Investment communities offer personalized insights and expert analysis, fostering collaborative decision-making among seasoned investors. Crowdfunding platforms provide access to diverse projects with lower entry barriers, enabling individuals to fund startups and innovative ventures directly. Explore the unique advantages of each to determine the best fit for your investment strategy.

Why it is important

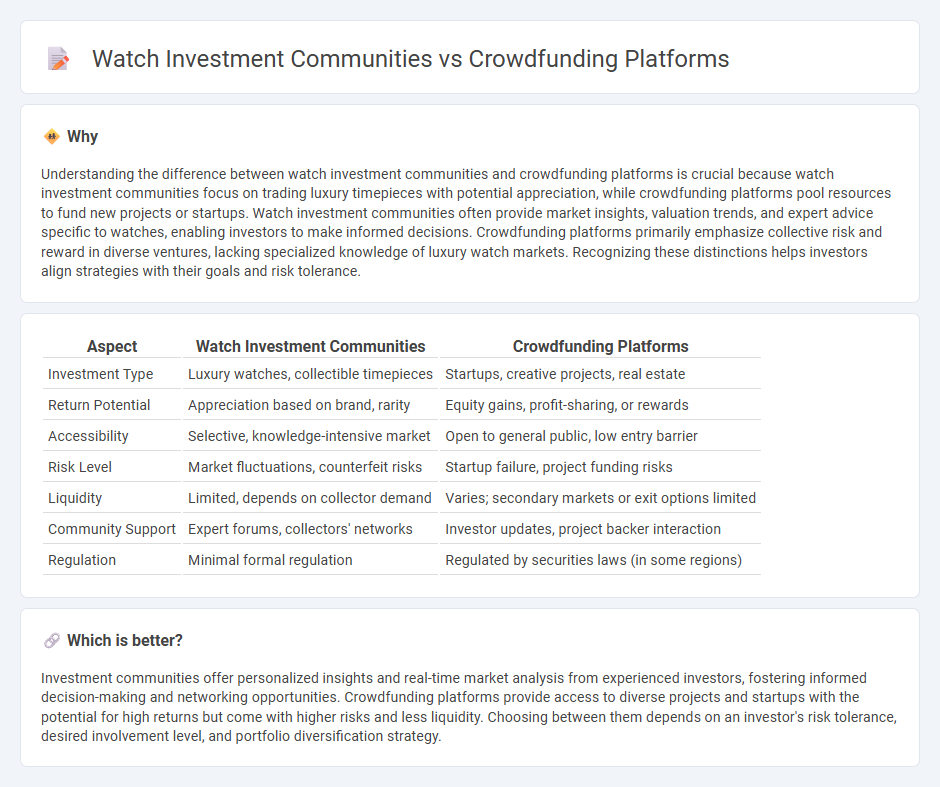

Understanding the difference between watch investment communities and crowdfunding platforms is crucial because watch investment communities focus on trading luxury timepieces with potential appreciation, while crowdfunding platforms pool resources to fund new projects or startups. Watch investment communities often provide market insights, valuation trends, and expert advice specific to watches, enabling investors to make informed decisions. Crowdfunding platforms primarily emphasize collective risk and reward in diverse ventures, lacking specialized knowledge of luxury watch markets. Recognizing these distinctions helps investors align strategies with their goals and risk tolerance.

Comparison Table

| Aspect | Watch Investment Communities | Crowdfunding Platforms |

|---|---|---|

| Investment Type | Luxury watches, collectible timepieces | Startups, creative projects, real estate |

| Return Potential | Appreciation based on brand, rarity | Equity gains, profit-sharing, or rewards |

| Accessibility | Selective, knowledge-intensive market | Open to general public, low entry barrier |

| Risk Level | Market fluctuations, counterfeit risks | Startup failure, project funding risks |

| Liquidity | Limited, depends on collector demand | Varies; secondary markets or exit options limited |

| Community Support | Expert forums, collectors' networks | Investor updates, project backer interaction |

| Regulation | Minimal formal regulation | Regulated by securities laws (in some regions) |

Which is better?

Investment communities offer personalized insights and real-time market analysis from experienced investors, fostering informed decision-making and networking opportunities. Crowdfunding platforms provide access to diverse projects and startups with the potential for high returns but come with higher risks and less liquidity. Choosing between them depends on an investor's risk tolerance, desired involvement level, and portfolio diversification strategy.

Connection

Investment communities foster collective knowledge sharing and collaboration, driving interest and trust in crowdfunding platforms. Crowdfunding platforms leverage these communities to attract diverse investors, democratizing access to funding for startups and projects. The synergy between investment communities and crowdfunding enhances transparency, boosts capital inflow, and accelerates market growth.

Key Terms

**Crowdfunding platforms:**

Crowdfunding platforms connect startups and creative projects with a broad audience willing to invest small amounts, enabling diverse funding options and democratizing access to capital. These platforms offer transparency in funding progress, project updates, and investor communication, fostering trust and engagement. Explore how crowdfunding platforms can fuel innovation and provide unique investment opportunities.

Equity funding

Equity funding through crowdfunding platforms enables startups and small businesses to raise capital by offering shares to a broad base of investors, creating opportunities for diverse portfolio growth. Watch investment communities concentrate on niche market equity, allowing investors to acquire stakes in luxury watch ventures with specialized valuation metrics and market insights. Explore the comparative advantages and strategic considerations of equity funding in both arenas to optimize investment outcomes.

Backers

Crowdfunding platforms empower backers by allowing direct financial contributions to diverse projects, offering rewards or early access in return. Watch investment communities attract backers interested in luxury timepieces as alternative assets, providing expert evaluations and market insights that foster informed investment decisions. Discover more about how backers can leverage each platform to maximize their returns and engagement.

Source and External Links

GoFundMe - A global leader in crowdfunding, allowing users to start fundraisers easily with no initial fee, and trusted by over 100 million people.

Fundly - Enables individuals and nonprofits to create digital fundraisers for various causes, with a payment processing fee of 2.9% plus 30 cents.

Mightycause - Offers tools and features for nonprofits, allowing unlimited fundraising campaigns without goal requirements, with monthly fees ranging from $79 to $119.

dowidth.com

dowidth.com