Wine cask aging offers a unique alternative investment by combining tangible assets with potential appreciation driven by vintage quality and scarcity, whereas real estate investments provide steady income streams and long-term capital growth through property value and rental yields. Diversifying portfolios with both wine casks and real estate can enhance risk management and portfolio resilience against market fluctuations. Discover how these contrasting asset classes can complement your investment strategy for balanced growth.

Why it is important

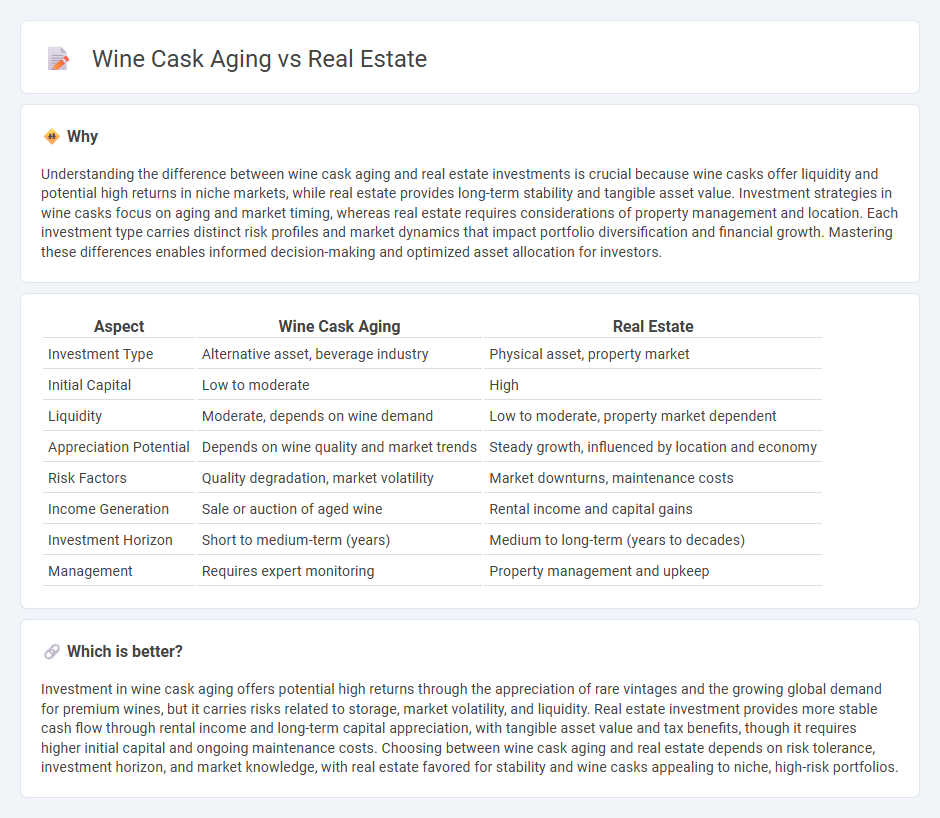

Understanding the difference between wine cask aging and real estate investments is crucial because wine casks offer liquidity and potential high returns in niche markets, while real estate provides long-term stability and tangible asset value. Investment strategies in wine casks focus on aging and market timing, whereas real estate requires considerations of property management and location. Each investment type carries distinct risk profiles and market dynamics that impact portfolio diversification and financial growth. Mastering these differences enables informed decision-making and optimized asset allocation for investors.

Comparison Table

| Aspect | Wine Cask Aging | Real Estate |

|---|---|---|

| Investment Type | Alternative asset, beverage industry | Physical asset, property market |

| Initial Capital | Low to moderate | High |

| Liquidity | Moderate, depends on wine demand | Low to moderate, property market dependent |

| Appreciation Potential | Depends on wine quality and market trends | Steady growth, influenced by location and economy |

| Risk Factors | Quality degradation, market volatility | Market downturns, maintenance costs |

| Income Generation | Sale or auction of aged wine | Rental income and capital gains |

| Investment Horizon | Short to medium-term (years) | Medium to long-term (years to decades) |

| Management | Requires expert monitoring | Property management and upkeep |

Which is better?

Investment in wine cask aging offers potential high returns through the appreciation of rare vintages and the growing global demand for premium wines, but it carries risks related to storage, market volatility, and liquidity. Real estate investment provides more stable cash flow through rental income and long-term capital appreciation, with tangible asset value and tax benefits, though it requires higher initial capital and ongoing maintenance costs. Choosing between wine cask aging and real estate depends on risk tolerance, investment horizon, and market knowledge, with real estate favored for stability and wine casks appealing to niche, high-risk portfolios.

Connection

Investment strategies involving wine cask aging and real estate both capitalize on asset appreciation through time and scarcity. Wine cask aging enhances the value of wine by improving its quality and rarity, while real estate investment benefits from property development and market demand increases. Both assets require patience and market knowledge to maximize returns and mitigate risks effectively.

Key Terms

Real Estate:

Investing in real estate offers tangible asset appreciation, steady rental income, and tax benefits, making it a stable long-term wealth builder compared to the niche and volatile market of wine cask aging. Real estate markets in urban centers and growing regions consistently outperform alternative investments due to demand for housing and commercial space. Explore how property investment strategies can diversify your portfolio and generate reliable returns.

Capital Appreciation

Capital appreciation in real estate typically offers steady, long-term growth driven by location, market demand, and property improvements. In contrast, wine cask aging can yield significant appreciation due to rarity, vintage quality, and market trends, though it carries higher volatility and liquidity risks. Explore detailed comparisons to understand which asset aligns best with your investment goals.

Rental Yield

Rental yield in real estate offers a consistent and measurable return through rental income relative to property value, typically ranging from 3% to 8% annually depending on location and market conditions. In contrast, wine cask aging does not produce rental income but can increase the cask's value over time based on the quality and rarity of the wine, which is subject to market demand and aging duration. Explore detailed comparisons and investment insights to determine which option aligns better with your financial goals.

Source and External Links

Real Estate Explained: Definition And Types - Provides a comprehensive overview of real estate, including its definition, types, and its impact on the economy.

Real Estate - Wikipedia - Offers detailed information on real estate, including its classification, environmental impact, and various types such as residential and commercial.

Trulia: Real Estate Listings, Homes For Sale, Housing Data - A platform for browsing homes for sale, rentals, and neighborhood insights to help users find their ideal property.

dowidth.com

dowidth.com