Litigation funding involves providing capital to plaintiffs in exchange for a portion of the judgment or settlement, offering investors a non-correlated asset class with potential high returns and moderate risk. Commodities trading focuses on buying and selling raw materials like oil, gold, and agricultural products, driven by market supply-demand dynamics and geopolitical factors. Explore these distinct investment strategies to determine which aligns with your financial goals and risk tolerance.

Why it is important

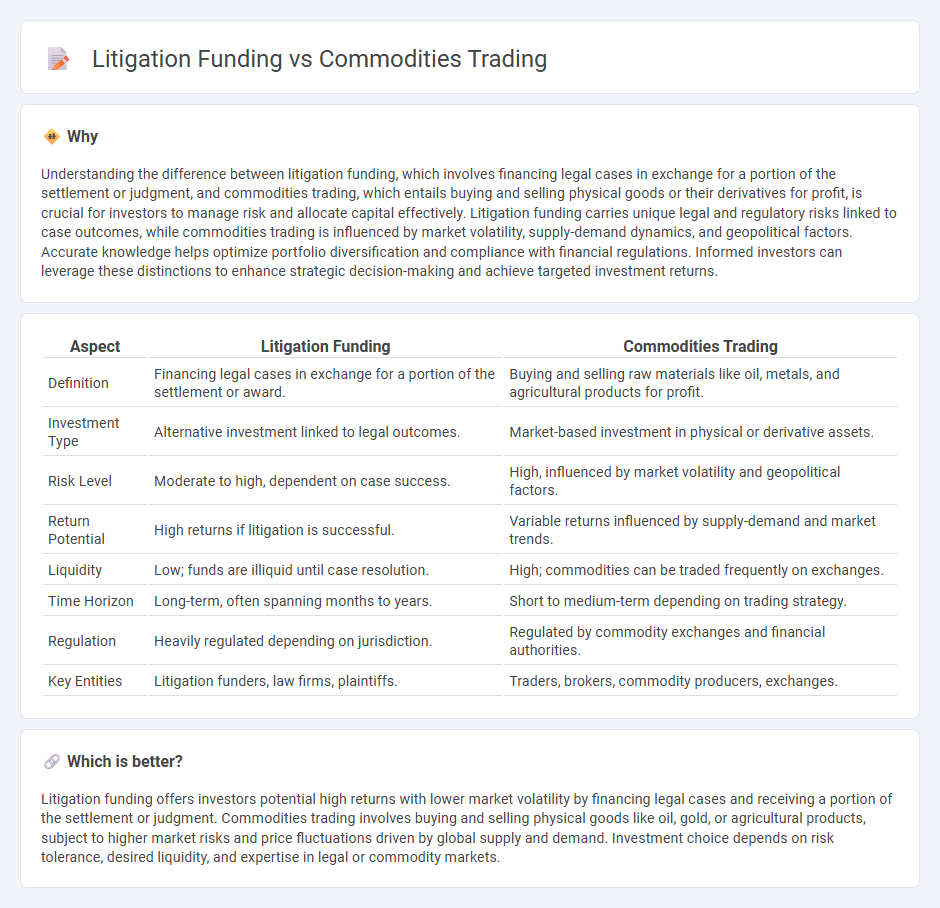

Understanding the difference between litigation funding, which involves financing legal cases in exchange for a portion of the settlement or judgment, and commodities trading, which entails buying and selling physical goods or their derivatives for profit, is crucial for investors to manage risk and allocate capital effectively. Litigation funding carries unique legal and regulatory risks linked to case outcomes, while commodities trading is influenced by market volatility, supply-demand dynamics, and geopolitical factors. Accurate knowledge helps optimize portfolio diversification and compliance with financial regulations. Informed investors can leverage these distinctions to enhance strategic decision-making and achieve targeted investment returns.

Comparison Table

| Aspect | Litigation Funding | Commodities Trading |

|---|---|---|

| Definition | Financing legal cases in exchange for a portion of the settlement or award. | Buying and selling raw materials like oil, metals, and agricultural products for profit. |

| Investment Type | Alternative investment linked to legal outcomes. | Market-based investment in physical or derivative assets. |

| Risk Level | Moderate to high, dependent on case success. | High, influenced by market volatility and geopolitical factors. |

| Return Potential | High returns if litigation is successful. | Variable returns influenced by supply-demand and market trends. |

| Liquidity | Low; funds are illiquid until case resolution. | High; commodities can be traded frequently on exchanges. |

| Time Horizon | Long-term, often spanning months to years. | Short to medium-term depending on trading strategy. |

| Regulation | Heavily regulated depending on jurisdiction. | Regulated by commodity exchanges and financial authorities. |

| Key Entities | Litigation funders, law firms, plaintiffs. | Traders, brokers, commodity producers, exchanges. |

Which is better?

Litigation funding offers investors potential high returns with lower market volatility by financing legal cases and receiving a portion of the settlement or judgment. Commodities trading involves buying and selling physical goods like oil, gold, or agricultural products, subject to higher market risks and price fluctuations driven by global supply and demand. Investment choice depends on risk tolerance, desired liquidity, and expertise in legal or commodity markets.

Connection

Litigation funding provides capital to plaintiffs in legal disputes, enabling access to justice without upfront costs, while commodities trading involves buying and selling raw materials for profit. Both sectors intersect through risk management strategies where litigation funding can be considered an alternative asset class within diversified commodity trading portfolios. Investors leverage litigation finance to hedge economic exposure and enhance returns by capitalizing on legal claim outcomes correlated with commodity market fluctuations.

Key Terms

**Commodities trading:**

Commodities trading involves buying and selling raw materials such as oil, gold, and agricultural products to capitalize on price fluctuations and market demand. It requires expertise in market analysis, risk management, and understanding global economic indicators that influence supply and demand dynamics. Explore more about the strategic approaches and benefits of commodities trading to enhance your investment portfolio.

Futures contracts

Futures contracts in commodities trading allow investors to buy or sell assets at predetermined prices, providing price risk management and market speculation opportunities. Litigation funding, by contrast, involves financing legal cases with the expectation of a return from settlements or judgments, lacking standardized contracts like futures but sharing risk transfer characteristics. Explore the nuances of futures contracts and their applications in commodities trading versus litigation funding for a comprehensive understanding.

Spot market

Commodities trading in the spot market involves the immediate purchase and sale of physical goods like oil, gold, or agricultural products, requiring real-time pricing and rapid transaction execution. Litigation funding, while fundamentally different, shares a market-driven approach where investors provide capital to plaintiffs in exchange for a portion of future settlement or judgment, often assessed based on legal merit and case duration. Explore more to understand how liquidity and risk assessment vary between these dynamic sectors.

Source and External Links

Commodity Trading via CFDs - FOREX.com - Commodities trading involves buying and selling contracts such as futures or CFDs on commodities like coffee, oil, gold, and metals, allowing traders to profit from both rising and falling markets with specific margin requirements and expiration dates for each commodity contract.

What Are Commodities and How Do You Trade Them? - IG - Trading commodities involves speculating on goods like gold, oil, and agricultural products through futures, spot prices, or CFDs, with market prices influenced by factors such as weather, supply chain disruptions, and demand.

What is Commodities Trading? | OANDA Global Markets - Commodity trading means buying and selling physical goods through financial derivatives, such as CFDs, on platforms that provide live pricing and analysis tools, where traders buy if they expect prices to rise and sell if they expect prices to fall.

dowidth.com

dowidth.com