investor goals: art tokenization suits those seeking alternative investments with potential for high appreciation, while REITs appeal to income-focused investors prioritizing stability and liquidity.

Connection

Art tokenization leverages blockchain technology to convert physical artworks into digital tokens, enabling fractional ownership and increasing liquidity in the art investment market. Real Estate Investment Trusts (REITs) share a similar structure by allowing investors to purchase shares in income-generating real estate assets without direct property management. Both art tokenization and REITs democratize access to traditionally illiquid assets, fostering diversified portfolios and expanding investment opportunities.

Key Terms

Liquidity

REITs offer investors liquidity through publicly traded shares on stock exchanges, enabling easier buying and selling compared to traditional real estate investments, while art tokenization provides fractional ownership of art assets via blockchain, which can increase market accessibility but often faces lower liquidity due to niche demand. The liquidity of REITs tends to benefit from established financial markets and regulatory frameworks, whereas art tokenization depends heavily on the development of secondary marketplaces and investor interest in digital asset trading. Explore further to understand how liquidity differences impact investment strategies in these evolving asset classes.

Fractional Ownership

REITs (Real Estate Investment Trusts) offer investors fractional ownership in real estate assets, providing liquidity and diversification traditionally unavailable in direct property investments. Art tokenization leverages blockchain technology to enable fractional ownership of high-value artworks, ensuring transparency, security, and broader market access. Explore how these innovative platforms transform investment opportunities through fractional ownership models.

Regulatory Framework

REITs operate under strict regulatory frameworks such as the SEC in the United States, ensuring transparency, investor protection, and compliance with financial reporting standards. Art tokenization falls under emerging regulatory environments that vary by jurisdiction, often involving securities laws, anti-money laundering (AML) policies, and digital asset guidelines. Explore the evolving legal landscape to better understand compliance and investment risks in both sectors.

Source and External Links

Real Estate Investment Trust - Wikipedia - This page provides an overview of REITs, including their types, benefits, and tax advantages.

Real Estate Investment Trusts (REITs) | Investor.gov - This resource explains the basics of REITs, including what they are, types of REITs, and why investors might invest in them.

What's a REIT (Real Estate Investment Trust)? - Nareit - This webpage describes the role of REITs in providing investors with income streams and diversification, and their benefits as a portfolio component.

dowidth.com

dowidth.com