Investing in viticulture land offers the opportunity to own tangible assets that can appreciate through vineyard production and wine market growth, while Real Estate Investment Trusts (REITs) provide diversified exposure to income-generating real estate without direct management responsibilities. Viticulture land acquisition involves agricultural risks and long-term commitments, whereas REITs offer liquidity and accessibility with dividend income streams. Explore detailed comparisons to determine which investment aligns better with your financial goals and risk tolerance.

Why it is important

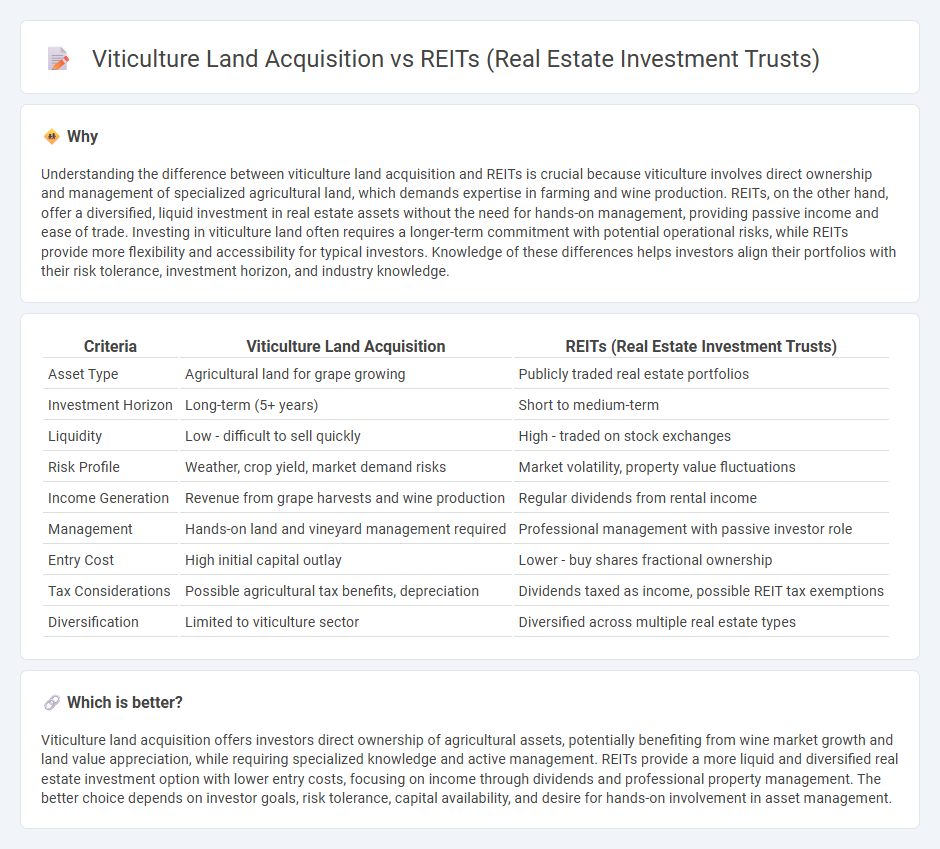

Understanding the difference between viticulture land acquisition and REITs is crucial because viticulture involves direct ownership and management of specialized agricultural land, which demands expertise in farming and wine production. REITs, on the other hand, offer a diversified, liquid investment in real estate assets without the need for hands-on management, providing passive income and ease of trade. Investing in viticulture land often requires a longer-term commitment with potential operational risks, while REITs provide more flexibility and accessibility for typical investors. Knowledge of these differences helps investors align their portfolios with their risk tolerance, investment horizon, and industry knowledge.

Comparison Table

| Criteria | Viticulture Land Acquisition | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Asset Type | Agricultural land for grape growing | Publicly traded real estate portfolios |

| Investment Horizon | Long-term (5+ years) | Short to medium-term |

| Liquidity | Low - difficult to sell quickly | High - traded on stock exchanges |

| Risk Profile | Weather, crop yield, market demand risks | Market volatility, property value fluctuations |

| Income Generation | Revenue from grape harvests and wine production | Regular dividends from rental income |

| Management | Hands-on land and vineyard management required | Professional management with passive investor role |

| Entry Cost | High initial capital outlay | Lower - buy shares fractional ownership |

| Tax Considerations | Possible agricultural tax benefits, depreciation | Dividends taxed as income, possible REIT tax exemptions |

| Diversification | Limited to viticulture sector | Diversified across multiple real estate types |

Which is better?

Viticulture land acquisition offers investors direct ownership of agricultural assets, potentially benefiting from wine market growth and land value appreciation, while requiring specialized knowledge and active management. REITs provide a more liquid and diversified real estate investment option with lower entry costs, focusing on income through dividends and professional property management. The better choice depends on investor goals, risk tolerance, capital availability, and desire for hands-on involvement in asset management.

Connection

Viticulture land acquisition offers investors exposure to agricultural real estate with potential for long-term value appreciation driven by high demand for premium wine production regions. REITs specializing in agricultural assets can include vineyards and viticulture land, allowing investors to gain diversified portfolio access without direct management responsibilities. The connection between viticulture land and REITs lies in the ability to capitalize on the growing wine market through scalable, income-generating real estate investments.

Key Terms

Liquidity

Liquidity in REITs (Real Estate Investment Trusts) is significantly higher than in viticulture land acquisitions due to their publicly traded nature and ease of buying or selling shares on major exchanges. Viticulture land involves substantial capital, longer holding periods, and limited marketability, resulting in lower liquidity and slower asset conversion to cash. Explore more to understand how liquidity impacts investment strategy and portfolio diversification in both sectors.

Income Yield

REITs offer a consistent income yield often ranging between 4% to 7%, driven by diversified real estate portfolios and mandated dividend distributions. Viticulture land acquisition, while less liquid, can provide lucrative returns through grape production, wine sales, and land appreciation, with income yields influenced by vineyard management and market demand. Explore the nuances of income yield strategies in these distinct investment avenues for a tailored portfolio approach.

Asset Appreciation

REITs offer liquidity and diversification with the potential for steady asset appreciation through rental income and property value increases, while viticulture land acquisition provides tangible asset growth driven by vineyard development, grape yield, and wine market demands. The appreciation of viticulture land is often influenced by climate conditions and premium wine branding, contrasting with the broader real estate market trends affecting REIT valuations. Explore the nuances of asset appreciation strategies in real estate investments and agricultural land acquisition to optimize your portfolio growth.

Source and External Links

Real estate investment trust - A REIT is a company that owns, operates, or finances income-producing real estate (like office buildings, apartments, hotels), often enjoying special tax status and distributing most of its income as dividends.

What's a REIT (Real Estate Investment Trust)? - REITs provide investors with regular income, diversification, and potential appreciation by pooling capital in real estate across various property sectors, and are mostly traded on major stock exchanges.

Real Estate Investment Trusts (REITs) - REITs allow individuals to invest in large-scale commercial real estate without directly owning property, and are available as publicly traded, public non-traded, and private forms, each with different risks and opportunities.

dowidth.com

dowidth.com