Investing in music royalties offers long-term passive income by earning a share of streaming, licensing, and broadcasting revenues tied to popular songs. Collectible cards investing focuses on acquiring rare and valuable cards that appreciate through market demand, condition, and scarcity among enthusiasts. Explore the unique financial dynamics and growth potential of these alternative investments to determine which aligns best with your portfolio goals.

Why it is important

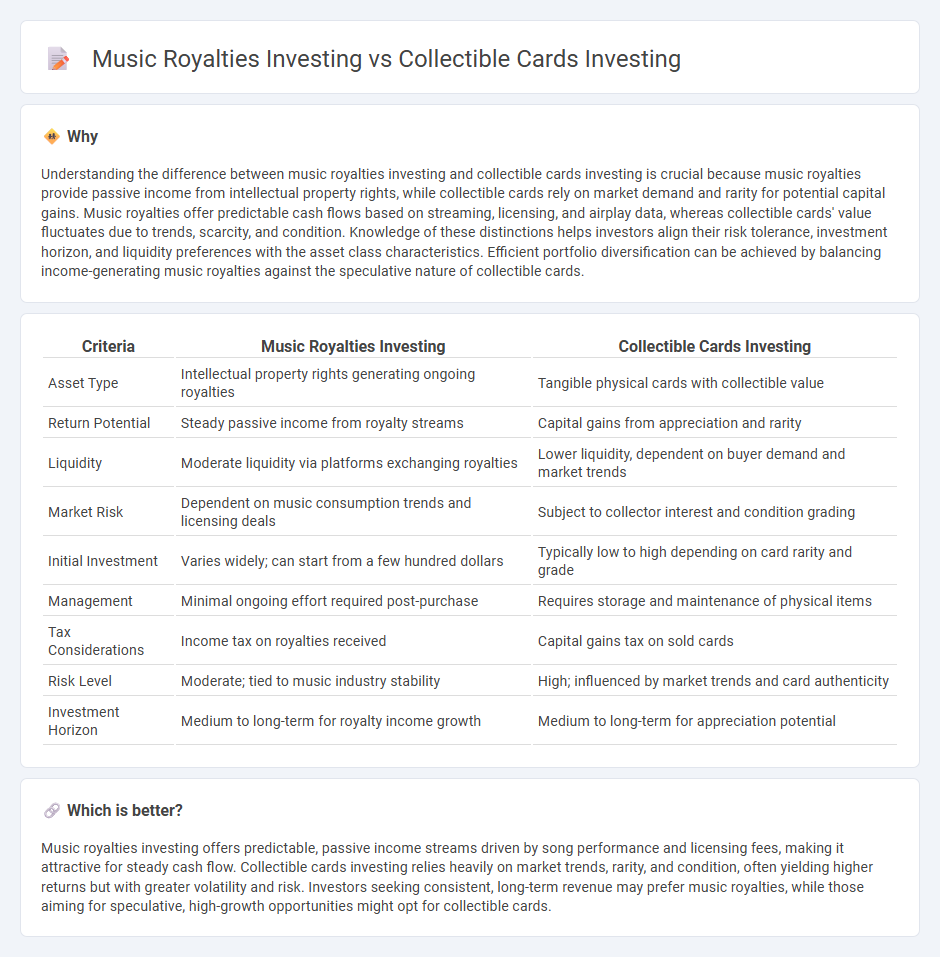

Understanding the difference between music royalties investing and collectible cards investing is crucial because music royalties provide passive income from intellectual property rights, while collectible cards rely on market demand and rarity for potential capital gains. Music royalties offer predictable cash flows based on streaming, licensing, and airplay data, whereas collectible cards' value fluctuates due to trends, scarcity, and condition. Knowledge of these distinctions helps investors align their risk tolerance, investment horizon, and liquidity preferences with the asset class characteristics. Efficient portfolio diversification can be achieved by balancing income-generating music royalties against the speculative nature of collectible cards.

Comparison Table

| Criteria | Music Royalties Investing | Collectible Cards Investing |

|---|---|---|

| Asset Type | Intellectual property rights generating ongoing royalties | Tangible physical cards with collectible value |

| Return Potential | Steady passive income from royalty streams | Capital gains from appreciation and rarity |

| Liquidity | Moderate liquidity via platforms exchanging royalties | Lower liquidity, dependent on buyer demand and market trends |

| Market Risk | Dependent on music consumption trends and licensing deals | Subject to collector interest and condition grading |

| Initial Investment | Varies widely; can start from a few hundred dollars | Typically low to high depending on card rarity and grade |

| Management | Minimal ongoing effort required post-purchase | Requires storage and maintenance of physical items |

| Tax Considerations | Income tax on royalties received | Capital gains tax on sold cards |

| Risk Level | Moderate; tied to music industry stability | High; influenced by market trends and card authenticity |

| Investment Horizon | Medium to long-term for royalty income growth | Medium to long-term for appreciation potential |

Which is better?

Music royalties investing offers predictable, passive income streams driven by song performance and licensing fees, making it attractive for steady cash flow. Collectible cards investing relies heavily on market trends, rarity, and condition, often yielding higher returns but with greater volatility and risk. Investors seeking consistent, long-term revenue may prefer music royalties, while those aiming for speculative, high-growth opportunities might opt for collectible cards.

Connection

Music royalties investing and collectible cards investing both represent alternative asset classes offering portfolio diversification and potential passive income streams. These investments rely on market demand, rarity, and historical performance data to determine value and return on investment. Intellectual property rights in music and scarcity in collectible cards create opportunities for investors seeking non-traditional revenue sources.

Key Terms

**Collectible cards investing:**

Investing in collectible cards offers tangible asset appreciation driven by rarity, condition, and player popularity, making it a highly sought-after market within alternative investments. The global trading card market is projected to exceed $10 billion, fueled by increasing demand from both collectors and investors seeking portfolio diversification. Explore in-depth analysis and trends to maximize returns in collectible card investing.

Grading

Grading plays a critical role in collectible cards investing, where professional grading services like PSA or Beckett assess condition, authenticity, and rarity to determine market value and liquidity. In music royalties investing, while formal grading doesn't exist, investors evaluate royalty streams based on factors such as historical earnings, contract terms, and artist popularity to gauge risk and return potential. Explore the detailed impact of grading and evaluation methods on these investment types for informed decision-making.

Rarity

Collectible cards investing centers on the rarity of specific cards, often determined by limited print runs, unique editions, or condition grades, which can significantly influence market value. Music royalties investing relies on the scarcity of income streams tied to popular songs or catalogs with enduring appeal, where rare rights or ownership percentages can yield substantial returns. Explore the distinct rarity dynamics in both markets to make informed investment decisions.

Source and External Links

Invest in Trading Cards - Trading cards offer high return potential, portfolio diversification, and are driven by growing demand and nostalgic cultural value, making them attractive for investors.

Investing in Sports Cards in 2025 (& Alternatives to Explore) - Vinovest - Tips for sports card investing include setting a budget, researching the market, developing a clear strategy (e.g., flipping, long-term holding), and diversifying to manage risk and optimize returns.

Is Investing in Sports Cards a Viable Investment? - Nasdaq - Rare and high-demand sports cards have yielded substantial returns but carry risks such as market volatility, athlete reputation impact, and economic factors affecting collectors' spending.

dowidth.com

dowidth.com