Whisky cask investment offers a unique alternative to stock market investment by providing tangible asset ownership with potential for portfolio diversification and capital appreciation driven by aging and rarity. Unlike stocks subject to market volatility and economic cycles, whisky casks often deliver value growth through scarcity and increasing demand in luxury goods markets. Explore the comparative advantages and risks of whisky cask investment versus traditional stock market options to make informed asset allocation decisions.

Why it is important

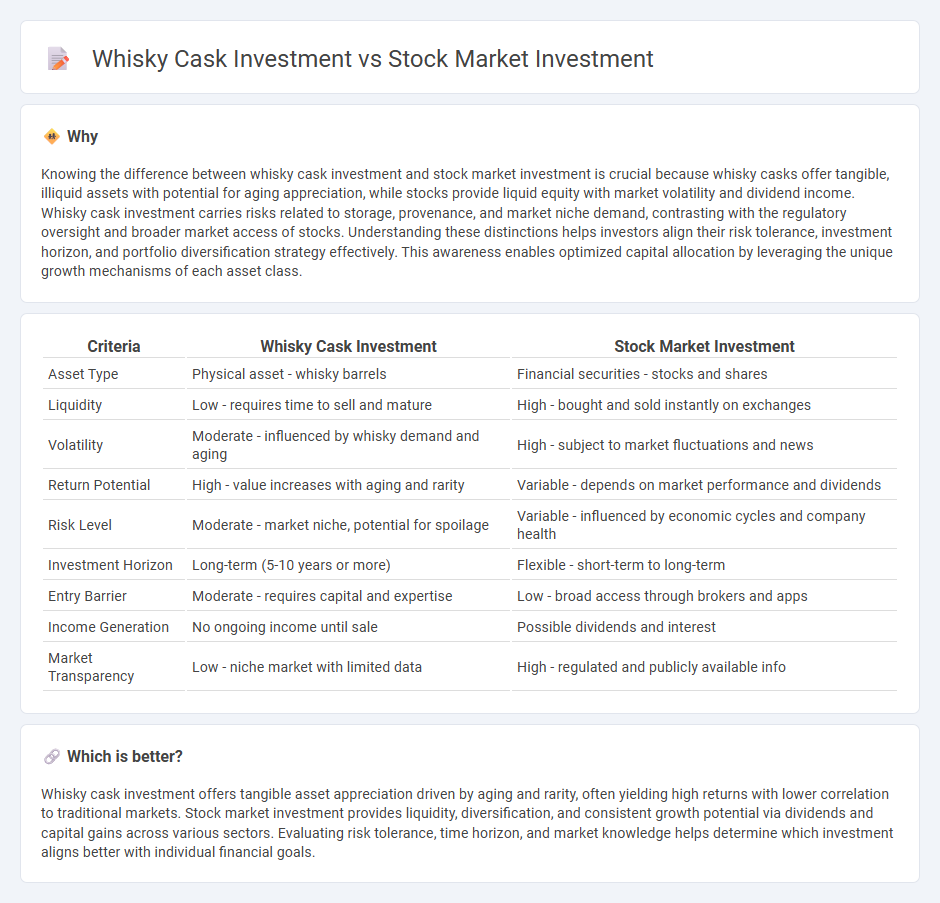

Knowing the difference between whisky cask investment and stock market investment is crucial because whisky casks offer tangible, illiquid assets with potential for aging appreciation, while stocks provide liquid equity with market volatility and dividend income. Whisky cask investment carries risks related to storage, provenance, and market niche demand, contrasting with the regulatory oversight and broader market access of stocks. Understanding these distinctions helps investors align their risk tolerance, investment horizon, and portfolio diversification strategy effectively. This awareness enables optimized capital allocation by leveraging the unique growth mechanisms of each asset class.

Comparison Table

| Criteria | Whisky Cask Investment | Stock Market Investment |

|---|---|---|

| Asset Type | Physical asset - whisky barrels | Financial securities - stocks and shares |

| Liquidity | Low - requires time to sell and mature | High - bought and sold instantly on exchanges |

| Volatility | Moderate - influenced by whisky demand and aging | High - subject to market fluctuations and news |

| Return Potential | High - value increases with aging and rarity | Variable - depends on market performance and dividends |

| Risk Level | Moderate - market niche, potential for spoilage | Variable - influenced by economic cycles and company health |

| Investment Horizon | Long-term (5-10 years or more) | Flexible - short-term to long-term |

| Entry Barrier | Moderate - requires capital and expertise | Low - broad access through brokers and apps |

| Income Generation | No ongoing income until sale | Possible dividends and interest |

| Market Transparency | Low - niche market with limited data | High - regulated and publicly available info |

Which is better?

Whisky cask investment offers tangible asset appreciation driven by aging and rarity, often yielding high returns with lower correlation to traditional markets. Stock market investment provides liquidity, diversification, and consistent growth potential via dividends and capital gains across various sectors. Evaluating risk tolerance, time horizon, and market knowledge helps determine which investment aligns better with individual financial goals.

Connection

Whisky cask investment and stock market investment are connected through their shared pursuit of asset diversification and potential high returns. Both investment types are influenced by market demand, economic trends, and investor sentiment, impacting the valuation and liquidity of assets like whisky casks and stocks. Understanding market fluctuations and risk management principles is essential for maximizing gains in these alternative and traditional investment vehicles.

Key Terms

Stock market investment:

Stock market investment offers liquidity, diversification, and potential for consistent returns through dividends and capital gains, driven by global economic trends and corporate performance. It allows investors to easily buy and sell shares with transparent pricing and regulatory oversight. Discover more about the advantages and strategies of stock market investing to maximize your portfolio growth.

Dividend

Stock market investments provide regular dividend payouts, typically ranging from 2% to 5% annually, offering steady income streams and liquidity. Whisky cask investments yield returns through cask appreciation and potential bottling profits, with dividends being less predictable and dependent on market demand and aging quality. Explore the unique dividend dynamics of both assets to determine which investment suits your financial goals.

Portfolio

Stock market investment offers liquidity, diversification, and potential for dividend income, making it suitable for dynamic portfolio management and risk mitigation. Whisky cask investment presents a unique alternative asset that can hedge against market volatility and provide potential high returns through appreciation and aging. Explore how integrating these assets can optimize your portfolio's performance and resilience.

Source and External Links

Stocks | FINRA.org - Investing in stocks means buying ownership shares in a company, where returns come from dividends or capital gains, and stock prices can fluctuate greatly, making stocks suitable for long-term investment goals.

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - To invest in stocks, open a brokerage account, invest regularly, and consider low-cost mutual funds like index funds or ETFs for diversified, long-term growth aligned with your risk tolerance and time horizon.

The Basics of Investing In Stocks - Stocks offer potential capital gains and dividend income but come with risks including price drops and company failure; methods to buy include direct stock plans, dividend reinvestment plans, brokers, and stock funds.

dowidth.com

dowidth.com