Whisky cask investment offers tangible asset appreciation driven by aging quality and limited supply, while diamond investment relies on rarity, market demand, and grading certifications to maintain value. Both investment types provide portfolio diversification and hedging against inflation, but whisky casks typically exhibit higher liquidity and shorter holding periods compared to diamonds. Discover the detailed advantages and market trends of whisky cask versus diamond investment to make informed decisions.

Why it is important

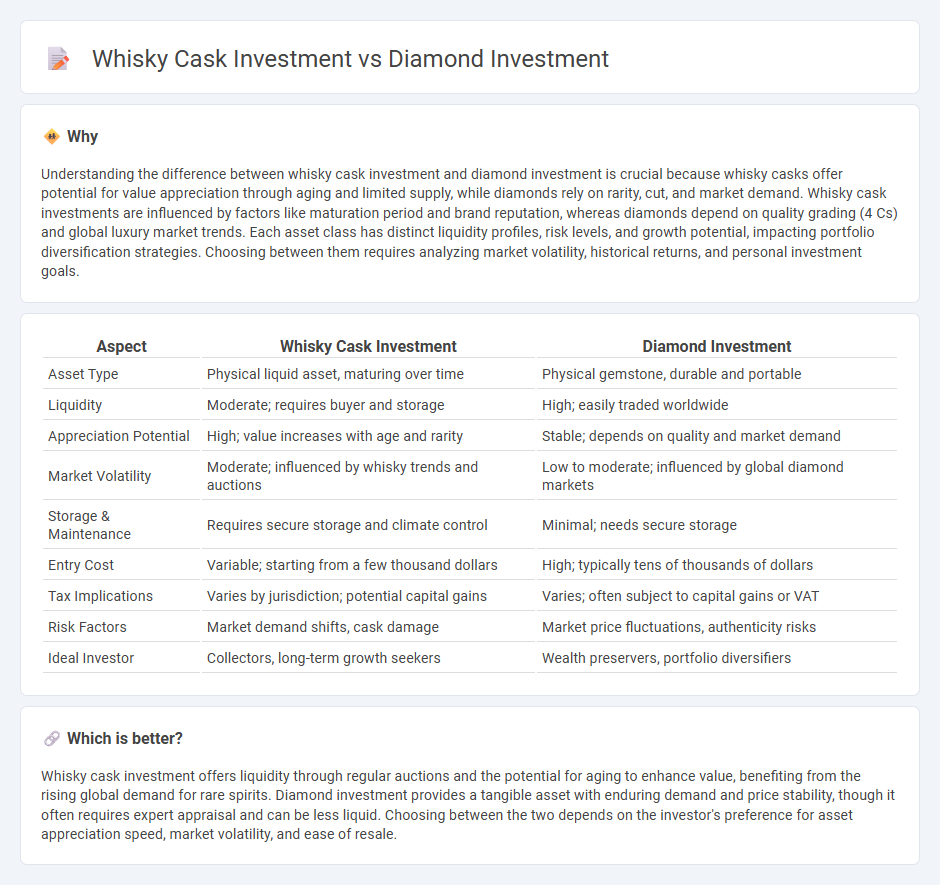

Understanding the difference between whisky cask investment and diamond investment is crucial because whisky casks offer potential for value appreciation through aging and limited supply, while diamonds rely on rarity, cut, and market demand. Whisky cask investments are influenced by factors like maturation period and brand reputation, whereas diamonds depend on quality grading (4 Cs) and global luxury market trends. Each asset class has distinct liquidity profiles, risk levels, and growth potential, impacting portfolio diversification strategies. Choosing between them requires analyzing market volatility, historical returns, and personal investment goals.

Comparison Table

| Aspect | Whisky Cask Investment | Diamond Investment |

|---|---|---|

| Asset Type | Physical liquid asset, maturing over time | Physical gemstone, durable and portable |

| Liquidity | Moderate; requires buyer and storage | High; easily traded worldwide |

| Appreciation Potential | High; value increases with age and rarity | Stable; depends on quality and market demand |

| Market Volatility | Moderate; influenced by whisky trends and auctions | Low to moderate; influenced by global diamond markets |

| Storage & Maintenance | Requires secure storage and climate control | Minimal; needs secure storage |

| Entry Cost | Variable; starting from a few thousand dollars | High; typically tens of thousands of dollars |

| Tax Implications | Varies by jurisdiction; potential capital gains | Varies; often subject to capital gains or VAT |

| Risk Factors | Market demand shifts, cask damage | Market price fluctuations, authenticity risks |

| Ideal Investor | Collectors, long-term growth seekers | Wealth preservers, portfolio diversifiers |

Which is better?

Whisky cask investment offers liquidity through regular auctions and the potential for aging to enhance value, benefiting from the rising global demand for rare spirits. Diamond investment provides a tangible asset with enduring demand and price stability, though it often requires expert appraisal and can be less liquid. Choosing between the two depends on the investor's preference for asset appreciation speed, market volatility, and ease of resale.

Connection

Whisky cask investment and diamond investment both serve as alternative asset classes offering portfolio diversification and inflation hedging. Each asset involves physical rarity and market-driven valuation, with whisky casks appreciating through aging and limited production, while diamonds gain value through carat size, clarity, and demand. Investors benefit from tangible assets that are less correlated with traditional financial markets, providing stability and potential for long-term capital growth.

Key Terms

Liquidity

Diamond investment typically offers moderate liquidity due to the need for specialized buyers and certification, while whisky cask investment may provide higher liquidity through established auction houses and private sales networks. Diamonds require inspection and grading that can delay quick sales, whereas whisky casks, being consumable assets, attract a broader market of enthusiasts and investors driving faster turnover. Explore detailed liquidity comparisons and market trends to optimize your investment strategy.

Provenance

Diamond investment offers unparalleled security through verifiable provenance supported by blockchain technology and certification from authoritative bodies like the GIA, ensuring traceability and authenticity. Whisky cask investment relies on detailed cask histories maintained by distilleries and key market platforms that document maturation and ownership, crucial for valuation. Explore more about how provenance impacts investment stability and value in these unique asset classes.

Market Volatility

Diamond investment typically experiences lower market volatility due to its status as a tangible luxury good with consistent demand among collectors and investors. Whisky cask investment, on the other hand, often faces higher volatility influenced by changing consumer preferences, vintage reputation, and limited market liquidity. Explore the dynamics of these asset classes to better understand their risk profiles and potential returns.

Source and External Links

Are Diamonds a Good Investment? | Industry Expert Insight - Diamonds can be a good investment as they tend to track inflation, with options including loose, investment-grade, certified diamonds, and diamond jewelry, though resale value requires expertise and they are less liquid than some other assets.

BNT Diamonds: The Diamond Investment Office - BNT Diamonds offers various investment options including a large selection of certified diamonds, personalized investment packages, and rare "Special Diamonds," all conflict-free and certified.

Diamond Standard | Invest in Natural Diamond Commodities - Diamond Standard enables easy investment in natural diamond commodities with patented technology and offers four investment products backed by physical natural diamonds, making diamonds an investable asset class globally.

dowidth.com

dowidth.com