Investment in music royalties offers a unique opportunity to earn passive income through copyright ownership and royalty collection, often providing steady cash flow regardless of market volatility. In contrast, investing in wine involves acquiring rare vintages that appreciate over time due to scarcity and demand in global markets, blending enjoyment with financial gain. Explore the distinct benefits and risks of music royalties versus wine investments to determine which aligns best with your financial goals.

Why it is important

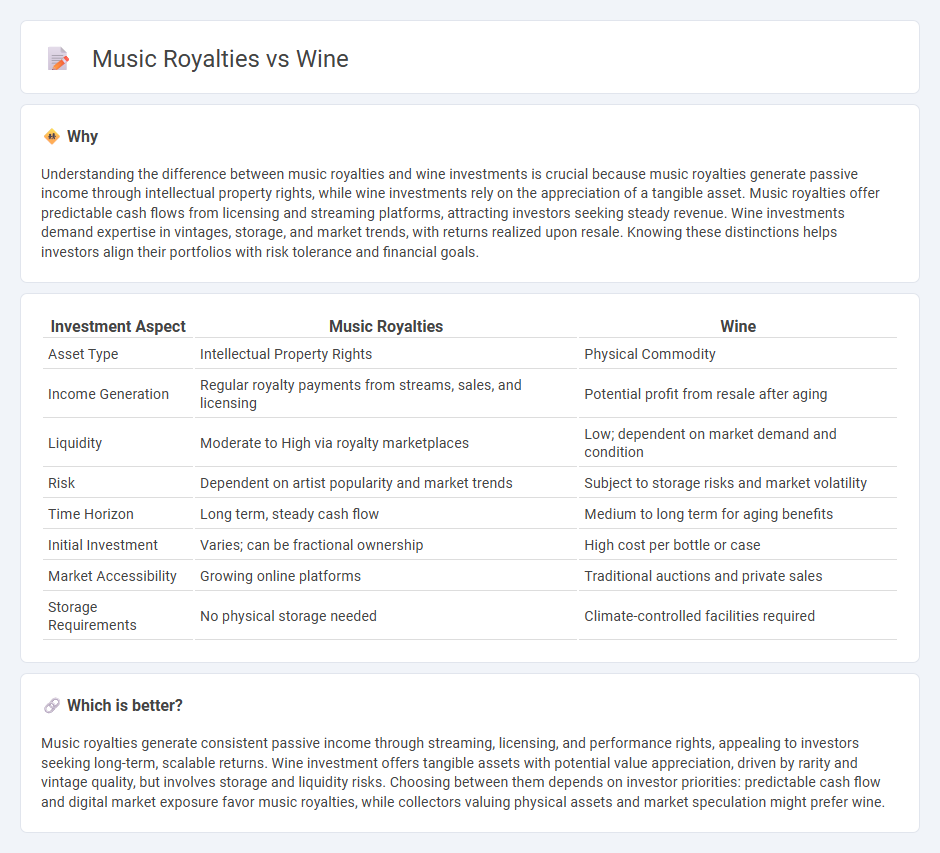

Understanding the difference between music royalties and wine investments is crucial because music royalties generate passive income through intellectual property rights, while wine investments rely on the appreciation of a tangible asset. Music royalties offer predictable cash flows from licensing and streaming platforms, attracting investors seeking steady revenue. Wine investments demand expertise in vintages, storage, and market trends, with returns realized upon resale. Knowing these distinctions helps investors align their portfolios with risk tolerance and financial goals.

Comparison Table

| Investment Aspect | Music Royalties | Wine |

|---|---|---|

| Asset Type | Intellectual Property Rights | Physical Commodity |

| Income Generation | Regular royalty payments from streams, sales, and licensing | Potential profit from resale after aging |

| Liquidity | Moderate to High via royalty marketplaces | Low; dependent on market demand and condition |

| Risk | Dependent on artist popularity and market trends | Subject to storage risks and market volatility |

| Time Horizon | Long term, steady cash flow | Medium to long term for aging benefits |

| Initial Investment | Varies; can be fractional ownership | High cost per bottle or case |

| Market Accessibility | Growing online platforms | Traditional auctions and private sales |

| Storage Requirements | No physical storage needed | Climate-controlled facilities required |

Which is better?

Music royalties generate consistent passive income through streaming, licensing, and performance rights, appealing to investors seeking long-term, scalable returns. Wine investment offers tangible assets with potential value appreciation, driven by rarity and vintage quality, but involves storage and liquidity risks. Choosing between them depends on investor priorities: predictable cash flow and digital market exposure favor music royalties, while collectors valuing physical assets and market speculation might prefer wine.

Connection

Music royalties and wine investments share a common appeal through their potential for long-term passive income and asset appreciation. Both markets offer diversification opportunities outside traditional stocks and bonds, with music royalties generating steady cash flow from intellectual property rights and fine wine appreciating in value due to scarcity and vintage quality. Investors benefit from the relatively low correlation of these assets to conventional financial markets, enhancing portfolio resilience.

Key Terms

Asset Appreciation

Wine and music royalties both serve as alternative investment assets, prized for their potential appreciation over time. Fine wine appreciates through scarcity, vintage quality, and aging potential, while music royalties generate ongoing income streams from copyrights and catalog value growth. Explore how these distinct asset classes can diversify a portfolio and maximize long-term value.

Copyright Ownership

Copyright ownership in music royalties grants creators exclusive rights to reproduce, distribute, and perform their works, ensuring continuous income streams from public use and licensing. Wine royalties, however, pertain to intellectual property rights tied to brand names, trademarks, or proprietary grape varietals, affecting market control rather than creative content exploitation. Explore further to understand the nuanced differences in copyright ownership and revenue generation between these two industries.

Market Liquidity

Market liquidity in wine investments is generally lower compared to music royalties due to the physical nature and limited trading platforms for wine assets. Music royalties benefit from digital platforms and consistent income streams, offering higher liquidity and attracting investors seeking regular cash flow. Explore detailed analyses to understand how liquidity impacts investment decisions in these two markets.

Source and External Links

Wine - Wikipedia - Wine is an alcoholic beverage made from fermented grapes, produced worldwide in various styles influenced by grape variety, region, and production techniques.

Download * Wiki * wine / wine * GitLab - The Wine project provides its development source code and binaries for users to run Windows applications on non-Windows operating systems.

WineHQ - Run Windows applications on Linux, BSD, Solaris and macOS - Wine is a compatibility layer that enables Windows applications to run on POSIX-compliant systems like Linux and macOS by translating Windows API calls into native system calls.

dowidth.com

dowidth.com