Crypto staking involves locking up cryptocurrency assets in a blockchain network to support operations and earn rewards, often providing stable and predictable returns. Yield farming, on the other hand, entails lending or providing liquidity in decentralized finance (DeFi) protocols to maximize returns through variable interest rates and token incentives. Explore the detailed differences and benefits of both strategies to optimize your investment portfolio.

Why it is important

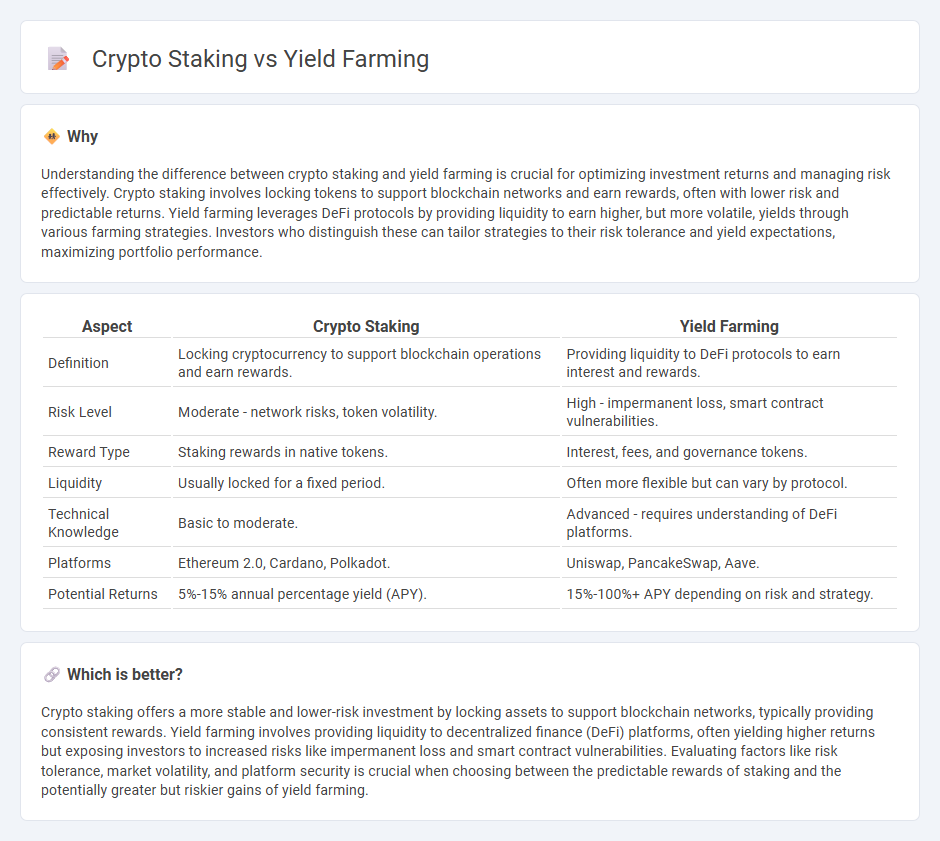

Understanding the difference between crypto staking and yield farming is crucial for optimizing investment returns and managing risk effectively. Crypto staking involves locking tokens to support blockchain networks and earn rewards, often with lower risk and predictable returns. Yield farming leverages DeFi protocols by providing liquidity to earn higher, but more volatile, yields through various farming strategies. Investors who distinguish these can tailor strategies to their risk tolerance and yield expectations, maximizing portfolio performance.

Comparison Table

| Aspect | Crypto Staking | Yield Farming |

|---|---|---|

| Definition | Locking cryptocurrency to support blockchain operations and earn rewards. | Providing liquidity to DeFi protocols to earn interest and rewards. |

| Risk Level | Moderate - network risks, token volatility. | High - impermanent loss, smart contract vulnerabilities. |

| Reward Type | Staking rewards in native tokens. | Interest, fees, and governance tokens. |

| Liquidity | Usually locked for a fixed period. | Often more flexible but can vary by protocol. |

| Technical Knowledge | Basic to moderate. | Advanced - requires understanding of DeFi platforms. |

| Platforms | Ethereum 2.0, Cardano, Polkadot. | Uniswap, PancakeSwap, Aave. |

| Potential Returns | 5%-15% annual percentage yield (APY). | 15%-100%+ APY depending on risk and strategy. |

Which is better?

Crypto staking offers a more stable and lower-risk investment by locking assets to support blockchain networks, typically providing consistent rewards. Yield farming involves providing liquidity to decentralized finance (DeFi) platforms, often yielding higher returns but exposing investors to increased risks like impermanent loss and smart contract vulnerabilities. Evaluating factors like risk tolerance, market volatility, and platform security is crucial when choosing between the predictable rewards of staking and the potentially greater but riskier gains of yield farming.

Connection

Crypto staking and yield farming both involve locking up digital assets to earn passive income, leveraging blockchain protocols to generate rewards. Staking secures proof-of-stake networks by validating transactions, while yield farming optimizes returns by providing liquidity to decentralized finance (DeFi) platforms. These mechanisms enhance capital efficiency and incentivize user participation in cryptocurrency ecosystems.

Key Terms

Liquidity Pool

Yield farming involves providing assets to liquidity pools on decentralized exchanges, earning rewards based on transaction fees and governance tokens. Crypto staking locks cryptocurrencies to support network security and consensus, often earning fixed or variable staking rewards without active trading participation. Explore how liquidity pools maximize yield farming benefits and their impact on DeFi protocols by learning more.

Annual Percentage Yield (APY)

Yield farming typically offers higher Annual Percentage Yield (APY) compared to crypto staking by leveraging liquidity pools and incentivizing token holders with rewards. Crypto staking provides a more stable and predictable APY through network participation, often associated with lower risk but reduced returns. Explore the nuances of APY in yield farming and staking to optimize your crypto investment strategy.

Lock-up Period

Yield farming often requires flexible lock-up periods that vary depending on the protocol, allowing users to maximize returns through liquidity provision. Crypto staking typically involves fixed lock-up durations, ranging from a few days to several months, which secure the network while earning rewards. Explore deeper insights into how lock-up periods impact your investment strategies and potential gains.

Source and External Links

What Is Yield Farming? Meaning and Definition - Chainlink - Yield farming, or liquidity mining, is a DeFi practice rewarding users for providing liquidity or value to a protocol, incentivizing liquidity bootstrapping and fair token distribution, with rewards proportional to deposited funds and often paid in native tokens to enhance ecosystem growth.

What is yield farming and how does it work? - Coinbase - Yield farming is a DeFi method where users allocate crypto assets into protocols to earn rewards, typically governance tokens, by providing liquidity and often reinvesting tokens to increase returns, but it carries risks like impermanent loss and smart contract flaws.

Yield Farming in DeFi Explained: Possibilities, Risks & Strategies - Yield farming is evolving from inflationary token rewards to more sustainable real yield models driven by platform revenue, increasingly employing AI for strategy optimization and facing growing regulatory oversight and crosschain innovations for broader interoperability.

dowidth.com

dowidth.com