Sneaker flipping involves buying limited-edition sneakers at retail and reselling them at a significant markup, capitalizing on hype and scarcity within the fashion market. Private equity focuses on acquiring equity stakes in private companies to drive growth and achieve substantial returns through operational improvements and strategic influence. Explore the advantages and risks of both investment strategies to determine which suits your financial goals.

Why it is important

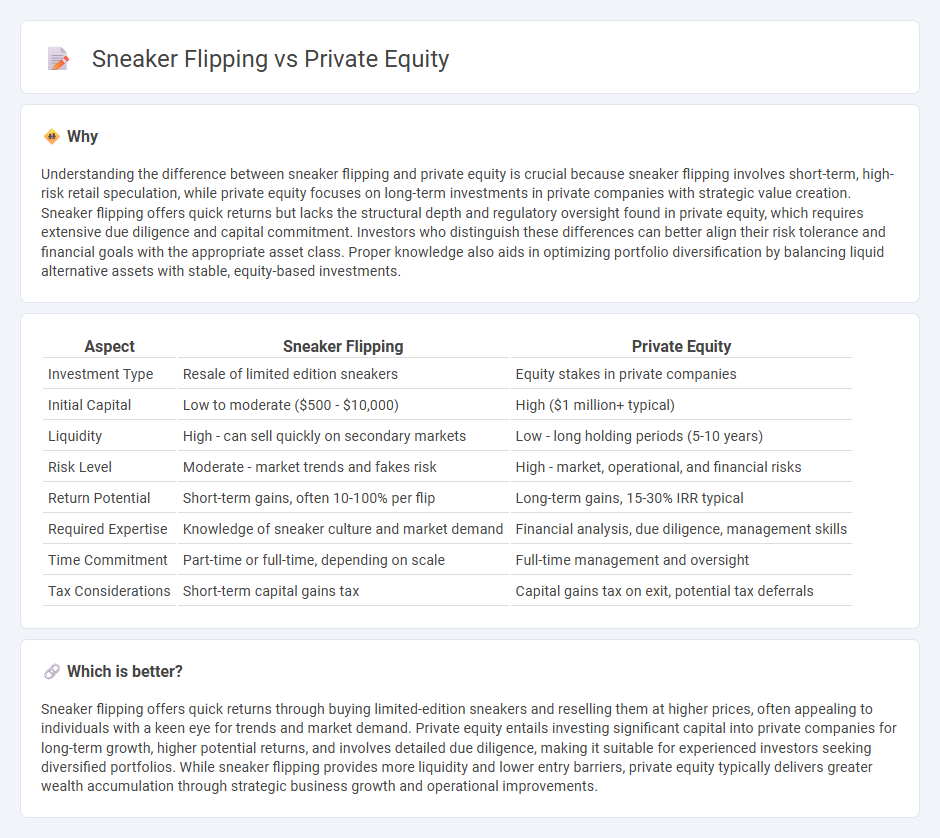

Understanding the difference between sneaker flipping and private equity is crucial because sneaker flipping involves short-term, high-risk retail speculation, while private equity focuses on long-term investments in private companies with strategic value creation. Sneaker flipping offers quick returns but lacks the structural depth and regulatory oversight found in private equity, which requires extensive due diligence and capital commitment. Investors who distinguish these differences can better align their risk tolerance and financial goals with the appropriate asset class. Proper knowledge also aids in optimizing portfolio diversification by balancing liquid alternative assets with stable, equity-based investments.

Comparison Table

| Aspect | Sneaker Flipping | Private Equity |

|---|---|---|

| Investment Type | Resale of limited edition sneakers | Equity stakes in private companies |

| Initial Capital | Low to moderate ($500 - $10,000) | High ($1 million+ typical) |

| Liquidity | High - can sell quickly on secondary markets | Low - long holding periods (5-10 years) |

| Risk Level | Moderate - market trends and fakes risk | High - market, operational, and financial risks |

| Return Potential | Short-term gains, often 10-100% per flip | Long-term gains, 15-30% IRR typical |

| Required Expertise | Knowledge of sneaker culture and market demand | Financial analysis, due diligence, management skills |

| Time Commitment | Part-time or full-time, depending on scale | Full-time management and oversight |

| Tax Considerations | Short-term capital gains tax | Capital gains tax on exit, potential tax deferrals |

Which is better?

Sneaker flipping offers quick returns through buying limited-edition sneakers and reselling them at higher prices, often appealing to individuals with a keen eye for trends and market demand. Private equity entails investing significant capital into private companies for long-term growth, higher potential returns, and involves detailed due diligence, making it suitable for experienced investors seeking diversified portfolios. While sneaker flipping provides more liquidity and lower entry barriers, private equity typically delivers greater wealth accumulation through strategic business growth and operational improvements.

Connection

Sneaker flipping and private equity share a core principle of acquiring undervalued assets to generate substantial returns through strategic resale or growth. Both markets rely on keen market analysis, timing, and understanding consumer demand or business potential to maximize profit margins. Investors leverage trends and market inefficiencies to capitalize on the differential between purchase price and eventual sale value.

Key Terms

Private Equity:

Private equity involves investing substantial capital into private companies to enhance their value over time, often resulting in significant financial returns through buyouts, restructuring, or strategic growth initiatives. This long-term investment strategy contrasts with sneaker flipping, which relies on short-term resale profits driven by market trends and limited editions. Explore the key benefits and risks of private equity to understand its impact on wealth building and corporate transformation.

Buyout

Private equity buyouts involve acquiring controlling interests in established companies, aiming for long-term value creation through strategic improvements and operational efficiency. Sneaker flipping centers on purchasing limited-edition sneakers at retail prices and reselling them quickly at a premium for short-term profits. Discover the key differences and investment strategies driving each approach.

Valuation

Private equity valuation involves rigorous financial analysis, considering discounted cash flows, EBITDA multiples, and market comparables to determine a company's intrinsic value. Sneaker flipping valuation relies on market demand, rarity, brand collaborations, and resale price trends, often driven by limited releases and cultural hype. Explore detailed valuation techniques in private equity and sneaker flipping to understand their distinct investment dynamics.

Source and External Links

Private equity - Wikipedia - Private equity (PE) involves investing in private companies, often using a mix of equity and debt financing, with the goal of generating returns over a period of 4-7 years by focusing on revenue growth, margin expansion, cash flow, and valuation improvement.

What is Private Equity? - BVCA - Private equity provides medium- to long-term capital in exchange for equity stakes in unquoted, potentially high-growth companies, working closely with management to drive growth, efficiency, and value before exiting the investment typically after four to seven years.

Private Equity Funds - Investor.gov - Private equity funds pool investor capital to acquire controlling or significant minority stakes in companies, actively managing these investments to increase value over a long-term horizon, often exceeding 10 years, and are not subject to the same public disclosure requirements as registered investment funds.

dowidth.com

dowidth.com