Social token investment offers a unique opportunity to support creators and communities by acquiring tokens that grant exclusive access or governance rights, contrasting with DeFi yield farming which focuses on earning returns through liquidity provision in decentralized finance protocols. While social tokens emphasize community engagement and long-term value creation, DeFi yield farming prioritizes maximizing short-term rewards via staking or lending assets on platforms like Uniswap or Aave. Explore the nuances between these investment strategies to determine which aligns best with your financial goals and risk appetite.

Why it is important

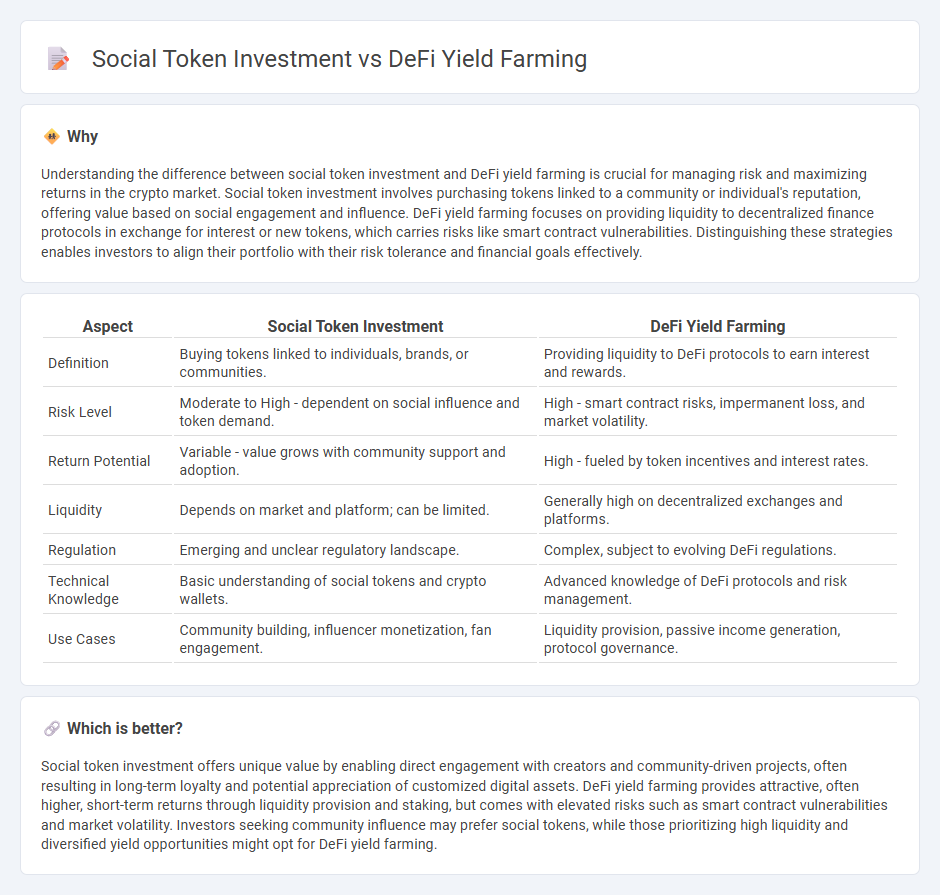

Understanding the difference between social token investment and DeFi yield farming is crucial for managing risk and maximizing returns in the crypto market. Social token investment involves purchasing tokens linked to a community or individual's reputation, offering value based on social engagement and influence. DeFi yield farming focuses on providing liquidity to decentralized finance protocols in exchange for interest or new tokens, which carries risks like smart contract vulnerabilities. Distinguishing these strategies enables investors to align their portfolio with their risk tolerance and financial goals effectively.

Comparison Table

| Aspect | Social Token Investment | DeFi Yield Farming |

|---|---|---|

| Definition | Buying tokens linked to individuals, brands, or communities. | Providing liquidity to DeFi protocols to earn interest and rewards. |

| Risk Level | Moderate to High - dependent on social influence and token demand. | High - smart contract risks, impermanent loss, and market volatility. |

| Return Potential | Variable - value grows with community support and adoption. | High - fueled by token incentives and interest rates. |

| Liquidity | Depends on market and platform; can be limited. | Generally high on decentralized exchanges and platforms. |

| Regulation | Emerging and unclear regulatory landscape. | Complex, subject to evolving DeFi regulations. |

| Technical Knowledge | Basic understanding of social tokens and crypto wallets. | Advanced knowledge of DeFi protocols and risk management. |

| Use Cases | Community building, influencer monetization, fan engagement. | Liquidity provision, passive income generation, protocol governance. |

Which is better?

Social token investment offers unique value by enabling direct engagement with creators and community-driven projects, often resulting in long-term loyalty and potential appreciation of customized digital assets. DeFi yield farming provides attractive, often higher, short-term returns through liquidity provision and staking, but comes with elevated risks such as smart contract vulnerabilities and market volatility. Investors seeking community influence may prefer social tokens, while those prioritizing high liquidity and diversified yield opportunities might opt for DeFi yield farming.

Connection

Social token investment leverages blockchain-based digital assets representing community influence and personal brands, creating new opportunities for decentralized finance (DeFi) yield farming by allowing holders to stake these tokens for rewards. DeFi yield farming protocols integrate social tokens as collateral or liquidity assets, facilitating passive income generation and enhancing token liquidity within decentralized exchanges. This synergy boosts investor engagement and token valuation through innovative financial mechanisms that combine social value and decentralized liquidity mining.

Key Terms

Liquidity Pool

Liquidity pools in DeFi yield farming enable users to earn returns by providing crypto assets, benefiting from trading fees and incentives, whereas social token investments rely on community engagement and token utility for value growth. Yield farming involves staking assets in decentralized exchanges like Uniswap or SushiSwap, maximizing capital efficiency through automated market makers (AMMs). Explore deeper insights on optimizing liquidity pool strategies and social token dynamics for enhanced investment outcomes.

Governance Token

Governance tokens in DeFi yield farming provide holders with voting rights and decision-making power over protocol upgrades, often rewarded through staking and liquidity provision. Social token investments enable community members to participate in decentralized projects by holding tokens that represent influence and access, fostering user engagement and value creation. Explore how governance tokens drive both financial returns and active participation in the evolving crypto ecosystem.

Community Engagement

DeFi yield farming offers investors high returns by providing liquidity to decentralized protocols, incentivizing participation through automated smart contracts and token rewards. Social token investment revolves around community engagement, with tokens representing membership or influence within a social ecosystem, fostering deeper user loyalty and collaboration. Explore how these distinct model benefits maximize community involvement and financial growth.

Source and External Links

DeFi yield farming explained - Yield farming is a DeFi strategy where cryptocurrency holders lend or stake assets to earn rewards, often using calculators to estimate returns based on capital, fees, and token rewards.

What is yield farming and how does it work? - Yield farming involves allocating digital assets to a DeFi protocol to receive rewards, typically in the form of governance tokens, with risks including impermanent loss and smart contract vulnerabilities.

What is Yield Farming in DeFi? - Yield farming allows users to deposit cryptocurrencies into smart contracts on DeFi platforms, earning rewards by providing liquidity and staking liquidity provider tokens for additional returns.

dowidth.com

dowidth.com