Sports memorabilia trading offers tangible assets with emotional value, often appreciating through rarity and athlete legacy, while venture capital targets high-growth startups with the potential for substantial financial returns driven by innovation and scalability. The liquidity, risk profiles, and market dynamics differ significantly between these investment types, making diversification an essential strategy for balanced portfolios. Explore the unique benefits and challenges of each to optimize your investment approach.

Why it is important

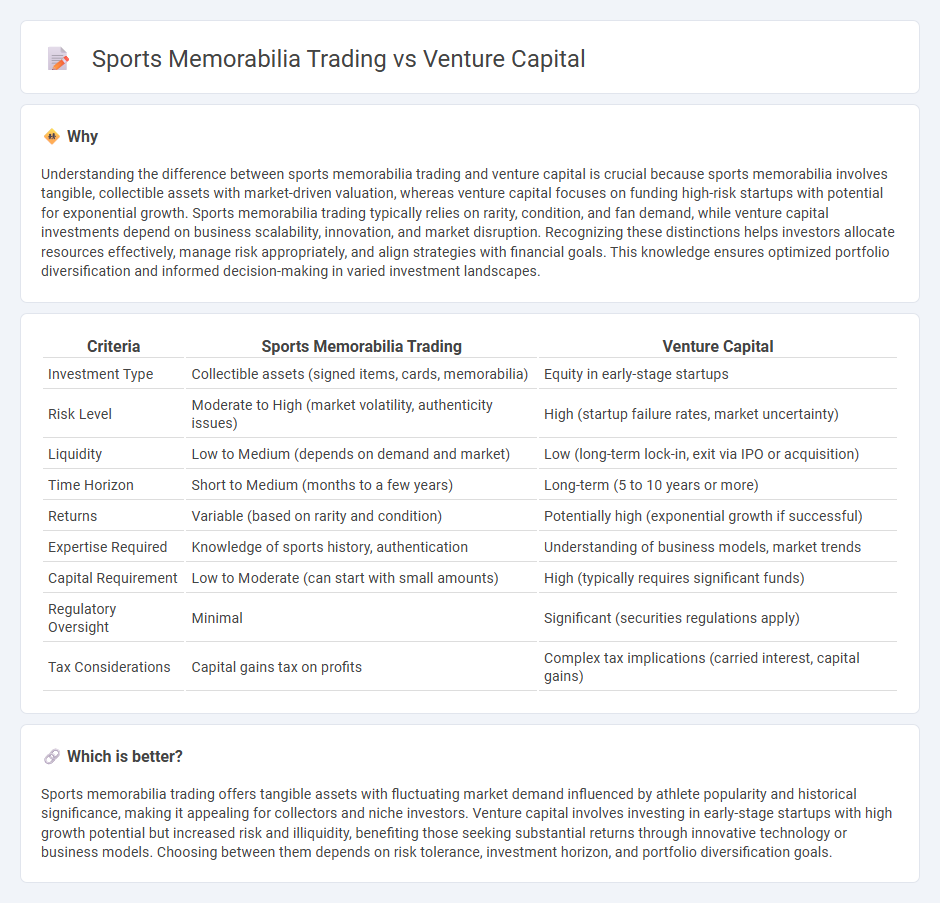

Understanding the difference between sports memorabilia trading and venture capital is crucial because sports memorabilia involves tangible, collectible assets with market-driven valuation, whereas venture capital focuses on funding high-risk startups with potential for exponential growth. Sports memorabilia trading typically relies on rarity, condition, and fan demand, while venture capital investments depend on business scalability, innovation, and market disruption. Recognizing these distinctions helps investors allocate resources effectively, manage risk appropriately, and align strategies with financial goals. This knowledge ensures optimized portfolio diversification and informed decision-making in varied investment landscapes.

Comparison Table

| Criteria | Sports Memorabilia Trading | Venture Capital |

|---|---|---|

| Investment Type | Collectible assets (signed items, cards, memorabilia) | Equity in early-stage startups |

| Risk Level | Moderate to High (market volatility, authenticity issues) | High (startup failure rates, market uncertainty) |

| Liquidity | Low to Medium (depends on demand and market) | Low (long-term lock-in, exit via IPO or acquisition) |

| Time Horizon | Short to Medium (months to a few years) | Long-term (5 to 10 years or more) |

| Returns | Variable (based on rarity and condition) | Potentially high (exponential growth if successful) |

| Expertise Required | Knowledge of sports history, authentication | Understanding of business models, market trends |

| Capital Requirement | Low to Moderate (can start with small amounts) | High (typically requires significant funds) |

| Regulatory Oversight | Minimal | Significant (securities regulations apply) |

| Tax Considerations | Capital gains tax on profits | Complex tax implications (carried interest, capital gains) |

Which is better?

Sports memorabilia trading offers tangible assets with fluctuating market demand influenced by athlete popularity and historical significance, making it appealing for collectors and niche investors. Venture capital involves investing in early-stage startups with high growth potential but increased risk and illiquidity, benefiting those seeking substantial returns through innovative technology or business models. Choosing between them depends on risk tolerance, investment horizon, and portfolio diversification goals.

Connection

Sports memorabilia trading attracts venture capital by showcasing high-growth potential in niche markets driven by passionate collectors and rising digital platforms such as NFTs. Venture capital funds target startups that innovate authentication, valuation, and trading technologies to enhance liquidity and market access for sports collectibles. This fusion accelerates market expansion while creating scalable investment opportunities within the memorabilia industry.

Key Terms

**Venture Capital:**

Venture capital involves investing in early-stage startups with high growth potential, typically in technology, healthcare, and renewable energy sectors, aiming for substantial returns through equity stakes. Unlike sports memorabilia trading, which relies on the appreciation of physical collectibles, venture capital emphasizes innovation-driven companies and scalable business models backed by detailed market analysis and risk assessment. Explore further to understand how venture capital fuels entrepreneurial ecosystems and shapes future industries.

Equity

Venture capital investments typically involve acquiring equity stakes in startups, offering potential high returns through company growth and eventual exits. In contrast, sports memorabilia trading focuses on buying and selling tangible assets, with value driven by rarity, demand, and provenance rather than equity ownership. Explore more to understand how equity plays a crucial role in venture capital compared to asset ownership in memorabilia trading.

Startup

Venture capital in startups drives innovation by providing essential funding, strategic guidance, and scalability opportunities that sports memorabilia trading lacks. Sports memorabilia trading offers niche market potential and collectible asset appreciation but lacks the dynamic growth and exit opportunities typical in venture-backed startups. Explore the key differences between these investment avenues to discover which better aligns with your entrepreneurial goals.

Source and External Links

What is Venture Capital? - Venture capital is funding that transforms ideas and basic research into high-growth companies, often partnering closely with entrepreneurs and providing long-term, high-risk equity investment that fuels innovation and job creation.

Fund your business | U.S. Small Business Administration - Venture capital is funding from investors in exchange for equity and often board involvement, aimed at high-growth companies with higher risk tolerance and a longer investment horizon, requiring entrepreneurs to give up some ownership and control.

What is venture capital? - Silicon Valley Bank - Venture capital is a form of private equity used to support startups and early-stage companies with rapid growth potential, where investors receive ownership stakes and often provide not only capital but also expertise and mentorship.

dowidth.com

dowidth.com