Fine art micro-shares enable investors to own fractions of valuable artworks, providing diversified access to the high-value art market with lower capital requirements. Venture capital syndicates pool resources from multiple investors to fund high-growth startups, offering potential for significant returns alongside higher risk and longer investment horizons. Explore further to compare these innovative investment strategies and their unique benefits.

Why it is important

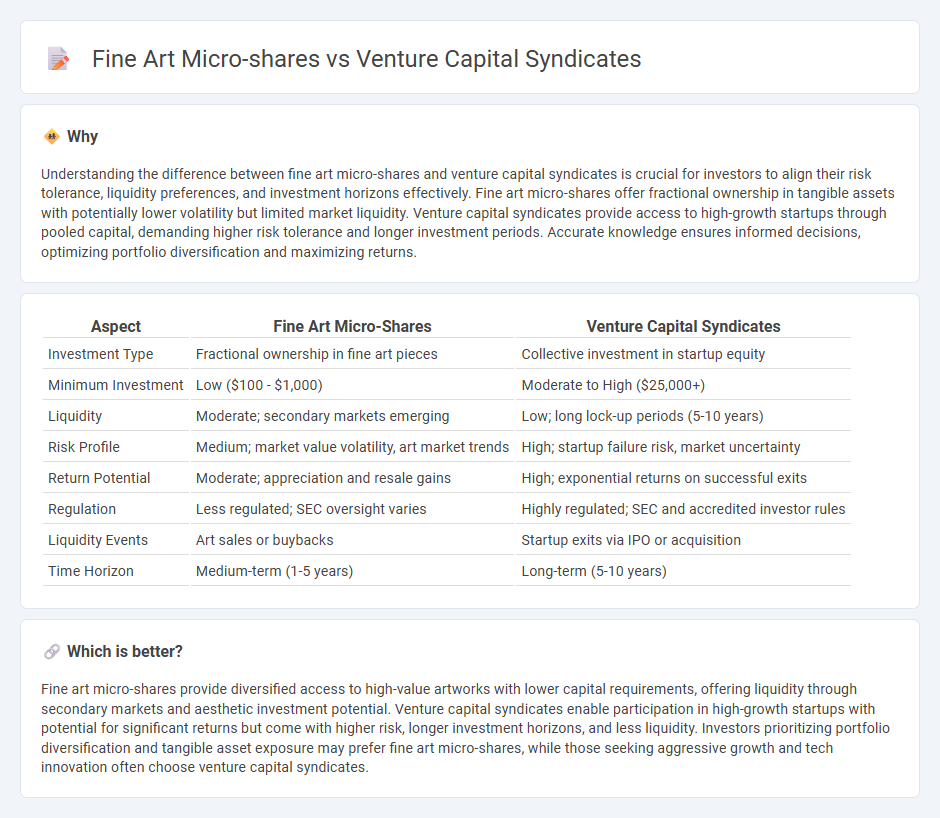

Understanding the difference between fine art micro-shares and venture capital syndicates is crucial for investors to align their risk tolerance, liquidity preferences, and investment horizons effectively. Fine art micro-shares offer fractional ownership in tangible assets with potentially lower volatility but limited market liquidity. Venture capital syndicates provide access to high-growth startups through pooled capital, demanding higher risk tolerance and longer investment periods. Accurate knowledge ensures informed decisions, optimizing portfolio diversification and maximizing returns.

Comparison Table

| Aspect | Fine Art Micro-Shares | Venture Capital Syndicates |

|---|---|---|

| Investment Type | Fractional ownership in fine art pieces | Collective investment in startup equity |

| Minimum Investment | Low ($100 - $1,000) | Moderate to High ($25,000+) |

| Liquidity | Moderate; secondary markets emerging | Low; long lock-up periods (5-10 years) |

| Risk Profile | Medium; market value volatility, art market trends | High; startup failure risk, market uncertainty |

| Return Potential | Moderate; appreciation and resale gains | High; exponential returns on successful exits |

| Regulation | Less regulated; SEC oversight varies | Highly regulated; SEC and accredited investor rules |

| Liquidity Events | Art sales or buybacks | Startup exits via IPO or acquisition |

| Time Horizon | Medium-term (1-5 years) | Long-term (5-10 years) |

Which is better?

Fine art micro-shares provide diversified access to high-value artworks with lower capital requirements, offering liquidity through secondary markets and aesthetic investment potential. Venture capital syndicates enable participation in high-growth startups with potential for significant returns but come with higher risk, longer investment horizons, and less liquidity. Investors prioritizing portfolio diversification and tangible asset exposure may prefer fine art micro-shares, while those seeking aggressive growth and tech innovation often choose venture capital syndicates.

Connection

Fine art micro-shares and venture capital syndicates both leverage fractional ownership models to democratize access to high-value investments, allowing smaller investors to participate in markets traditionally reserved for wealthy individuals. These investment structures utilize blockchain technology and legal frameworks to enable transparent, secure, and divisible asset holdings, enhancing liquidity in illiquid asset classes like fine art and startup equity. The convergence of these approaches reflects a growing trend towards decentralization and inclusivity in alternative investment portfolios, driving diversified asset allocation strategies.

Key Terms

Co-investment

Venture capital syndicates enable co-investors to pool capital, share risk, and access diversified startup portfolios, often yielding high-growth opportunities. Fine art micro-shares allow fractional ownership of valuable artworks, increasing liquidity and democratizing access to expensive assets. Explore how co-investment strategies differ in risk, return, and market dynamics between these two innovative asset classes.

Asset fractionalization

Venture capital syndicates enable multiple investors to pool funds and share equity stakes in startups, providing diversified exposure to high-growth opportunities through asset fractionalization. Fine art micro-shares allow collectors to own fractional interests in valuable artworks, democratizing access to an asset class traditionally limited to high-net-worth individuals. Explore the evolving landscape of asset fractionalization to understand how these models redefine investment accessibility.

Due diligence

Due diligence in venture capital syndicates involves comprehensive analysis of startup business models, market potential, and team expertise to mitigate investment risks. In fine art micro-shares, due diligence centers on artwork provenance, authenticity, and market demand, ensuring the asset's value and liquidity. Explore deeper insights into how due diligence varies across these investment types for informed decision-making.

Source and External Links

Syndicates: Why Angel Syndicates are Valuable - Carta - Angel syndicates are deal-by-deal venture investment groups where a lead sets up a special purpose vehicle (SPV), pools capital from individual investors to back startups, and shares profits according to a predetermined structure after exits.

What is a syndicate? - AngelList Help Center - A syndicate is a group of backers who pool funds via SPVs to invest in startups deal-by-deal, giving investors flexibility to choose which opportunities to join while leveraging the lead's expertise, and in return, the lead takes a percentage of profits upon a successful exit.

Startup Syndicate Funding: Here's How it Works - Visible.vc - Syndicate funding is led by a prominent investor who selects a startup, creates an investment vehicle to aggregate capital from backers, and manages the investment process through platforms like AngelList, with backers able to review and opt into specific deals.

dowidth.com

dowidth.com