Song catalog purchases offer consistent royalty income and potential value appreciation driven by streaming growth and licensing deals, appealing to investors seeking long-term, passive earnings. Classic cars, on the other hand, present tangible assets with value influenced by rarity, condition, and collector demand, often requiring active management and higher entry costs. Explore the distinct benefits and challenges of these unique investment opportunities to determine which aligns best with your portfolio goals.

Why it is important

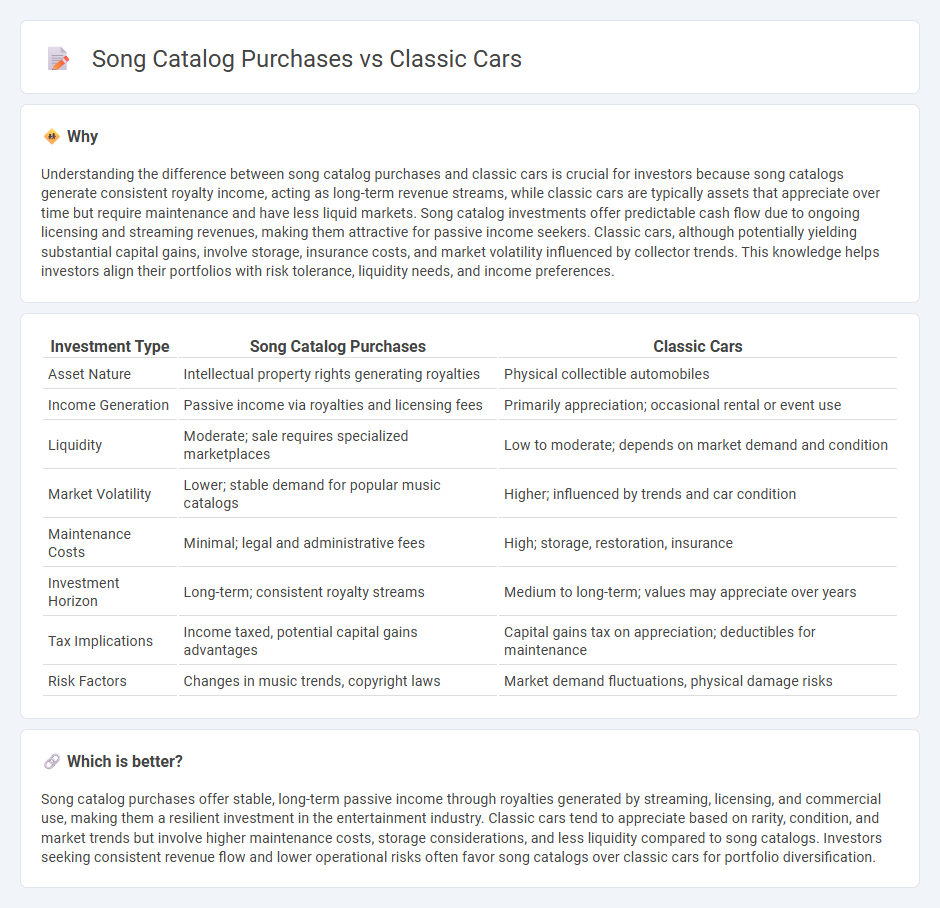

Understanding the difference between song catalog purchases and classic cars is crucial for investors because song catalogs generate consistent royalty income, acting as long-term revenue streams, while classic cars are typically assets that appreciate over time but require maintenance and have less liquid markets. Song catalog investments offer predictable cash flow due to ongoing licensing and streaming revenues, making them attractive for passive income seekers. Classic cars, although potentially yielding substantial capital gains, involve storage, insurance costs, and market volatility influenced by collector trends. This knowledge helps investors align their portfolios with risk tolerance, liquidity needs, and income preferences.

Comparison Table

| Investment Type | Song Catalog Purchases | Classic Cars |

|---|---|---|

| Asset Nature | Intellectual property rights generating royalties | Physical collectible automobiles |

| Income Generation | Passive income via royalties and licensing fees | Primarily appreciation; occasional rental or event use |

| Liquidity | Moderate; sale requires specialized marketplaces | Low to moderate; depends on market demand and condition |

| Market Volatility | Lower; stable demand for popular music catalogs | Higher; influenced by trends and car condition |

| Maintenance Costs | Minimal; legal and administrative fees | High; storage, restoration, insurance |

| Investment Horizon | Long-term; consistent royalty streams | Medium to long-term; values may appreciate over years |

| Tax Implications | Income taxed, potential capital gains advantages | Capital gains tax on appreciation; deductibles for maintenance |

| Risk Factors | Changes in music trends, copyright laws | Market demand fluctuations, physical damage risks |

Which is better?

Song catalog purchases offer stable, long-term passive income through royalties generated by streaming, licensing, and commercial use, making them a resilient investment in the entertainment industry. Classic cars tend to appreciate based on rarity, condition, and market trends but involve higher maintenance costs, storage considerations, and less liquidity compared to song catalogs. Investors seeking consistent revenue flow and lower operational risks often favor song catalogs over classic cars for portfolio diversification.

Connection

Song catalog purchases and classic cars both represent alternative investment assets that offer diversification beyond traditional stocks and bonds. These assets generate steady cash flows through royalties or appreciation, appealing to investors seeking passive income and long-term value retention. The growth of digital streaming platforms boosts song catalog valuations, while the limited supply and increasing demand enhance the classic car market's investment potential.

Key Terms

Asset Appreciation

Classic cars have shown consistent asset appreciation due to their rarity, historical significance, and collector demand, often outperforming traditional investments over time. Song catalog purchases provide a steady income stream with long-term asset appreciation driven by royalties, licensing, and increasing digital consumption. Explore how these distinct asset classes compare in terms of growth potential and investment strategy.

Liquidity

Classic cars often have lower liquidity due to niche markets and slower resale processes, while song catalog purchases typically offer higher liquidity through digital rights licensing and streaming revenues. Song catalog assets generate recurring income streams and can be sold in portions or full ownership, providing flexible exit strategies. Discover how liquidity differences impact investment choices between classic cars and song catalogs.

Intellectual Property Rights

Classic cars and song catalog purchases represent distinct asset classes with unique intellectual property rights implications. Classic cars involve physical ownership, often tied to trademarks and design patents, whereas song catalog acquisitions encompass copyrights and royalties linked to musical compositions and recordings. Explore deeper insights into intellectual property rights in these asset types to make informed investment decisions.

Source and External Links

Classic Car - Wikipedia - A classic car is typically described as an automobile 25 years or older with historical interest, often becoming collectible and restored rather than scrapped.

Classic Cars and Trucks for Sale on Autotrader - Offers a premier marketplace to buy and sell classic cars, antique cars, muscle cars, and collector cars.

Gateway Classic Cars - The world's largest classic car sales company with over 26 years of experience, providing a vast selection of classic, exotic, and muscle cars.

dowidth.com

dowidth.com