Forestry investment offers long-term asset growth through timber production and carbon credit opportunities, benefiting from sustainable forest management and ecosystem services. Renewable energy investment focuses on expanding clean energy infrastructure like solar, wind, and hydroelectric power, driving innovation and reducing carbon emissions globally. Explore detailed comparisons of risk, return, and environmental impact to make informed investment decisions.

Why it is important

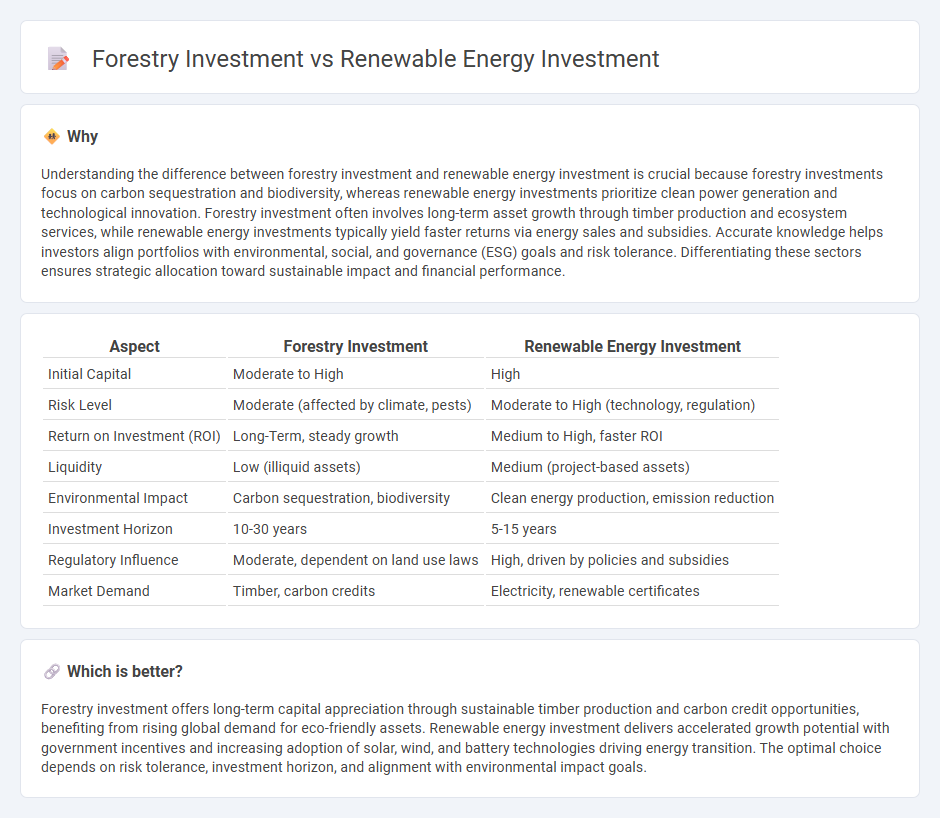

Understanding the difference between forestry investment and renewable energy investment is crucial because forestry investments focus on carbon sequestration and biodiversity, whereas renewable energy investments prioritize clean power generation and technological innovation. Forestry investment often involves long-term asset growth through timber production and ecosystem services, while renewable energy investments typically yield faster returns via energy sales and subsidies. Accurate knowledge helps investors align portfolios with environmental, social, and governance (ESG) goals and risk tolerance. Differentiating these sectors ensures strategic allocation toward sustainable impact and financial performance.

Comparison Table

| Aspect | Forestry Investment | Renewable Energy Investment |

|---|---|---|

| Initial Capital | Moderate to High | High |

| Risk Level | Moderate (affected by climate, pests) | Moderate to High (technology, regulation) |

| Return on Investment (ROI) | Long-Term, steady growth | Medium to High, faster ROI |

| Liquidity | Low (illiquid assets) | Medium (project-based assets) |

| Environmental Impact | Carbon sequestration, biodiversity | Clean energy production, emission reduction |

| Investment Horizon | 10-30 years | 5-15 years |

| Regulatory Influence | Moderate, dependent on land use laws | High, driven by policies and subsidies |

| Market Demand | Timber, carbon credits | Electricity, renewable certificates |

Which is better?

Forestry investment offers long-term capital appreciation through sustainable timber production and carbon credit opportunities, benefiting from rising global demand for eco-friendly assets. Renewable energy investment delivers accelerated growth potential with government incentives and increasing adoption of solar, wind, and battery technologies driving energy transition. The optimal choice depends on risk tolerance, investment horizon, and alignment with environmental impact goals.

Connection

Forestry investment and renewable energy investment are interconnected through their shared focus on sustainable resource management and carbon sequestration. Timber harvested from sustainably managed forests can be used as biomass fuel, a renewable energy source that reduces reliance on fossil fuels. Investments in both sectors support climate change mitigation by promoting carbon capture and reducing greenhouse gas emissions.

Key Terms

Return on Investment (ROI)

Renewable energy investment typically offers higher ROI potential due to government incentives, technology advancements, and growing demand for clean energy, with average returns ranging from 8% to 12% annually. Forestry investment provides stable, long-term ROI through timber value appreciation and carbon credit opportunities, usually yielding 4% to 7% yearly, benefiting from increasing global emphasis on sustainability. Explore deeper insights into these investment opportunities to optimize your portfolio's performance.

Carbon Credits

Renewable energy investment increasingly drives carbon credit generation by reducing greenhouse gas emissions through technologies like solar and wind power, offering scalable and sustainable climate solutions. Forestry investment contributes to carbon credits by enhancing carbon sequestration via afforestation, reforestation, and improved forest management, promoting biodiversity and ecosystem resilience. Explore detailed comparisons on carbon credit mechanisms and benefits in renewable energy versus forestry sectors to optimize your sustainable investment strategies.

Asset Diversification

Investing in renewable energy offers exposure to rapidly growing sectors like solar and wind power, driven by global decarbonization efforts and government incentives, while forestry investment provides a stable, long-term asset benefiting from carbon credit markets and timber demand. Renewable energy assets tend to exhibit higher volatility but greater growth potential, contrasting with forestry's steady cash flow and portfolio diversification against traditional financial risks. Explore how combining these investments can enhance asset diversification and stability in your portfolio.

Source and External Links

Renewable Energy Opportunities For Investors | Russell Investments - Global renewable energy investment has surpassed $200 billion annually for nine consecutive years, driven by lower costs and government support, with solar energy leading new capacity additions over the past decade.

Overview and key findings - World Energy Investment 2024 - IEA - In 2024, global energy investment is expected to exceed $3 trillion, with $2 trillion allocated to clean energy technologies, including renewables, making clean energy spending surpass fossil fuels for the first time.

Investing in Renewable Energy - GreenPortfolio - Studies show renewable energy investments outperform fossil fuels with significantly higher returns and lower volatility over 5- and 10-year periods, offering financial performance benefits while supporting sustainable energy transition.

dowidth.com

dowidth.com