Royalty stream investing generates steady income by purchasing rights to future revenue from intellectual property, music, or natural resources, offering predictable cash flows and diversification. Collectibles investing involves acquiring tangible assets like art, vintage cars, or rare coins, with potential appreciation based on rarity and market demand but higher volatility and liquidity risk. Explore the unique advantages and risks of each investment approach to determine the best fit for your portfolio.

Why it is important

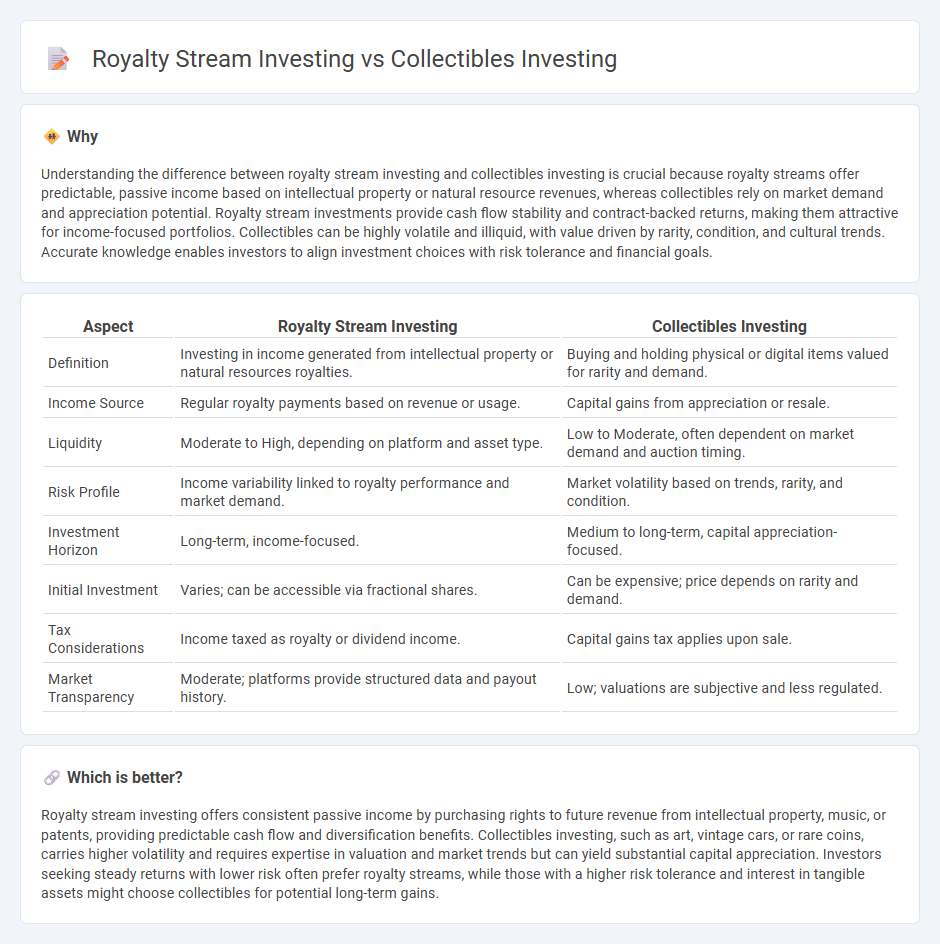

Understanding the difference between royalty stream investing and collectibles investing is crucial because royalty streams offer predictable, passive income based on intellectual property or natural resource revenues, whereas collectibles rely on market demand and appreciation potential. Royalty stream investments provide cash flow stability and contract-backed returns, making them attractive for income-focused portfolios. Collectibles can be highly volatile and illiquid, with value driven by rarity, condition, and cultural trends. Accurate knowledge enables investors to align investment choices with risk tolerance and financial goals.

Comparison Table

| Aspect | Royalty Stream Investing | Collectibles Investing |

|---|---|---|

| Definition | Investing in income generated from intellectual property or natural resources royalties. | Buying and holding physical or digital items valued for rarity and demand. |

| Income Source | Regular royalty payments based on revenue or usage. | Capital gains from appreciation or resale. |

| Liquidity | Moderate to High, depending on platform and asset type. | Low to Moderate, often dependent on market demand and auction timing. |

| Risk Profile | Income variability linked to royalty performance and market demand. | Market volatility based on trends, rarity, and condition. |

| Investment Horizon | Long-term, income-focused. | Medium to long-term, capital appreciation-focused. |

| Initial Investment | Varies; can be accessible via fractional shares. | Can be expensive; price depends on rarity and demand. |

| Tax Considerations | Income taxed as royalty or dividend income. | Capital gains tax applies upon sale. |

| Market Transparency | Moderate; platforms provide structured data and payout history. | Low; valuations are subjective and less regulated. |

Which is better?

Royalty stream investing offers consistent passive income by purchasing rights to future revenue from intellectual property, music, or patents, providing predictable cash flow and diversification benefits. Collectibles investing, such as art, vintage cars, or rare coins, carries higher volatility and requires expertise in valuation and market trends but can yield substantial capital appreciation. Investors seeking steady returns with lower risk often prefer royalty streams, while those with a higher risk tolerance and interest in tangible assets might choose collectibles for potential long-term gains.

Connection

Royalty stream investing and collectibles investing both offer alternative asset classes that generate passive income or appreciate in value through unique ownership rights or scarcity. Royalty streams provide investors with ongoing payments from intellectual property or natural resources, while collectibles hold intrinsic value driven by rarity, provenance, and market demand. Both strategies diversify investment portfolios beyond traditional stocks and bonds, appealing to investors seeking inflation hedges and non-correlated returns.

Key Terms

**Collectibles Investing:**

Collectibles investing involves acquiring physical assets such as rare coins, vintage toys, or limited-edition art that appreciate over time due to rarity and demand fluctuations in niche markets. This asset class offers tangible value and potential high returns, but requires expert knowledge, authenticity verification, and careful storage to preserve condition. Explore more to understand the benefits and risks associated with collectibles investing.

Rarity

Collectibles investing thrives on rarity, with unique or limited-edition items commanding premium prices due to their scarcity and historical significance. Royalty stream investing leverages rare intellectual properties or exclusive rights generating consistent income based on their ongoing value and demand. Explore how rarity shapes return dynamics in both markets to optimize your investment strategy.

Provenance

Provenance in collectibles investing establishes the item's historical ownership and authenticity, significantly impacting its market value and rarity. Royalty stream investing relies on transparent legal documentation confirming the origin of revenue rights, ensuring investors receive payments derived from verifiable intellectual property or assets. Explore detailed strategies to assess provenance and optimize investment decisions in both markets.

Source and External Links

Investing In The $500 Billion Collectibles Market: How To Get Started - Explains that investing in collectibles involves knowing the market well, developing a network, and for some categories like art or spirits, using specialized platforms such as Masterworks or WhiskyInvestDirect to buy shares of curated portfolios with fees and liquidity considerations.

Types of Collectible Investments To Consider - SmartAsset - Highlights popular collectible categories like fine art, rare coins, stamps, and classic cars, noting that collectibles diversify portfolios but come with challenges like storage, insurance, illiquidity, and value subjectivity.

Best Collectibles to Invest In: Guide for 2024 - Benzinga - Provides a broad list of well-regarded collectibles including fine art, coins, stamps, vintage cars, investment-grade wine, and comic books, emphasizing collectibles' ability to diversify investments and grow in value based on rarity, demand, and condition.

dowidth.com

dowidth.com