Hedge fund replication aims to mimic the returns and risk profile of hedge funds by using liquid, transparent strategies that capture their core risk exposures, often at lower costs and improved scalability. Alternative risk premia focus on harvesting systematic, persistent sources of return such as value, momentum, and carry across various asset classes, offering diversified exposure beyond traditional market risks. Discover how these innovative investment approaches can enhance portfolio diversification and risk-adjusted performance.

Why it is important

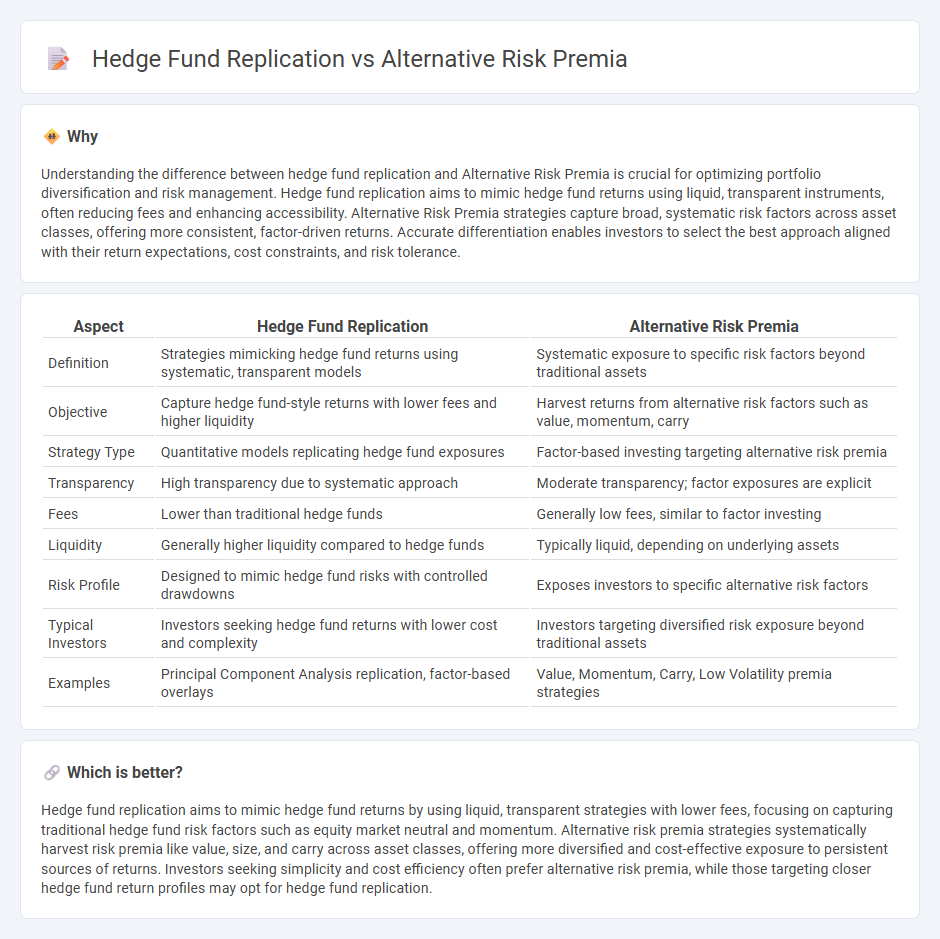

Understanding the difference between hedge fund replication and Alternative Risk Premia is crucial for optimizing portfolio diversification and risk management. Hedge fund replication aims to mimic hedge fund returns using liquid, transparent instruments, often reducing fees and enhancing accessibility. Alternative Risk Premia strategies capture broad, systematic risk factors across asset classes, offering more consistent, factor-driven returns. Accurate differentiation enables investors to select the best approach aligned with their return expectations, cost constraints, and risk tolerance.

Comparison Table

| Aspect | Hedge Fund Replication | Alternative Risk Premia |

|---|---|---|

| Definition | Strategies mimicking hedge fund returns using systematic, transparent models | Systematic exposure to specific risk factors beyond traditional assets |

| Objective | Capture hedge fund-style returns with lower fees and higher liquidity | Harvest returns from alternative risk factors such as value, momentum, carry |

| Strategy Type | Quantitative models replicating hedge fund exposures | Factor-based investing targeting alternative risk premia |

| Transparency | High transparency due to systematic approach | Moderate transparency; factor exposures are explicit |

| Fees | Lower than traditional hedge funds | Generally low fees, similar to factor investing |

| Liquidity | Generally higher liquidity compared to hedge funds | Typically liquid, depending on underlying assets |

| Risk Profile | Designed to mimic hedge fund risks with controlled drawdowns | Exposes investors to specific alternative risk factors |

| Typical Investors | Investors seeking hedge fund returns with lower cost and complexity | Investors targeting diversified risk exposure beyond traditional assets |

| Examples | Principal Component Analysis replication, factor-based overlays | Value, Momentum, Carry, Low Volatility premia strategies |

Which is better?

Hedge fund replication aims to mimic hedge fund returns by using liquid, transparent strategies with lower fees, focusing on capturing traditional hedge fund risk factors such as equity market neutral and momentum. Alternative risk premia strategies systematically harvest risk premia like value, size, and carry across asset classes, offering more diversified and cost-effective exposure to persistent sources of returns. Investors seeking simplicity and cost efficiency often prefer alternative risk premia, while those targeting closer hedge fund return profiles may opt for hedge fund replication.

Connection

Hedge fund replication strategies aim to mimic the returns of hedge funds by systematically capturing Alternative Risk Premia, such as value, momentum, and carry factors. These premia represent persistent sources of excess returns across various asset classes, providing diversified risk exposures without the high fees and complexity of traditional hedge funds. By focusing on Alternative Risk Premia, investors can achieve hedge fund-like performance with improved transparency and lower cost structures.

Key Terms

Factor Exposure

Alternative risk premia strategies systematically target specific risk factors such as value, momentum, and low volatility to achieve diversified returns with transparent factor exposures. Hedge fund replication aims to mimic hedge fund returns by approximating their broad factor exposures but may introduce additional idiosyncratic risks due to model limitations. Explore further to understand how precise factor exposure management differentiates these approaches in portfolio construction.

Systematic Strategies

Alternative risk premia strategies systematically capture broad, persistent sources of return such as value, momentum, and carry, offering diversified exposure beyond traditional asset classes. Hedge fund replication techniques utilize quantitative models to mimic hedge fund performance by extracting similar risk premia through liquid instruments, aiming to reduce costs and improve transparency. Explore detailed insights and comparative analyses to understand how systematic strategies enhance portfolio resilience.

Performance Benchmarking

Alternative risk premia strategies systematically capture specific risk factors such as value, momentum, and carry, offering transparent and cost-efficient performance compared to traditional hedge funds. Hedge fund replication seeks to emulate hedge fund returns by blending alternative risk premia but often faces challenges in fully capturing the alpha generated by active management. Explore comprehensive performance benchmarking techniques to understand how alternative risk premia and hedge fund replication strategies measure up in risk-adjusted returns and diversification benefits.

Source and External Links

Alternative risk premia: Building blocks for resilient portfolios - Alternative risk premia (ARP) are systematic, rules-based investment strategies that aim to deliver attractive and durable returns through exposure to economic and behavioral sources, often implemented via long-short techniques in liquid securities for diversification benefits.

An Introduction to Alternative Risk Premia - ARP strategies offer systematic, transparent, and liquid ways to access risk premia that were historically only available in higher-fee hedge funds, and they often use derivatives and swaps for capital efficiency and leverage.

Alternative Risk Premia - Meketa Investment Group - ARP strategies focus on non-traditional risk premia (like value, momentum, and carry) that are uncorrelated to traditional betas, potentially offering valuable portfolio diversification benefits.

dowidth.com

dowidth.com