Wine investing platforms offer exposure to rare and collectible vintages with potential for high appreciation based on rarity, provenance, and market trends, appealing to niche investors seeking tangible assets. REIT platforms provide diversified investments in real estate portfolios, delivering regular income through dividends and the opportunity for capital growth tied to property market dynamics. Explore how these distinct investment vehicles align with your financial goals and risk tolerance.

Why it is important

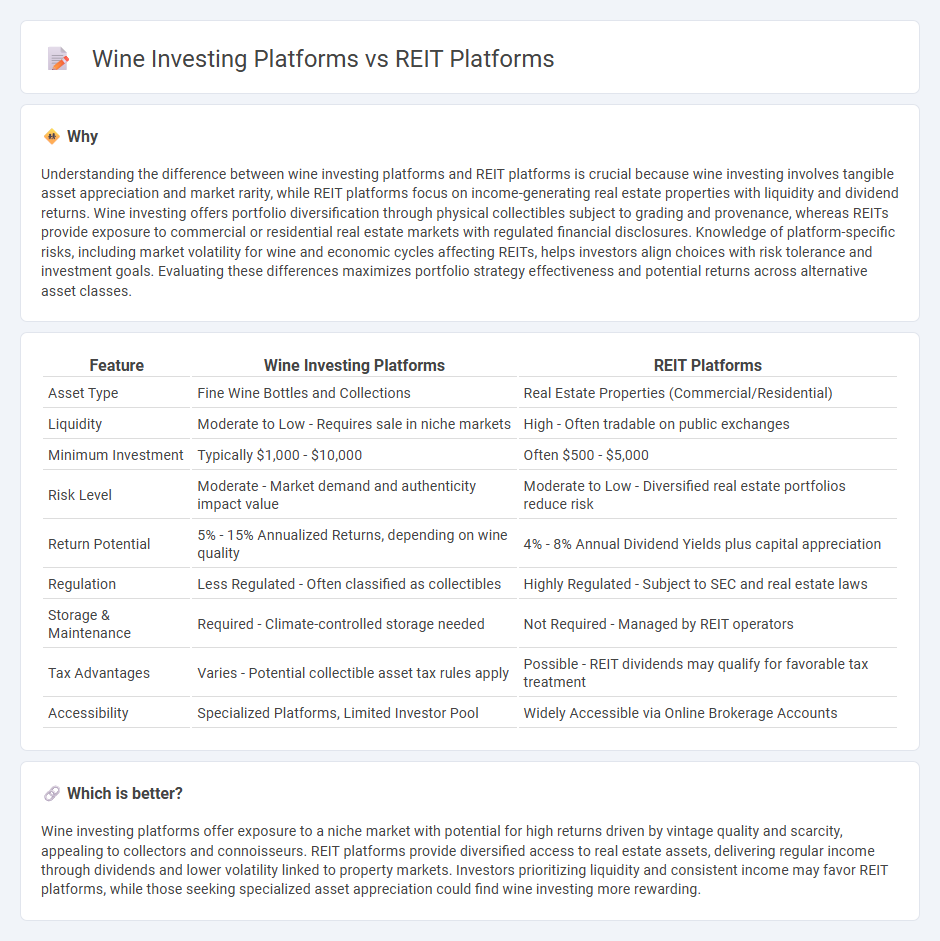

Understanding the difference between wine investing platforms and REIT platforms is crucial because wine investing involves tangible asset appreciation and market rarity, while REIT platforms focus on income-generating real estate properties with liquidity and dividend returns. Wine investing offers portfolio diversification through physical collectibles subject to grading and provenance, whereas REITs provide exposure to commercial or residential real estate markets with regulated financial disclosures. Knowledge of platform-specific risks, including market volatility for wine and economic cycles affecting REITs, helps investors align choices with risk tolerance and investment goals. Evaluating these differences maximizes portfolio strategy effectiveness and potential returns across alternative asset classes.

Comparison Table

| Feature | Wine Investing Platforms | REIT Platforms |

|---|---|---|

| Asset Type | Fine Wine Bottles and Collections | Real Estate Properties (Commercial/Residential) |

| Liquidity | Moderate to Low - Requires sale in niche markets | High - Often tradable on public exchanges |

| Minimum Investment | Typically $1,000 - $10,000 | Often $500 - $5,000 |

| Risk Level | Moderate - Market demand and authenticity impact value | Moderate to Low - Diversified real estate portfolios reduce risk |

| Return Potential | 5% - 15% Annualized Returns, depending on wine quality | 4% - 8% Annual Dividend Yields plus capital appreciation |

| Regulation | Less Regulated - Often classified as collectibles | Highly Regulated - Subject to SEC and real estate laws |

| Storage & Maintenance | Required - Climate-controlled storage needed | Not Required - Managed by REIT operators |

| Tax Advantages | Varies - Potential collectible asset tax rules apply | Possible - REIT dividends may qualify for favorable tax treatment |

| Accessibility | Specialized Platforms, Limited Investor Pool | Widely Accessible via Online Brokerage Accounts |

Which is better?

Wine investing platforms offer exposure to a niche market with potential for high returns driven by vintage quality and scarcity, appealing to collectors and connoisseurs. REIT platforms provide diversified access to real estate assets, delivering regular income through dividends and lower volatility linked to property markets. Investors prioritizing liquidity and consistent income may favor REIT platforms, while those seeking specialized asset appreciation could find wine investing more rewarding.

Connection

Wine investing platforms and REIT platforms are connected through their shared appeal as alternative investment options that diversify traditional portfolios beyond stocks and bonds. Both platforms offer fractional ownership, enabling investors to access tangible assets like fine wine collections or real estate properties with lower capital requirements. This democratization of asset ownership leverages digital technology to provide liquidity and transparency, attracting investors seeking portfolio diversification and inflation hedging.

Key Terms

Liquidity

REIT platforms offer higher liquidity through secondary markets and frequent trading opportunities, enabling investors to buy and sell shares with relative ease. Wine investing platforms, by contrast, generally have lower liquidity due to limited market size and longer holding periods required for value appreciation. Explore detailed comparisons to understand which investment suits your liquidity preferences best.

Asset Diversification

REIT platforms offer investors access to diversified real estate portfolios across commercial, residential, and industrial properties, reducing risk through asset variety. Wine investing platforms provide diversification by allowing investment in various vintages, regions, and grape varietals, capitalizing on market trends and rarity. Explore our detailed comparison to understand which asset diversification strategy aligns with your investment goals.

Yield Potential

REIT platforms typically offer stable dividend yields averaging 4-7%, benefiting from consistent rental income and property appreciation, while wine investing platforms show variable returns influenced by vintage quality, rarity, and market demand, with some rare bottles appreciating over 10% annually. Both investment types provide portfolio diversification but differ in liquidity and risk profiles, with wine investments often reserved for longer-term holdings due to market volatility. Explore detailed comparisons and data-driven insights to determine the optimal yield potential for your investment goals.

Source and External Links

9 Best Real Estate Crowdfunding Sites - A detailed comparison of top real estate crowdfunding platforms like Arrived, CrowdStreet, Fundrise, and others, highlighting features such as minimum investments, fees, and investor types served.

Best Real Estate Investing Apps of June 2025 - Reviews of notable real estate investing platforms including CrowdStreet (best for experienced accredited investors) and Fundrise (best for beginners), describing their specialties, fees, and investor requirements.

Fundrise - America's largest direct-access platform offering real estate and alternative investments with a technology-driven approach that provides low fees, flexible minimums, and quarterly liquidity through integrated asset and fund management software.

dowidth.com

dowidth.com