Wine investing platforms offer access to a niche market with tangible assets, combining passion for fine wines and portfolio diversification through collectibles that often appreciate over time. Startup equity crowdfunding provides opportunities to invest in early-stage companies with high growth potential, albeit with greater risk and longer investment horizons. Explore the differences in risk profile, liquidity, and returns to decide which investment avenue suits your financial goals.

Why it is important

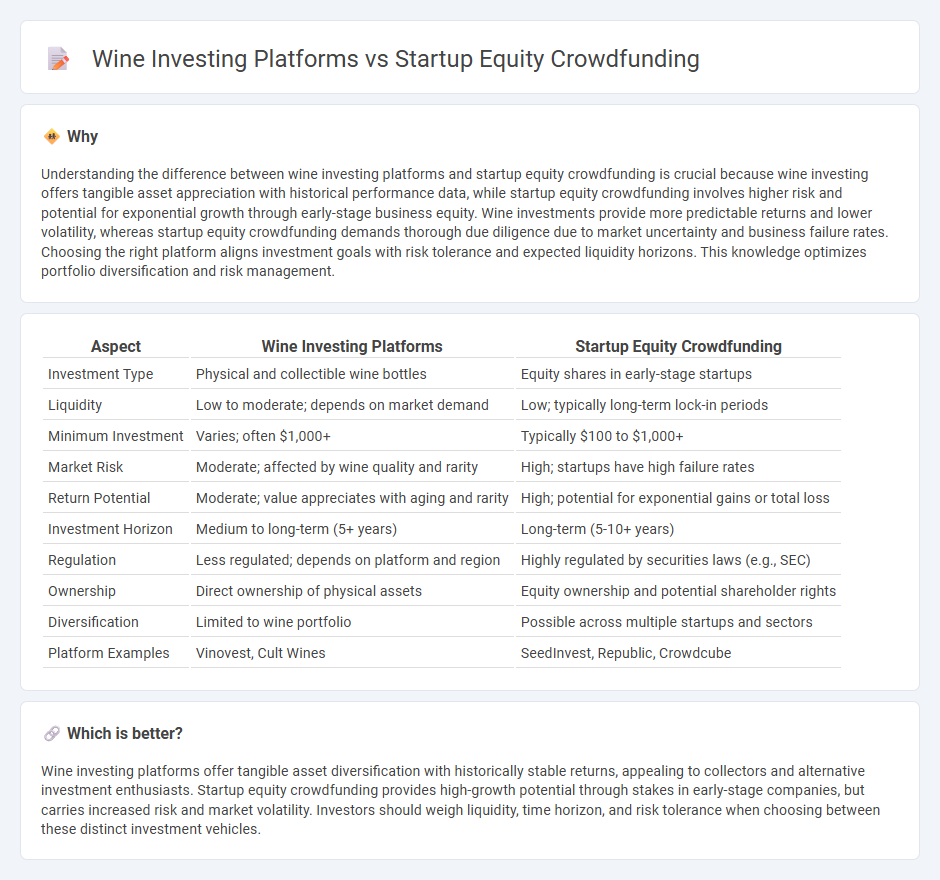

Understanding the difference between wine investing platforms and startup equity crowdfunding is crucial because wine investing offers tangible asset appreciation with historical performance data, while startup equity crowdfunding involves higher risk and potential for exponential growth through early-stage business equity. Wine investments provide more predictable returns and lower volatility, whereas startup equity crowdfunding demands thorough due diligence due to market uncertainty and business failure rates. Choosing the right platform aligns investment goals with risk tolerance and expected liquidity horizons. This knowledge optimizes portfolio diversification and risk management.

Comparison Table

| Aspect | Wine Investing Platforms | Startup Equity Crowdfunding |

|---|---|---|

| Investment Type | Physical and collectible wine bottles | Equity shares in early-stage startups |

| Liquidity | Low to moderate; depends on market demand | Low; typically long-term lock-in periods |

| Minimum Investment | Varies; often $1,000+ | Typically $100 to $1,000+ |

| Market Risk | Moderate; affected by wine quality and rarity | High; startups have high failure rates |

| Return Potential | Moderate; value appreciates with aging and rarity | High; potential for exponential gains or total loss |

| Investment Horizon | Medium to long-term (5+ years) | Long-term (5-10+ years) |

| Regulation | Less regulated; depends on platform and region | Highly regulated by securities laws (e.g., SEC) |

| Ownership | Direct ownership of physical assets | Equity ownership and potential shareholder rights |

| Diversification | Limited to wine portfolio | Possible across multiple startups and sectors |

| Platform Examples | Vinovest, Cult Wines | SeedInvest, Republic, Crowdcube |

Which is better?

Wine investing platforms offer tangible asset diversification with historically stable returns, appealing to collectors and alternative investment enthusiasts. Startup equity crowdfunding provides high-growth potential through stakes in early-stage companies, but carries increased risk and market volatility. Investors should weigh liquidity, time horizon, and risk tolerance when choosing between these distinct investment vehicles.

Connection

Wine investing platforms and startup equity crowdfunding both leverage digital technology to connect investors with alternative asset opportunities, expanding access beyond traditional markets. These platforms enable fractional ownership, allowing investors to diversify portfolios by acquiring shares in high-potential wine collections or innovative startups. By utilizing blockchain and secure online frameworks, they enhance transparency and liquidity in otherwise illiquid markets, attracting a broader range of investors seeking unique asset classes.

Key Terms

**Startup equity crowdfunding:**

Startup equity crowdfunding allows investors to buy shares in early-stage companies, offering potential high returns through equity ownership in innovative startups. Platforms like SeedInvest and Crowdcube facilitate access to diverse industries, enabling fractional investments with varying risk profiles. Explore more about how startup equity crowdfunding can diversify your investment portfolio and support emerging businesses.

Valuation

Startup equity crowdfunding platforms typically offer valuation metrics based on market potential, financial performance, and growth projections, enabling investors to assess equity stakes in emerging companies. Wine investing platforms focus on asset appreciation, using factors like vintage year, rarity, and auction sale prices to determine wine valuation. Explore more insights into how valuation differs fundamentally between these two investment avenues.

Shares (Equity)

Startup equity crowdfunding platforms enable investors to acquire shares representing ownership stakes in early-stage companies, offering potential for high returns through company growth and exit events. Wine investing platforms provide fractional shares in wine collections, focusing on tangible assets that appreciate based on rarity, vintage, and market trends rather than company performance. Explore detailed comparisons to understand which shares-based investment suits your portfolio goals.

Source and External Links

Equity Crowdfunding: Pros & Cons of Funding Options - Nav - Equity crowdfunding allows startups to raise capital from individual and institutional investors who receive equity ownership instead of a loan to repay, making it a popular alternative when traditional loans or venture capital are not available.

What is crowdfunding? Here are four types for startups to know - Stripe - Equity crowdfunding involves offering company shares to investors who may provide larger capital amounts and expertise but requires sharing ownership and navigating regulatory complexities.

Crowdfunding a Startup: Types, Strategies and Benefits - J.P. Morgan - Equity crowdfunding lets startups raise up to $5 million annually by selling ownership shares, making it suitable for growth-stage companies seeking larger sums compared to reward-based crowdfunding which is often used for product pre-sales.

dowidth.com

dowidth.com