Wine cask aging offers a tangible asset investment with potential appreciation through expert maturation, contrasting with peer-to-peer lending's digital platform providing direct loan opportunities and steady interest returns. Investors seeking diversification can leverage the unique characteristics of wine cask market volatility versus the structured, data-driven risk models of peer-to-peer lending platforms. Explore the advantages and risks of these distinct investment avenues to make informed financial decisions.

Why it is important

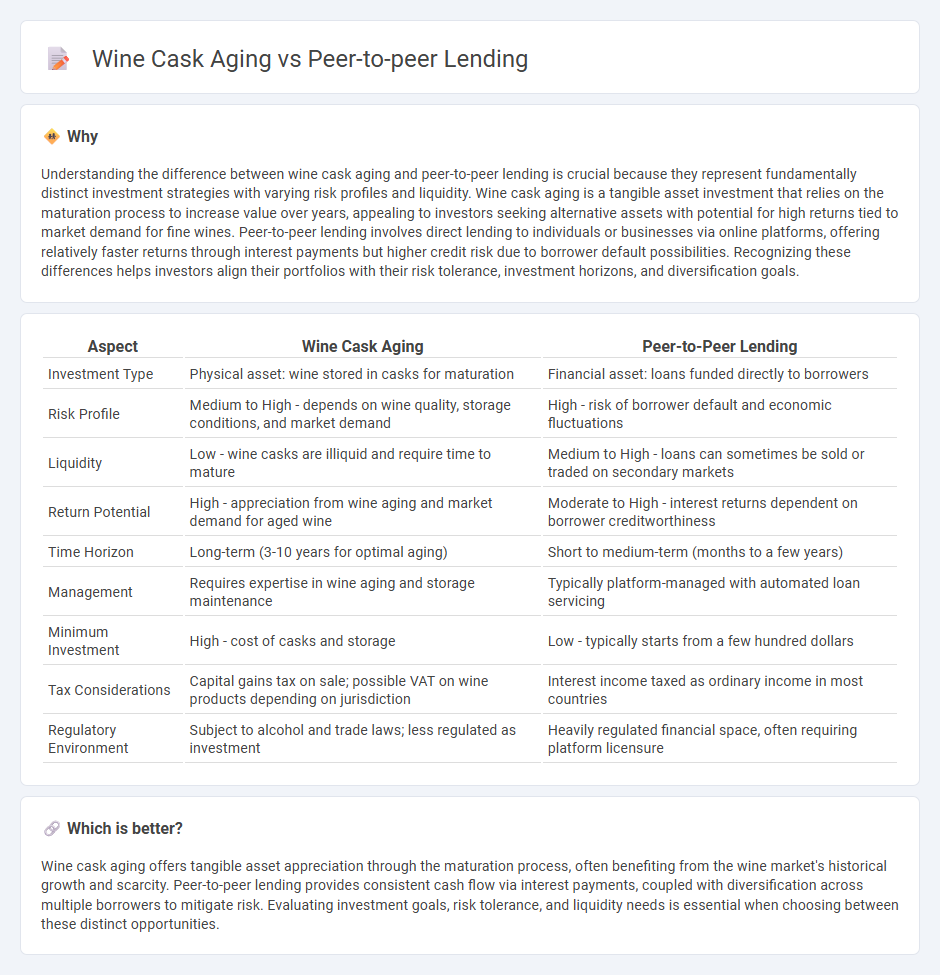

Understanding the difference between wine cask aging and peer-to-peer lending is crucial because they represent fundamentally distinct investment strategies with varying risk profiles and liquidity. Wine cask aging is a tangible asset investment that relies on the maturation process to increase value over years, appealing to investors seeking alternative assets with potential for high returns tied to market demand for fine wines. Peer-to-peer lending involves direct lending to individuals or businesses via online platforms, offering relatively faster returns through interest payments but higher credit risk due to borrower default possibilities. Recognizing these differences helps investors align their portfolios with their risk tolerance, investment horizons, and diversification goals.

Comparison Table

| Aspect | Wine Cask Aging | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Physical asset: wine stored in casks for maturation | Financial asset: loans funded directly to borrowers |

| Risk Profile | Medium to High - depends on wine quality, storage conditions, and market demand | High - risk of borrower default and economic fluctuations |

| Liquidity | Low - wine casks are illiquid and require time to mature | Medium to High - loans can sometimes be sold or traded on secondary markets |

| Return Potential | High - appreciation from wine aging and market demand for aged wine | Moderate to High - interest returns dependent on borrower creditworthiness |

| Time Horizon | Long-term (3-10 years for optimal aging) | Short to medium-term (months to a few years) |

| Management | Requires expertise in wine aging and storage maintenance | Typically platform-managed with automated loan servicing |

| Minimum Investment | High - cost of casks and storage | Low - typically starts from a few hundred dollars |

| Tax Considerations | Capital gains tax on sale; possible VAT on wine products depending on jurisdiction | Interest income taxed as ordinary income in most countries |

| Regulatory Environment | Subject to alcohol and trade laws; less regulated as investment | Heavily regulated financial space, often requiring platform licensure |

Which is better?

Wine cask aging offers tangible asset appreciation through the maturation process, often benefiting from the wine market's historical growth and scarcity. Peer-to-peer lending provides consistent cash flow via interest payments, coupled with diversification across multiple borrowers to mitigate risk. Evaluating investment goals, risk tolerance, and liquidity needs is essential when choosing between these distinct opportunities.

Connection

Wine cask aging and peer-to-peer lending intersect as alternative investment opportunities appealing to investors seeking portfolio diversification beyond traditional stocks and bonds. Both markets allow fractional ownership: wine cask aging enables investors to own and trade portions of maturing wine barrels, while peer-to-peer lending platforms facilitate lending capital directly to borrowers in exchange for interest returns. These avenues provide unique risk profiles and potential for high returns driven by market demand and asset appreciation.

Key Terms

Peer-to-peer lending:

Peer-to-peer lending connects borrowers directly with individual investors through online platforms, bypassing traditional financial institutions and enabling faster access to loans with typically lower interest rates. This innovative financing model leverages technology to assess credit risk and facilitate transparent transactions, offering attractive returns for investors while supporting diverse borrower needs. Discover how peer-to-peer lending is transforming personal and business finance by exploring its benefits and potential risks.

Default Risk

Peer-to-peer lending involves direct loans between individuals, carrying default risk influenced by borrower creditworthiness and platform risk management. Wine cask aging, while not a financial transaction, carries intrinsic risks including spoilage and loss in value, but no default risk as it is an asset preservation process. Explore further to understand how default risk varies fundamentally between financial and asset aging contexts.

Interest Rate

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 12%, providing lenders with steady returns based on borrower creditworthiness and loan terms. Wine cask aging does not generate traditional interest but can yield significant appreciation in wine value over time, influenced by aging conditions, wine variety, and market demand. Explore detailed comparisons to understand how interest rates and value appreciation impact investment strategies in these distinct asset classes.

Source and External Links

Peer-to-Peer Lending | Equifax - Peer-to-peer lending allows individuals to borrow or lend money without banks, often through online platforms that connect borrowers with investors.

Peer-to-Peer Lending - Wikipedia - Peer-to-peer lending involves lending money to individuals or businesses through online services, bypassing traditional financial institutions.

Peer to Peer Lending - MoneyHelper - Peer-to-peer lending is a platform-based method where individuals lend money to others or businesses, earning interest in return but with higher risks.

dowidth.com

dowidth.com