Sports memorabilia investment offers tangible assets such as signed jerseys, rare cards, and vintage equipment that often appreciate based on athlete popularity and event significance. Comic book investment centers on rare issues, first editions, and limited runs, with values driven by character demand, condition, and cultural impact. Explore deeper insights into the risks and rewards of sports memorabilia versus comic book investments to make informed decisions.

Why it is important

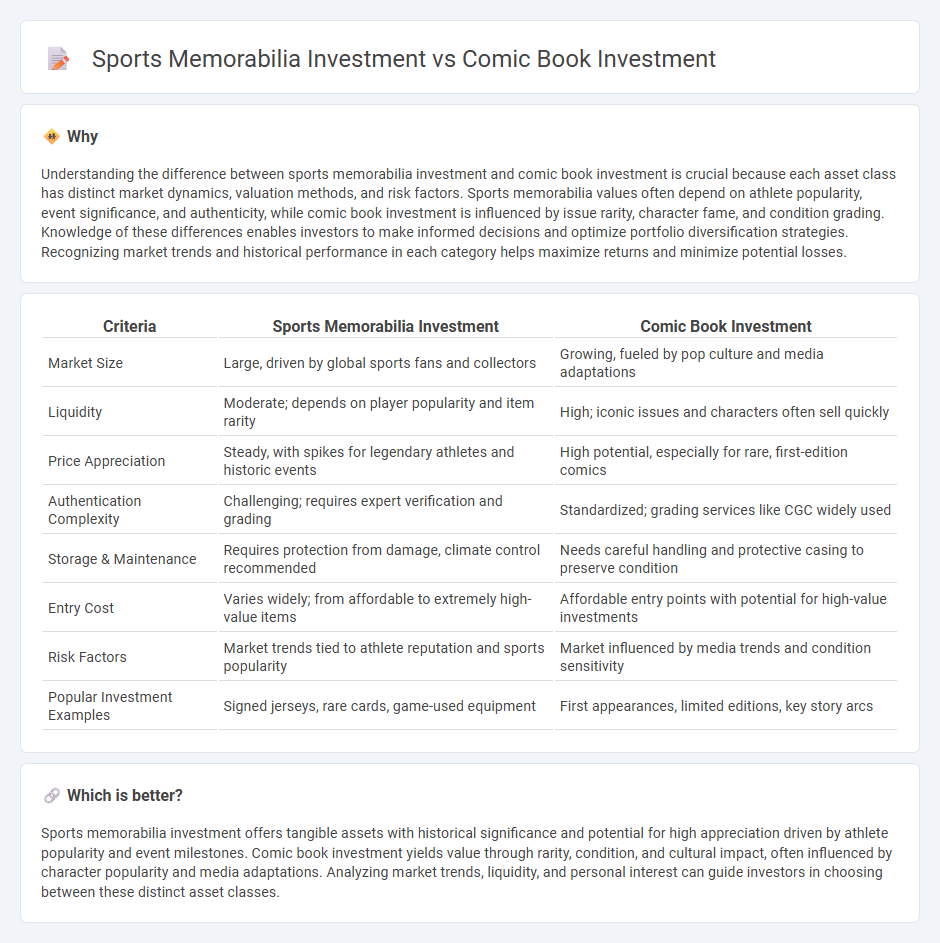

Understanding the difference between sports memorabilia investment and comic book investment is crucial because each asset class has distinct market dynamics, valuation methods, and risk factors. Sports memorabilia values often depend on athlete popularity, event significance, and authenticity, while comic book investment is influenced by issue rarity, character fame, and condition grading. Knowledge of these differences enables investors to make informed decisions and optimize portfolio diversification strategies. Recognizing market trends and historical performance in each category helps maximize returns and minimize potential losses.

Comparison Table

| Criteria | Sports Memorabilia Investment | Comic Book Investment |

|---|---|---|

| Market Size | Large, driven by global sports fans and collectors | Growing, fueled by pop culture and media adaptations |

| Liquidity | Moderate; depends on player popularity and item rarity | High; iconic issues and characters often sell quickly |

| Price Appreciation | Steady, with spikes for legendary athletes and historic events | High potential, especially for rare, first-edition comics |

| Authentication Complexity | Challenging; requires expert verification and grading | Standardized; grading services like CGC widely used |

| Storage & Maintenance | Requires protection from damage, climate control recommended | Needs careful handling and protective casing to preserve condition |

| Entry Cost | Varies widely; from affordable to extremely high-value items | Affordable entry points with potential for high-value investments |

| Risk Factors | Market trends tied to athlete reputation and sports popularity | Market influenced by media trends and condition sensitivity |

| Popular Investment Examples | Signed jerseys, rare cards, game-used equipment | First appearances, limited editions, key story arcs |

Which is better?

Sports memorabilia investment offers tangible assets with historical significance and potential for high appreciation driven by athlete popularity and event milestones. Comic book investment yields value through rarity, condition, and cultural impact, often influenced by character popularity and media adaptations. Analyzing market trends, liquidity, and personal interest can guide investors in choosing between these distinct asset classes.

Connection

Sports memorabilia investment and comic book investment share common traits as alternative asset classes driven by collector demand and cultural significance. Both markets rely heavily on rarity, condition, and provenance to determine value, attracting enthusiasts who view these items as tangible assets with potential for appreciation. Historical trends indicate that iconic sports collectibles and rare comic books often experience parallel growth patterns influenced by nostalgia and pop culture trends.

Key Terms

Comic Book Investment:

Comic book investment has seen a significant surge in value, with rare issues like Action Comics #1 fetching millions in auction markets, driven by increasing interest from collectors and pop culture enthusiasts. Unlike sports memorabilia, comic books offer a diverse range of grades and editions, providing investors with multiple entry points and potential for high returns through limited print runs and iconic characters. Discover the best strategies to maximize returns in the growing comic book investment market.

Grading (e.g., CGC certification)

Comic book investment benefits significantly from CGC certification, which provides standardized grading crucial for determining value and authenticity, thereby enhancing market trust and resale potential. Sports memorabilia investment relies heavily on grading services like PSA and Beckett, where accurate authentication and condition grading drive collector confidence and price stability. Explore how grading impacts the long-term value and liquidity of both asset types to make informed investment choices.

First Appearance

Investing in comic books often centers on first appearances of iconic characters like Spider-Man or Batman, which dramatically increase value due to rarity and cultural significance. In sports memorabilia, first appearances or rookie cards of legendary athletes such as Michael Jordan or Babe Ruth hold similar prestige and drive market demand. Explore more to understand the nuanced market dynamics behind these high-value collectibles.

Source and External Links

Everything You Need To Know About Investing In Comic Books - A detailed video explaining how to start investing in comics, highlighting which comics hold investment value and how comic book returns compare favorably to traditional assets like stocks and real estate over time.

I buy comics as an investment... - CGC Chat Boards - A perspective on the risks of comic book investment due to demographic shifts, emphasizing that while comics can yield returns if carefully selected and timed, they carry considerable long-term risk compared to other investments.

About $600-700 to invest in 1 comic - Discussion about selecting individual comic books to invest a mid-level amount, recommending key modern issues like Ultimate Fallout 4 or Edge of the Spiderverse 2 as safer bets within that budget range.

dowidth.com

dowidth.com