Sports team ownership shares offer unique investment opportunities by combining passion-driven assets with the potential for appreciation influenced by team performance and fan engagement. Private equity funds provide diversified exposure to various industries through pooled capital managed by professionals, aiming for long-term growth and risk mitigation. Explore the distinct dynamics and benefits of these investment vehicles to make informed financial decisions.

Why it is important

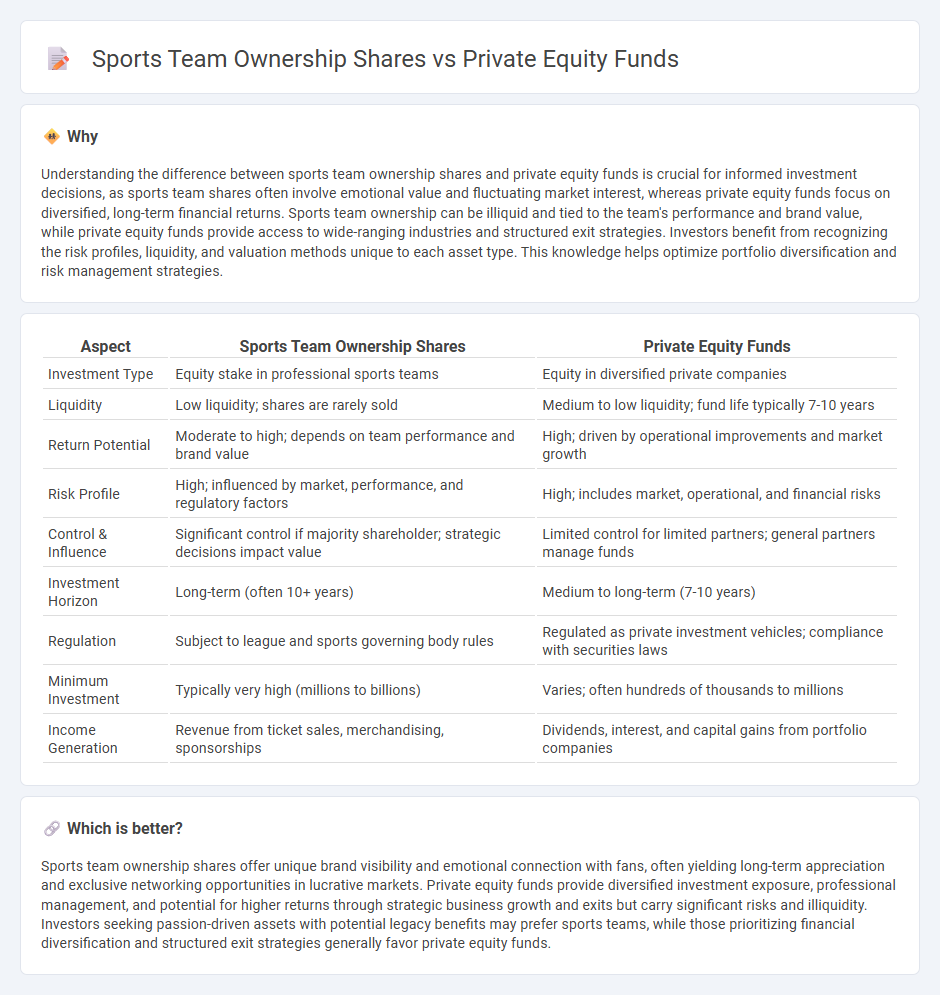

Understanding the difference between sports team ownership shares and private equity funds is crucial for informed investment decisions, as sports team shares often involve emotional value and fluctuating market interest, whereas private equity funds focus on diversified, long-term financial returns. Sports team ownership can be illiquid and tied to the team's performance and brand value, while private equity funds provide access to wide-ranging industries and structured exit strategies. Investors benefit from recognizing the risk profiles, liquidity, and valuation methods unique to each asset type. This knowledge helps optimize portfolio diversification and risk management strategies.

Comparison Table

| Aspect | Sports Team Ownership Shares | Private Equity Funds |

|---|---|---|

| Investment Type | Equity stake in professional sports teams | Equity in diversified private companies |

| Liquidity | Low liquidity; shares are rarely sold | Medium to low liquidity; fund life typically 7-10 years |

| Return Potential | Moderate to high; depends on team performance and brand value | High; driven by operational improvements and market growth |

| Risk Profile | High; influenced by market, performance, and regulatory factors | High; includes market, operational, and financial risks |

| Control & Influence | Significant control if majority shareholder; strategic decisions impact value | Limited control for limited partners; general partners manage funds |

| Investment Horizon | Long-term (often 10+ years) | Medium to long-term (7-10 years) |

| Regulation | Subject to league and sports governing body rules | Regulated as private investment vehicles; compliance with securities laws |

| Minimum Investment | Typically very high (millions to billions) | Varies; often hundreds of thousands to millions |

| Income Generation | Revenue from ticket sales, merchandising, sponsorships | Dividends, interest, and capital gains from portfolio companies |

Which is better?

Sports team ownership shares offer unique brand visibility and emotional connection with fans, often yielding long-term appreciation and exclusive networking opportunities in lucrative markets. Private equity funds provide diversified investment exposure, professional management, and potential for higher returns through strategic business growth and exits but carry significant risks and illiquidity. Investors seeking passion-driven assets with potential legacy benefits may prefer sports teams, while those prioritizing financial diversification and structured exit strategies generally favor private equity funds.

Connection

Sports team ownership shares often attract private equity funds seeking diversified investment portfolios with potentially high returns. Private equity firms acquire significant equity stakes in sports franchises, leveraging brand value, media rights, and merchandising revenues to enhance asset appreciation. This strategic alliance enables private equity funds to capitalize on sports teams' growing commercial opportunities while providing liquidity and governance expertise to team owners.

Key Terms

Liquidity

Private equity funds typically offer limited liquidity, with investors' capital locked up for several years until the fund exits its investments, often through sales or public offerings. In contrast, ownership shares in sports teams may have variable liquidity, especially if the shares are publicly traded or part of a larger ownership group that allows for private transactions. Explore deeper insights into liquidity nuances and investment strategies between these asset classes.

Valuation

Private equity funds typically value assets based on financial metrics such as EBITDA multiples, cash flow projections, and market comparables, emphasizing long-term return on investment and exit strategies. Sports team ownership shares are appraised considering brand equity, fan base size, media rights, and league revenue sharing, resulting in valuations often influenced by intangible factors and market sentiment. Explore detailed comparisons to understand the nuanced approaches to valuation in private equity versus sports team investments.

Governance

Private equity funds typically implement centralized governance structures with active management and strict performance oversight, ensuring alignment with investor interests through board control and detailed reporting. Sports team ownership shares often involve distributed governance, where decisions may require consensus among diverse owners or involve influence from league regulations, impacting strategic direction differently. Explore the nuances of governance mechanisms in both investment types to understand their effects on decision-making and value creation.

Source and External Links

Private Equity Fund - Wikipedia - A private equity fund is a collective investment scheme used for making investments in various equity securities, typically structured as limited partnerships with a fixed term.

Private Equity Funds - Corporate Finance Institute - Private equity funds are pools of capital invested in companies offering high return opportunities, often involving venture capital or buyout strategies.

Private Equity Funds | Investor.gov - Private equity funds are pooled investment vehicles managed by private equity firms, focusing on long-term investments with a typical investment horizon of 10 or more years.

dowidth.com

dowidth.com