Carbon credits trading enables companies to offset emissions by buying and selling permits that represent one ton of CO2. Clean tech venture capital funds innovative startups developing technologies such as solar power, energy storage, and electric vehicles to reduce carbon footprints. Explore the distinct benefits and investment strategies involved in carbon credits trading and clean tech venture capital.

Why it is important

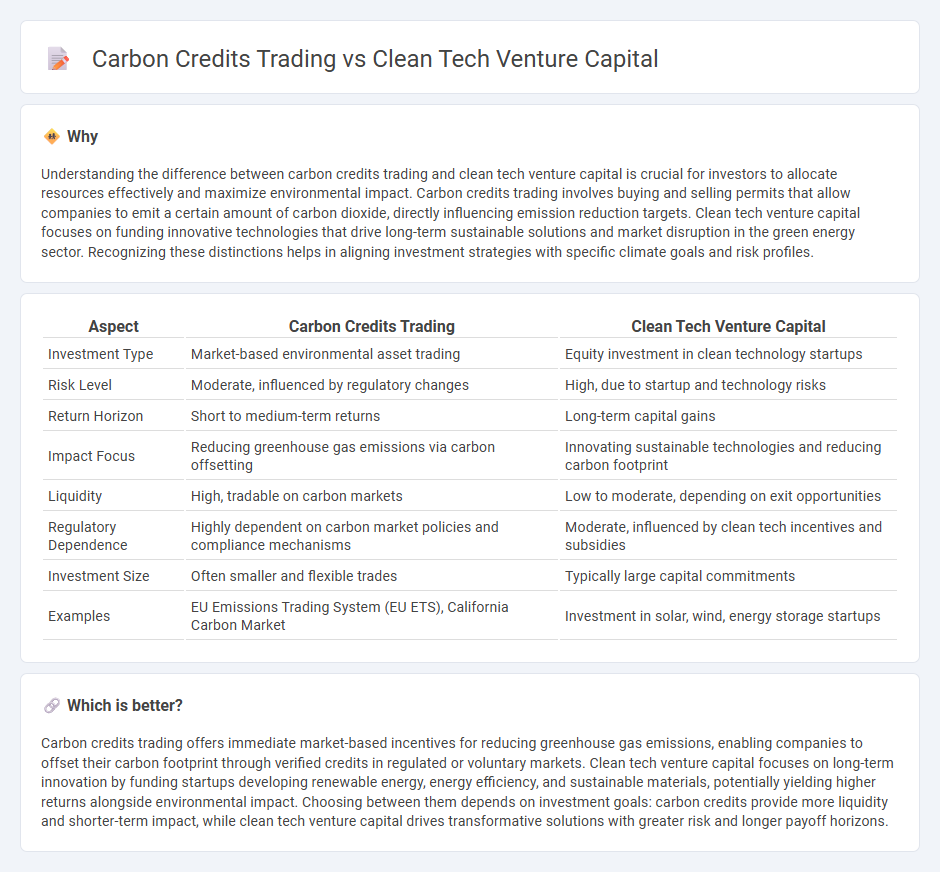

Understanding the difference between carbon credits trading and clean tech venture capital is crucial for investors to allocate resources effectively and maximize environmental impact. Carbon credits trading involves buying and selling permits that allow companies to emit a certain amount of carbon dioxide, directly influencing emission reduction targets. Clean tech venture capital focuses on funding innovative technologies that drive long-term sustainable solutions and market disruption in the green energy sector. Recognizing these distinctions helps in aligning investment strategies with specific climate goals and risk profiles.

Comparison Table

| Aspect | Carbon Credits Trading | Clean Tech Venture Capital |

|---|---|---|

| Investment Type | Market-based environmental asset trading | Equity investment in clean technology startups |

| Risk Level | Moderate, influenced by regulatory changes | High, due to startup and technology risks |

| Return Horizon | Short to medium-term returns | Long-term capital gains |

| Impact Focus | Reducing greenhouse gas emissions via carbon offsetting | Innovating sustainable technologies and reducing carbon footprint |

| Liquidity | High, tradable on carbon markets | Low to moderate, depending on exit opportunities |

| Regulatory Dependence | Highly dependent on carbon market policies and compliance mechanisms | Moderate, influenced by clean tech incentives and subsidies |

| Investment Size | Often smaller and flexible trades | Typically large capital commitments |

| Examples | EU Emissions Trading System (EU ETS), California Carbon Market | Investment in solar, wind, energy storage startups |

Which is better?

Carbon credits trading offers immediate market-based incentives for reducing greenhouse gas emissions, enabling companies to offset their carbon footprint through verified credits in regulated or voluntary markets. Clean tech venture capital focuses on long-term innovation by funding startups developing renewable energy, energy efficiency, and sustainable materials, potentially yielding higher returns alongside environmental impact. Choosing between them depends on investment goals: carbon credits provide more liquidity and shorter-term impact, while clean tech venture capital drives transformative solutions with greater risk and longer payoff horizons.

Connection

Carbon credits trading incentivizes companies to reduce greenhouse gas emissions by assigning monetary value to carbon offsets, creating a market-driven approach to environmental sustainability. Clean tech venture capital funds startups developing innovative technologies for energy efficiency and carbon reduction, accelerating the transition to low-carbon economies. Investment in clean technology enhances carbon credit projects' effectiveness, making these two sectors interdependent drivers of sustainable economic growth.

Key Terms

Clean tech venture capital:

Clean tech venture capital involves investing in innovative technologies aimed at reducing environmental impact, such as renewable energy, energy efficiency, and sustainable materials. This form of investment drives long-term growth by funding startups and enterprises developing breakthrough solutions to combat climate change. Explore how clean tech venture capital fuels green innovation and shapes the future of sustainability.

Early-stage funding

Early-stage funding in clean tech venture capital emphasizes innovation and technology development, targeting startups with scalable solutions for renewable energy, energy efficiency, and sustainable materials. Carbon credits trading primarily involves market mechanisms allowing businesses to buy and sell emissions allowances, often focusing on established companies and regulatory compliance rather than direct funding for early-stage ventures. Explore how both approaches shape the future of sustainable investments and climate action.

Technology scalability

Clean tech venture capital prioritizes scalable innovations such as renewable energy technologies, energy storage, and green infrastructure with potential for rapid global deployment. Carbon credits trading operates within existing regulatory frameworks, offering immediate but often limited scalability tied to emission reduction projects and market demand fluctuations. Explore further to understand how technology scalability influences investment strategies and environmental impact outcomes in these two domains.

Source and External Links

Clean Energy Ventures | Climate Tech Venture Capital - Clean Energy Ventures is a Boston-based VC specializing in scalable early-stage climate tech startups that can collectively reduce 2.5 gigatons of CO2 emissions by 2050; their team includes trained physicists and engineers focusing on planet-changing technologies with high greenhouse gas impact potential.

Venture Capital and Cleantech: Investing in a Sustainable Future - Venture capital investment in cleantech reached $70 billion in 2022, with key players like Energy Impact Partners, SOSV, Khosla Ventures, and Clean Energy Ventures funding early to late-stage startups focused on zero-carbon technologies and sustainability innovations.

10 Climate Tech Venture Capital Firms You Should Know in 2024 - Lowercarbon Capital, one of the leading climate tech VCs, raised $550 million in 2023 for funds targeting emissions slashing, carbon removal, and climate impact mitigation technologies, emphasizing hard science and ambitious decarbonization goals.

dowidth.com

dowidth.com