Litigation funding involves third-party financing that covers legal expenses in exchange for a portion of the settlement or judgment, minimizing upfront costs and risk for claimants. Royalty finance provides capital by purchasing future revenue streams from intellectual property, allowing businesses to maintain ownership without incurring debt. Explore how each funding option can strategically enhance your investment portfolio.

Why it is important

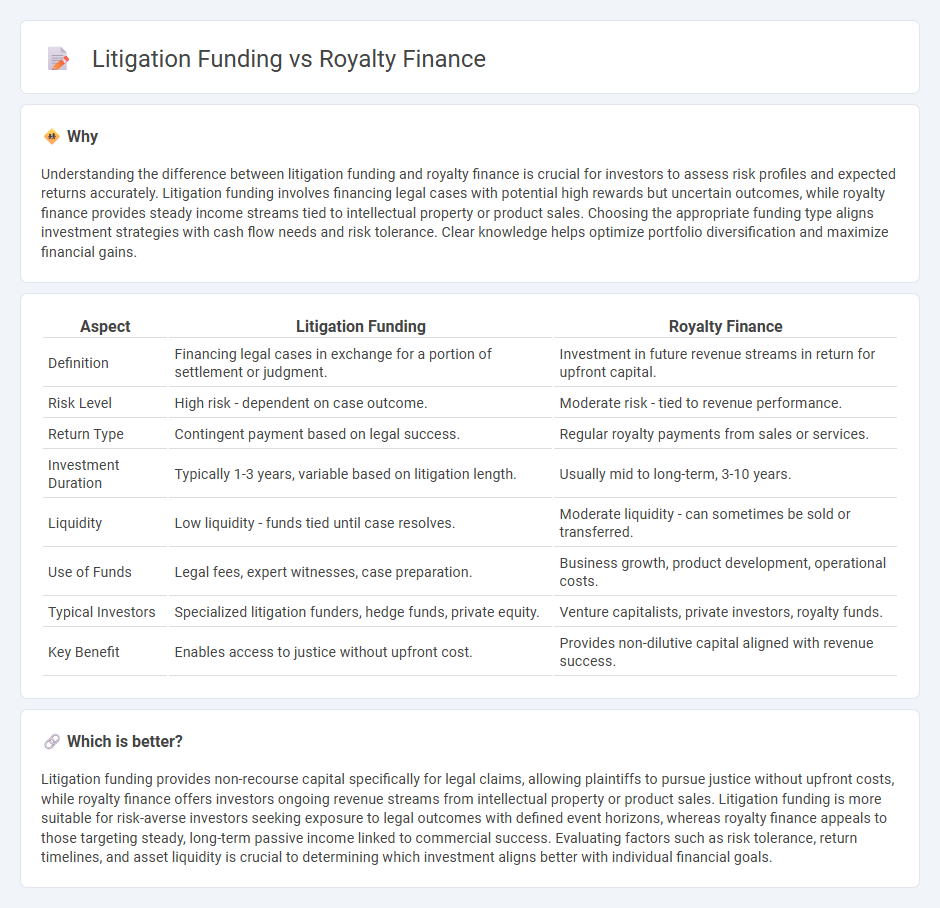

Understanding the difference between litigation funding and royalty finance is crucial for investors to assess risk profiles and expected returns accurately. Litigation funding involves financing legal cases with potential high rewards but uncertain outcomes, while royalty finance provides steady income streams tied to intellectual property or product sales. Choosing the appropriate funding type aligns investment strategies with cash flow needs and risk tolerance. Clear knowledge helps optimize portfolio diversification and maximize financial gains.

Comparison Table

| Aspect | Litigation Funding | Royalty Finance |

|---|---|---|

| Definition | Financing legal cases in exchange for a portion of settlement or judgment. | Investment in future revenue streams in return for upfront capital. |

| Risk Level | High risk - dependent on case outcome. | Moderate risk - tied to revenue performance. |

| Return Type | Contingent payment based on legal success. | Regular royalty payments from sales or services. |

| Investment Duration | Typically 1-3 years, variable based on litigation length. | Usually mid to long-term, 3-10 years. |

| Liquidity | Low liquidity - funds tied until case resolves. | Moderate liquidity - can sometimes be sold or transferred. |

| Use of Funds | Legal fees, expert witnesses, case preparation. | Business growth, product development, operational costs. |

| Typical Investors | Specialized litigation funders, hedge funds, private equity. | Venture capitalists, private investors, royalty funds. |

| Key Benefit | Enables access to justice without upfront cost. | Provides non-dilutive capital aligned with revenue success. |

Which is better?

Litigation funding provides non-recourse capital specifically for legal claims, allowing plaintiffs to pursue justice without upfront costs, while royalty finance offers investors ongoing revenue streams from intellectual property or product sales. Litigation funding is more suitable for risk-averse investors seeking exposure to legal outcomes with defined event horizons, whereas royalty finance appeals to those targeting steady, long-term passive income linked to commercial success. Evaluating factors such as risk tolerance, return timelines, and asset liquidity is crucial to determining which investment aligns better with individual financial goals.

Connection

Litigation funding and royalty finance are connected through their role as alternative investment strategies that provide non-dilutive capital to businesses. Both methods offer investors the opportunity to finance specific assets or outcomes, such as legal claims or intellectual property royalties, generating returns tied to the success of those assets. This alignment of risk and reward creates a specialized investment niche that diversifies portfolios beyond traditional equity and debt instruments.

Key Terms

**Royalty Finance:**

Royalty finance provides companies with capital by selling future revenue streams, allowing businesses to access funds without diluting equity or incurring debt. This financing method aligns investor returns with company performance, minimizing risk through a flexible repayment structure based on actual royalties generated. Explore further to understand how royalty finance can offer innovative funding solutions for growth and development.

Revenue Share

Royalty finance involves investors providing capital in exchange for a percentage of future revenue streams, allowing businesses to retain ownership without incurring debt, whereas litigation funding supplies capital to cover legal expenses in exchange for a portion of the settlement or judgment. Revenue share in royalty finance is directly tied to ongoing business performance, offering dynamic returns aligned with sales or revenue growth. Explore detailed comparisons and strategic applications of revenue-sharing models in royalty finance and litigation funding to optimize your financial decisions.

Intellectual Property

Royalty finance allows investors to receive a percentage of revenue generated from intellectual property assets, aligning returns directly with the success of patented innovations or trademarks. Litigation funding, by contrast, provides capital to cover legal expenses in intellectual property disputes, with repayment contingent on winning the case or settling favorably. Explore further to understand which financing strategy best supports your intellectual property portfolio.

Source and External Links

Royalty fund - Wikipedia - Royalty finance involves purchasing the right to a royalty, which is a percentage of future revenue from a product or service, and is used in industries like pharmaceuticals, mining, and entertainment; such funds avoid corporate level taxation by distributing income as dividends directly to investors.

Royalty Financing: Unlocking Value in the Life Sciences - Royalty financing is a way to raise capital by exchanging funds for a percentage of future revenues, providing companies with flexible funding for product launches or R&D without the risks of equity or traditional debt financing.

Understanding Royalty Loan Agreements in Business - Royalty financing is used by businesses to raise capital based on future revenue streams, commonly applied in technology, pharmaceuticals, media, natural resources, and franchise expansions, allowing business owners to preserve ownership and avoid giving up equity.

dowidth.com

dowidth.com